A broadcaster with a "hidden asset" that is selling at a 63% discount with many potential catalysts.

Investigating Entravision (EVC)

This company has a legacy broadcast media business worth 240mm, an ad tech business worth 200mm, broadcast spectra worth 100mm in present value, and net debt of 90mm. All together this yields a target market cap of 450mm, but it is selling for 168mm. A 63% discount. It is my largest position.

Entravision Communications Corp (EVC) is a media company that owns 49 television stations, 44 owned radio stations, AdWake (a digital marketing agency) and an ad-tech business (programmatic mobile DSP platform). The stock is trading near 52 week lows as the market reacts to the fact that it has lost its digital marketing business (a major change).

Legacy Media Business (Television and Radio)

Entrevision's broadcast business is the largest affiliate group of the Univision and UniMás television networks in the US.

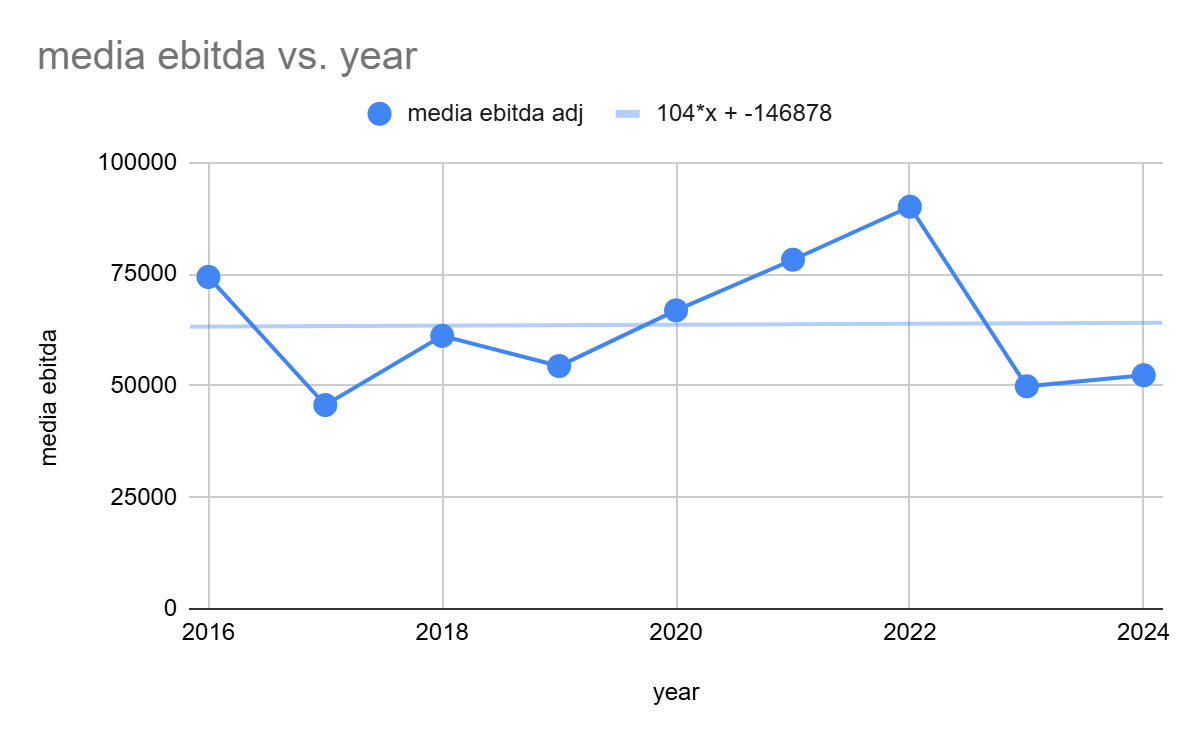

EBITDA for the segment in 2024 was 52mm, and in 2023 was 50mm. On average (since 2016) the pure media segment (only Radio and TV, no additional digital services) earns 65mm a year in EBITDA. Even though broadcast is a dying market (literally), EBITDA has increased 0.1mm a year. So the core business has been fairly steady.

source: https://docs.google.com/spreadsheets/d/1MccsCXVKHpFXsHctSGBwqSOED9Qb7is2yDt8hIwVIek/edit?usp=sharing

Considering that "Gray Television (GTN), E.W. Scripps (SSP), and Townsquare Media (TSQ) [are] trading at TTM EBITDA multiples of 7.6x, 7.4x, and 8.5x" (SeekingAlpha)

Consider that Nexstar Media Group's recent acquisition of Tribune Media (2019) was priced at 7.5x. (yhamiltonblog.substack.com) and that The E.W. Scripps Company's Acquisition of Ion Media (2021) was completed at 8.2x Ion's last twelve months EBITDA. (Pulse 2.0+2ir.scripps.com+2Scripps+2)

A multiple of 7.5 seems conservative. That gets us to a value of 487.5mm.

