5 Money Managers that "Beat the Market"

Only 10% of money managers can beat the S&P 500. The ones that have are in a league of their own and offer important lessons for all investors.

Disclaimers:

I have not been paid (or even spoken to) the funds I am covering in this write-up. I am just using public documents I have found about each fund.

The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

Past performance is not indicative of future results or a guarantee of future returns. The performance returns presented herein represent the average return of the Fund’s limited partners, include the reinvestment of dividends, interest, and other earnings, and are shown net of operating expenses, management fees and incentive allocations. An individual investor’s actual returns will differ from the results shown herein due to factors such as the timing of capital contributions/withdrawals, different fee arrangements, and treatment of loss carryforwards.

Thus, individual investor performance as well as the Fund’s aggregate performance will differ from the performance presented herein. The Fund’s performance is shown compared to the S&P 500 Total Return Index. The S&P 500 Index, a widely used benchmark of US equity performance, consists of 500 large cap companies chosen for market size, liquidity, and industry group representation. Each company’s weight in the S&P 500 Index is proportional to the total market value of all outstanding shares of such company. The S&P 500 Total Return Index measures the performance of the S&P 500 Index by assuming that all cash distributions are reinvested, in addition to tracking the components' price movements. Indices are unmanaged and are not subject to fees or expenses, nor can you invest directly in an Index. Due to their differences, performance of the Fund and the Indices is not comparable. I am not aware of any index that is directly comparable to any of these Fund’s strategies. (Taken from Smoak Capital's letter but true for all. Please read each fund's disclaimers in addition to these..)

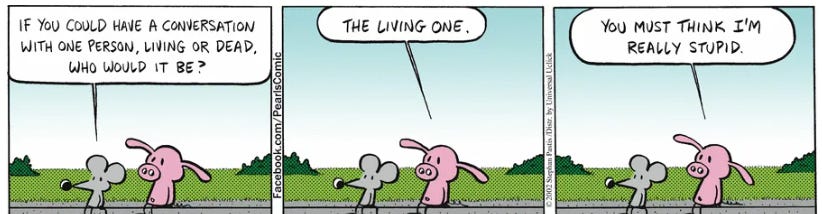

Investors should always be learning. We should learn from both the eminent dead, and from the successful among the living. However, if I had to choose to invest my money with someone from either group today, I would choose someone from the latter category.

I spent the last week seeking out active funds who have been in operation for over 5 years that have been able to beat the market (which I define as the S&P 500 index). Only 10% of money managers have accomplished this feat, so I think we can learn something from each of these investors.

"The idea of picking some extreme example and asking my favorite question — 'What in the hell is going on here?' — is the way to wisdom in this world." - Charlie Munger

I went through over 30 fund websites looking for any published performance information. I came across these funds on Twitter, Substack, Google, or word of mouth. Funds were included in this list if they:

1. Have been in operation for over 5 years.

2. Have beat the S&P 500 (including dividends) over that time period, net of fees.

3. Are currently open for investment.

5 funds passed this criteria, here I have included notes that the firm has provided online and added some of my notable takeaways about each firm.

1. Smoak Capital Management (778% vs. S&P 157%)

From the fund’s website:

"Smoak Capital Management, LLC is an investment firm focused on finding, researching, and investing in small and/or micro-cap companies in order to achieve greater returns while minimizing risk. Due to market inefficiencies among smaller companies, we believe this strategy will outperform relevant market indices over the long term and generate attractive investment returns. The Firm’s goal is to outperform the S&P 500 Index as much as possible over the next five years while minimizing the risk of permanent losses."

"Smoak Capital, LP is a private fund managed by Daniel Smoak. Daniel Smoak, has invested in public companies for over 10 years and has a strong background in Accounting, Financial Analysis, and Taxation. He is an active and top ranked member of MicroCapClub.com, a community for experienced microcap investors, as well as a member of the exclusive ValueInvestorsClub.com. His work history includes public accounting firm experience and as a tax accountant at a privately-owned global manufacturing company."

"If you’re an accredited investor with a long-term focus and are interested in a concentrated, uncorrelated investment strategy that has the potential to outperform the broader market, we’d love to talk to you. If you’d simply like to discuss investment opportunities or observations please feel free to reach out as well."