U Shares

TelevisaUnivision owns approximately 10% of Entrevision’s common stock on a fully-converted basis (market value of 17.5mm). These class U shares limit EVC's ability to sell off its TV and radio stations.

Per the latest 10-K

"TelevisaUnivision is the holder of all of our issued and outstanding Class U common stock. Although the Class U common stock has limited voting rights and does not include the right to elect directors, we may not, without the consent of TelevisaUnivision, merge, consolidate or enter into a business combination, dissolve or liquidate or dispose of any interest in any FCC license with respect to television stations which are affiliates of TelevisaUnivision, among other things. TelevisaUnivision’s ownership interest may have the effect of delaying, deterring or preventing a change in control and may make some transactions more difficult or impossible to complete without TelevisaUnivision’s support or due to TelevisaUnivision’s then-existing media interests in applicable markets."

Also, per the latest 10-K.

"Our network affiliations and other contractual relationships with television networks, particularly TelevisaUnivision, are essential to our business, results of operations and financial condition. If our network affiliation and/or other agreements or contractual relationship with a network, especially in the case of the Univision network, were terminated, in whole or in part, or if a network, such as Univision, were to stop providing programming to us for any reason and we were unable to obtain replacement programming of comparable quality, it would have a material adverse effect on our business, results of operations and financial condition. "

Univision is deeply connected to Entravision's broadcast business; they profit from the current arrangement. I have a hard time seeing how they assent to the media company being spun-off. I think it is more likely that Univision (or its parent companies Searchlight Capital, Forgelight) buys the media business. In a less likely scenario, an outside buyer would need to pay Univision a premium to relinquish its control.

The Ad Tech Business

The ad tech business is where the valuation gets interesting, and where significant value lies.

Facing a declining audience, legacy media companies have been trying to break into digital media. Most broadcasters have a digital marketing department to cross-sell digital marketing services to their advertising clients, Entravision did too. From 2018-2022 Entravision was also buying digital media startups. Most of these were not value accretive. By 2025, Entravision has sold most of these media companies, except for Smadex (bought in 2018) and AdWake.

Smadex is an app-environment focused DSP platform that helps advertisers target users on mobile apps. App-first DSPs are distinct from desktop-first DSPs. Apps have unique technologies and considerations (mobile SDKs, rewarded ads, device IDs, contextual signals, interstitials, rewarded video, playable ads, install tracking, in-app events). It is positioned in the lower-spend part of the market. Larger competitors are walled gardens (Google) or for high-spend clients only (Tradedesk, Applovin). Smadex competes most directly with Liftoff.io (owned by Blackrock) and Moloco.

The DSP market is projected to grow at 20% a year globally. This seems reasonable, as I have noticed that most advertisers start advertising with the major players (Google, Facebook, etc.), but eventually reach a spend level where they are either oversaturating users or seeing a lower ROI. When this happens they consider other advertising channels, and DSPs are a common consideration. When advertisers start working with DSPs they will often run campaigns with multiple DSP providers. Over time they increase spend on the platform that they like best (customer service and performance).

DSPs in this segment have access to the same ad inventory, but compete with each other in auctions to win placements from the ad inventory suppliers. Over the long run, the firm that can deliver the best targeting and performance will win. That means a firm needs to be focused on what matters: predictive analytics. Once a firm pursues this path it starts building a flywheel. The firm that has the most data has the best targeting, and the firm with the best targeting gets more clients (which gets more data). A type of reinforcing moat can develop.

Having worked in digital marketing I know that digital media companies can pursue one of 2 strategies: aggressive sales or performance with transparency. Smadex is still run by its founder and has chosen the performance with transparency route. Its competitors have not. Basically, aggressive sales is the easiest option and data is complicated so most companies go the sales route. Once they do, it's difficult (near impossible) to change course. I've never seen it.

After speaking with employees of Smadex, I also learned something interesting. Its competitors operate on a win at any cost strategy. Competitors will operate at a 0% margin in order to win clients. Smadex does not do this, and yet it has been growing successfully. This suggests to me that the business has significant pricing power.

While there is no barrier to entry in the industry, due to its network effects I believe that Smadex has a competitive advantage over competitors and new entrants. The risk here is that major players with more data start moving down-segment to compete. I think that is unlikely.

The growth story is backed up by historical data. Revenue growth since it was acquired in 2018 has been 172% annualized. Naturally, that has slowed. Since 2022 revenue growth has been 26.6% annualized.