Daniel knows a bargain when he sees one. I have enjoyed his writings on Citizens Bancshares, which was a hugely mispriced security. Reading that alone should give you a good idea of his style of investing: Annual Letter 2022

Daniel is successful because he understands the businesses he invests in deeply. He reads far beyond what a financial statement or screen alone would tell us. I think his investment in Hemacare is a good case study to understand his philosophy. Notably, when he considered Hemacare in 2018, the company had notable characteristics that would eliminate it from most investors' watchlists:

It was in the biotechnology sector.

It had a market cap of $12mn

It had been dark for 5 years, that is it had no filings with the SEC.

It had a negative pre-tax income.

Shares outstanding had increased since going dark.

And there were no comparable publicly traded US companies.

This investment yielded a 26x return. His logic was sound, and the outcome was knowable. It just took turning over many rocks in the "small and illiquid" category.

You can read his write up on Hemacare here.

Iggy on investing has also researched some of Daniel's positions. I enjoyed that write-up very much.

2. Emeth Value Capital (336% vs. S&P 157%)

"Emeth Value Capital is an investment firm focused on maximizing long-term net returns for a select group of qualified investors. Our investment approach emphasizes business quality and seeks to identify a small number of highly mispriced securities. Independent thought, structural simplicity, and philosophically aligned investors feed the competitive advantage of our strategy."

"Our research focuses intensely on understanding the real free cash flow we would be entitled to as an owner of a business in its entirety, and the elements that might threaten protect or augment those cash flows. We believe that institutional constraints and human emotion often drive prices away from intrinsic value, allowing our partnership the ability to leverage a highly favorable aspect of public market investing – the ability to invest at any time at a quoted price. In theory, we seek to own unregulated capital-light monopolies that sell an essential good with high and structurally growing demand. In practice, however, we aim to find some of these elements present in businesses that we are able to purchase for substantially below intrinsic value."

"Andrew Carreon is the Founder and Managing Partner of Emeth Value Capital, LLC. Prior to founding Emeth Value Capital, Andrew spent the previous seven years of his career at the University of Notre Dame Investment Office, where he was an Investment Manager. Notre Dame is internationally recognized as a leader in endowment management, overseeing a comprehensive global portfolio of $15.6 billion across major asset classes, including: Public Equity, Private Equity, Real Estate, Natural Resources, and Credit. While at the University of Notre Dame Investment Office, Andrew specialized in global public equities, co-managing a $6+ billion portfolio consisting of long-only, hedge fund, and direct equity strategies. Andrew received a Bachelor of Business Administration degree in accounting from the University of Notre Dame, with a dual major in Economics. He is a CFA® charterholder, CFA Institute"

Andrew is very smart. He has an edge by looking at securities that are too complicated for most to even consider. He digs deeply through what is typically in my "too hard to call" pile, and has found winning opportunities there.

I particularly enjoyed Andrew's comments on position sizing. In his 2022 mid year letter he takes time to explain the Kelly criterion in relation to bet sizing. I picked that up from poker theory, but I think explanation of the principle would benefit any investor.

I think his write-up of Buford Capital should give you a good idea of his investing style and philosophy.

3. Saber Capital Management (Outperform)

"I don't look to jump over 7-foot bars: I look around for 1-foot bars I can step over."

– Warren Buffett

"John Huber is the founder and portfolio manager of Saber Capital Management. Saber manages separate accounts and a partnership modeled after the original Warren Buffett partnerships from the 1950’s. Investors in the fund pay no management fees, and Saber only gets compensated for returns that exceed 6% annually. John and his family have nearly all of their net worth invested right alongside Saber investors."

"Saber has been managing client capital since 2014 using a value investing approach inspired by Buffett’s simple principles of value investing: stocks are pieces of real businesses, buy stocks for less than their fair value, and patiently think for the long-term."

"We believe long-term investment success comes from an active implementation of these value investing principles and proper behavior traits."

"John has also written extensively about investing for well over a decade. Please see Base Hit Investing for investment writeups and articles on our investing strategy. Our Research Page and Podcast Q&A Page also contain discussion of our investment approach."

"The names Saber and Base Hit Investing are metaphors that reference baseball and my broad philosophy: to make steady progress day after day, focus on continuous improvement, and emphasize value investing."

I could only find limited data to verify this, but based on what I have found so far, I am confident that John has beat the index over 5-10 years.

John's website and Substack are a treasure trove so I can't add much more than what he has said about himself already. I can say a few things however. For one thing, I find his investment style as simple as it needs to be, but no more so. He focuses on 3 engines of stock value growth: earnings growth, earnings yield, and share count reduction. He doesn't rule out international, microcap, or small cap. These 3 engines are his main consideration.

His style is very similar to how Bruce Greenwald approaches valuation. The way he invests particularly reminds me of Charlie Munger's "sit on your ass investing" (which is a lot harder than it sounds). He stays focused on quality, growth (businesses with a durable moat against market entrants), and value. I have learned a lot from his writings, and I highly recommend checking out the resources on his website.

4. Cedar Creek Partners (214% vs. S&P 157%)

"Cedar Creek Partners is a private investment partnership that focuses primarily on micro and small cap equities. We believe that meaningful outperformance can be achieved by being a smaller player and finding niches that are too small for larger funds.

We apply a bottom-up value approach of looking for securities that are trading at a discount to our estimate of their intrinsic value.

We believe excessive diversification leads to mediocre results.

We emphasize free cash flow and earnings capacity.

The ideal investment is growing its intrinsic value, has pricing power, minimal capital requirement, high margins, sales growth, and capable management.

Ideally the company has a near term catalyst enabling us to capture the current discount."

"Mr. Eriksen has a Masters in Business Administration from Texas A&M University, and Bachelor of Arts degrees in History and in Political Studies from the The Master’s University.

“From 2004 to 2005, Mr. Eriksen worked for Walker’s Manual Inc., a publisher of investment books and newsletters that focuses on unlisted stocks, micro-cap stocks and community bank stocks."

Investors can learn a lot from Tim. He led a successful proxy fight at Solitron and Pharmchem. In terms of activism, proxy campaigns or turnarounds I can't think of anyone better to learn from.

5. Laughing Water Capital (175% vs. S&P 157%)

"Laughing Water Capital is a boutique investment partnership. Our partners believe that careful analysis of a select group of businesses can lead to above average investment returns for equity investors. Our small size and patient approach give us an advantage that cannot be matched by traditional asset managers or hedge funds that are focused on the day to day gyrations of the stock market, rather than the fundamental value of businesses."

"We Believe That Alignment of Interests Is Critical For Success. At Laughing Water Capital, our interests are fully aligned with our partners as nearly all of our personal wealth is invested in our strategy. We only succeed when our partners succeed. Further, we seek to invest in companies where management is personally invested in the business, ensuring that their interests are aligned with ours."

"Good Investments Are Hard to Find. Laughing Water Capital follows a concentrated approach to equity investing, typically owning 10 - 15 businesses at a time. We often buy shares in companies that are out of favor on Wall Street due to some sort of operational, optical, or structural problem that we believe is within management’s ability to fix, given enough time. This problem results in a cheap purchase price, and over time we expect our investments to benefit from both operational improvements and a re-rating as the market’s view shifts from pessimism to optimism."

This interview by Graham-Doddsville is far better than anything I could do, I recommend you read it.

Here are a few excerpts that stood out to me.

"For me, an idea really has to boil down to two or three bullet points at most that explain how earnings power for a business is going to be changing for the better and how perception is going to change over the next few years. And I'm a big believer that as long as you don't overpay going in, if you can find a business that will have significantly higher earnings power in a few years and it's currently unloved, you have a very strong foundation from which to generate acceptable investment returns."

"I typically own 15 stocks with a focus on fundamental value"

"I was very much aware that I was choosing a [business model] path that would lend itself towards performance but not scale."

"It has a very, very high what I call, "ick" factor where people would look at this and wonder how I could ever own it."

Matt's comment on "ick" stocks stands out to me. Michael Burry talked about that same concept in his fund letters, and I think that category is a great place for value investors to look. Is the market selling off a stock because owning it looks bad, regardless of its fundamentals? If so, the odds will be tilted in favor of a small individual investor.