The segment is also profitable with 8.1mm in operating profit in 2024, and growing. EBITDA growth since 2022 has been 24.8% annualized.

Now let's value this segment with its competitive advantages, and 8mm in EBIT.

I project it to grow at 25% a year for 5 years and 15% for the next 10, terminal growth of 1%, at a 12% discount rate. A Discounted cash flow model gets us $383mm in present value for this company.

I have seen other analysts value it at $200mm. They point to the acquisition of AdTheorent Holding Company, which was acquired for a $200 million enterprise value on April 1st, 2024 , they had $170 million of revenues and $15.6 million of EBITDA. Perhaps you would consider a similar value.

AdWake is their in-house digital marketing agency. They use this to cross sell traditional media buyers into digital marketing packages. Management does not provide any guidance on how much of the ad technology & services segment is Smadex and how much is AdWake. But based on employee count (200 at Samdex, 100 ad AdWake), headcount trends (25% annual growth at Smadex, -14% at AdWake), and industry margins. I don't consider AdWake very significant to future cash flows, and it does not factor into my valuation.

Corporate Expenses

Corporate expenses (mostly connected with the media business) average 33mm, so apply a similar 7.5 multiple to that as the media business, we get -247.5mm.

Owned Spectra

I have seen analysts suggest that EVC could sell off some of its broadcast spectra rights (as it did in 2016). I think this is possible within the decade.

In 2016 the Federal Communications Commission (FCC) oversaw a reverse auction to buy spectra from broadcasters and sell it for 5G use. The auction targeted frequencies from 614 to 698 MHz, corresponding to UHF television channels 37 to 51. 175 broadcasters were compensated a total of $10.05 billion for relinquishing their spectrum rights. EVC sold the spectra rights of 4 stations for 246mm.

EVC still has 10 stations with owned spectra in that band; these stations cover ~8 million Nielsen viewers. At the past valuations of $66mm per station and $21 per nielsen viewer, that would equal 726mm or 168mm respectively.

Value being realized here is predicated on the there being another FCC reverse auction. While FCC Chair Brendan Carr has hinted at an auction 2.0, I find that highly improbable in the next four years. For one, the FCC no longer has the authority to conduct another auction. That authority expired in 2023. And also, most proposals are focused on opening up the mid band (Aviation Week) or upper c-band of spectra (TV Technology). Not UHF spectra.

However there is still some future value of this spectra. If sold, it would be worth more than the current market cap. I don't account for this in my valuation, but it is something to consider.

Let’s take a final valuation of 200mm for the spectra, discounted at 8% for 10 years, we get a net present value of 100mm. I add this to my valuation.

Final Valuation

Media 487.5mm

Operating expense -247.5mm

Smadex 200mm (gave this a haircut to be conservative, consider it a higher discount rate, and lower starting EBIT)

Spectra 100mm

Net Debt 90mm

Shares outstanding: 91mm

Target price = 4.94

Current price = 1.85

Upside: 168%

Free Options to Consider

Consolidation in the broadcast media space may drive the Broadcast Media EBITDA multiple up.

Smadex may grow faster than anticipated or be sold separately.

Spectra may be sold in the near future.

Risks

An economic downturn may reduce advertising spend and EBITDA.

Upstream players may move downstream to compete with Smadex.

Why the Discount?

1. The company is primarily in a tough and declining industry (broadcast media).

2. The financials look bad at first glance, so the company does not screen well.

3. Media investors don't understand DSP, and ad tech people are not interested in legacy media.

4. Microcap with no analyst coverage.

5. Multiple “hidden assets” that are not on listed on the balance sheet explicitly.

A Note on Financial Performance for Each Segment

In the filings prior to 2024, Management had 3 segments: Radio, Television and Digital. Starting in 2024, it has 2 segments: Media and Ad Technology & Services. The 2024 10-K restated prior financials for 2022, 2023 for the Media segment with +22M in revenues and -14M -9.5M EBITDA respectively. I am assuming this is fully removing all digital marketing spend from the segment. Now the media segment is just pure play media. As a result when I look at the media segment, I model it from the point of view of the restated financials, and give reported segment data prior to 2022 a 12M EBITDA haircut.

Most of the Facebook business was attributed to the Digital segment, and has been removed from the restated financials. It appears that they account for cross-sold digital marketing services under AdWake which is under Ad Technology & Services.

A Note on Headquarters

In 2024, Entravision moved its headquarters to 1 Estrella Way Burbank, California 91504. The same location as Estrella Media Inc, a likely acquirer of Entravision.

Disclaimer:

The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

I have new doubts about this one that may neccessitate a new article. Bought with a cost basis of 1.87, sold on the way up to a cost basis of 2.29. No longer invested. 23% return.