Honorable Mentions:

Gate City Capital Management

Michael Melby is the portfolio manager at Gate City Capital Management. His fund is often invested in the "deep value" category, akin to Walter Schloss or Michael Burry. He invests only in long equities, only in microcaps, and heavily in the United States. He invests in land deals or "hidden asset" plays more than the others on this list. The AMREP investment is a good example of this. Gate City’s Analysts Nicholas Bodnar and Harry Sauers are also very talented and worth following.

Gate City is an honorable mention because although I know that they have beat the index, I can not find specific results to cite as their letters are not public. Also this fund is closed to new investment. I think that is very notable. The fund was closed because if the fund were to grow, Gate City would have to either narrow its investable universe or deliver worse results for shareholders. Mike decided that he wanted to remain focused on the niche that he has successfully operated in for 10 years: microcap equities. I can think of a few investors who have done this at one time or another, but all have the utmost integrity: Buffett, Schloss, Seth Klarman, Chuck Akre, Joel Greenblatt, Li Lu and Jim Simons to name a few.

In a world where most investors get paid based on funds under management, limiting your fund or returning capital to new investors really shows your commitment to investors, and not the paycheck.

Read more: https://microcapclub.com/a-conversation-with-michael-melby-of-gate-city-capital-management/

Dirt Cheap Stocks

Dirt from Dirt Cheap Stocks on Substack doesn't manage money, but he has profiled some very attractive under-valuations. Based on what he has covered and how he thinks about stocks, I am sure he has beat the index.

He has chosen not to open a fund, instead focusing on investing his own money. Again, I think that this shows a unique integrity on his part. I recommend you read through his write-ups.

Conclusion

As I researched these funds I noticed a few commonalities.

Each runs a concentrated portfolio. I don't think any have owned more than 20 stocks at a time.

All make use of what John Huber calls "time arbitrage". That is to say that while institutions have quarterly goals and incentives, these funds think and invest over the long run. I've noticed that most retail investors have difficulty copying that same "sit on your ass" approach. All of these funds have a low portfolio turnover.

And finally, all have personality traits that are suited to the above observations. They are mild mannered, patient, work to stay within their circle of competence, they respect their investors, have internalized that stocks are a piece of a business, and strive to learn more about business every day. I think it is very hard to find someone who has all of these traits, but they are probably necessary traits to have in order to achieve an outsized performance.

It also looks like these investors are very particular in who the limited partners in their fund are. They want to work with partners who deeply understand their philosophy, and have a similarly long term philosophy.

Ironically, I don't think any of these investors are focused only on money and returns. I also doubt any of these money managers are consciously trying to "beat the index", and I doubt they would want investors who have only that priority.

There is a Tao to investing that is interesting. For as Lao Tzu said:

"For the further one travels

The less one knows.

Therefore the Sage arrives without going,

Sees all without looking,

Does nothing, yet achieves everything."

I think the more an investor strives to get rich or beat the index, the less likely they are to do so. However, I think if you methodically develop wisdom every day and have patience over time, one day you just find yourself having gotten there.

So I will say that if your main goal is to make money fast, I am not sure these funds would be excited to work with you. So reach out with caution.

Well, those are my thoughts. But I encourage anyone interested to take one's time and learn more about each of these investors. It would be very wise.

They're all great investors! I fondly remember reading John Huber's blog back in 2014. I learned a lot from him!

Personally, I really like the work of Andrew Carreon, Matt Sweeney, and Michael Melby. Reading their letters is an absolute pleasure!

Just recently, I published a summary of the most recent letters from Gate City Capital, Laughing Water Capital, and Cedar Creek.

https://www.worldlyinvest.com/p/the-best-ideas-i-found-in-q1-2025

https://www.worldlyinvest.com/p/best-ideas-investor-letters-q1-2025-part2

Really insightful list! I especially like the focus on time arbitrage and running concentrated portfolios. In my own investing journey, I’ve found that less is more when it comes to holding positions in companies that I truly understand. It’s all about being patient and allowing the market to recognize value over time, rather than getting caught up in short-term fluctuations. I also agree with the emphasis on investor-manager alignment. Working with investors who share a long-term vision makes a huge difference. Thanks for sharing these examples and offering such thoughtful reflections!