A company that is selling at 3.8 EV/EBIT, returns 133% of earnings as dividends and that is now selling at liquidation value.

The market prices Future fuel (FF) at liquidation value (expecting no future cash flows). Insiders think otherwise and are buying.

This is an amazing company in a “roadkill” industry with a recent major price dislocation. It is currently trading below liquidation value due to regulatory uncertainty in its primary market, temporary production issues, and recently restated financials. Despite these headwinds, the company has no debt, excellent management, high insider ownership, recent insider purchases, and historically has returned all of its earnings back to shareholders as dividends. It is currently selling at 3.8 EV/EBIT. Today’s price offers investors an asymmetric risk/reward profile with tangible downside protection.

“My definition of a special situation is one where a price dislocation has occurred, either at a single company or across an industry, because the market has identified a particular idiosyncratic risk and assigned an uncertainty discount to it… Although markets are generally good at estimating the magnitude of a contingent liability, they are often poor at evaluating outcomes probabilistically. Examples include litigations, regulatory actions, or other events that create the perception of going concern risk.”

-Jamie Mai from Cornwall Capital

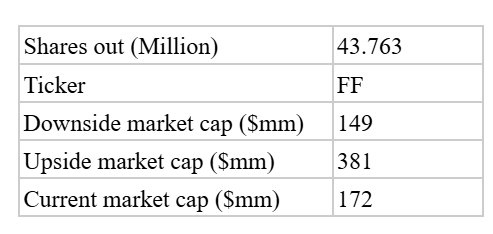

Key Figures

(Market data from 3-31-25, Fundamentals data from 10-K)

Market Cap $172mm

Net Cash $110mm

Enterprise Value (EV) $61mm

Tangible Book Value (TBV) $205mm

Estimated Liquidation Value $172mm

EBIT (TTM) $16mm

Free Cash Flow (TTM) $10mm

P/TBV = 0.84

EV/EBIT = 3.8

Shareholder Yield (8-year avg): 133% of net income, all in dividends.

40% insider ownership, with recent insider buying.

Background

Futurefuel is a chemical company located six miles southeast of Batesville in north central Arkansas. They have 2 major divisions. Specialty chemical and biodiesel.

The specialty chemical division includes two components: custom manufacturing (for specific customers) and performance chemicals (multi customer sales). Custom manufacturing accounts for most of the chemical segment revenue. These contracts include production of cleaning products, oilfield chemicals, agrochemicals, polymer modifiers, solvents, and more. They are not using all of their production capacity in this segment. They also have a vision to expand this segment into other new markets, and have brought on a new CEO Roeland Polet in September of 2024 to guide this strategy.

Biodiesel can be made from soybean oil, canola oil, animal fats, and other feedstocks. Futurefuel is able to use all of these feedstocks in its production. Biodiesel competes with petroleum-based diesel, and renewable diesel.

Futurefuel's two segments are not connected except for one product: glycerin, which is sold by the chemicals division and is a byproduct of biodiesel production.

Biodiesel Exists in A "Policy Market"

"Policy markets are most uncertain when policy is uncertain."

- Dr. Scott H. Irwin, Agricultural Economist at the University of Illinois Urbana-Champaign.

The biodiesel industry relies on 3 federal supports:

RFS blending mandates (mandating biofuels in transportation fuels)

RINs (Renewable Identification Numbers, a policy to account for and subsidize biofuel production)

Production tax credits (BTC/45Z)

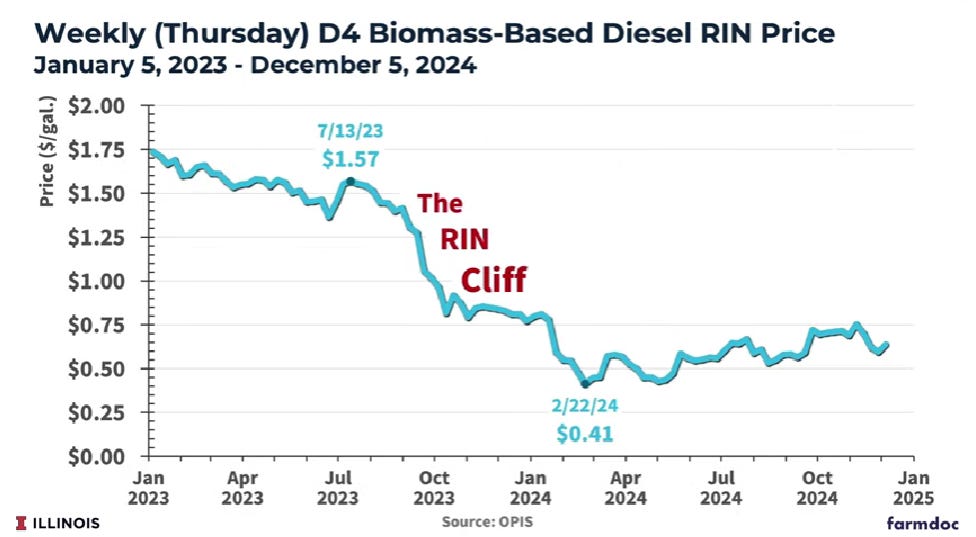

Policy uncertainty and overproduction has cratered RIN prices and investor confidence. Trump’s prior administration weakened the RFS with waivers, and his new appointees have a history of opposing biofuel subsidies. While they’ve softened their stance for confirmation hearings, clarity is lacking. The BTC expired under Trump in 2018 before being retroactively reinstated by Congress in 2020. We may see a similar situation.

Despite this uncertainty, FF is better positioned than peers in the industry:

It’s the 8th largest biodiesel producer in the U.S. in an industry where scale matters.

Operates with diverse feedstocks, providing cost advantages.

Has historically maintained profit margins during prior RIN collapses (2014, 2018, 2023)

Produced near breakeven in 2024 while renewable diesel producers paused production, imports ended and peer FAME producers halted production.

Company Specific Issues

In 2024, FF restated its cash flows due to misclassifications related to derivative accounting. This had no impact on earnings or total FCF, but triggered a class action and a share price decline. Over the lawsuit's alleged period the stock dropped by $200mm in market cap.

The highest trading day for FF was on November 11, 2024 when the company reported its 3rd quarter financial results. Reporting a net loss. The loss was driven by losses in the biodiesel segment. The company pointed to "a decline in renewable fuel and RIN prices with market supply in excess of the EPA RIN mandate" and production issues that could not be quickly resolved as their equipment supplier delayed service.

Trading volume also increased on a likely related announcement on Jan 31st, when the company announced an unplanned outage in biodiesel production; it is expected to be online by March 2025.

It appears that the company is refitting their biodiesel production equipment to prevent future production delays. This is clearly a temporary issue. And I don't expect major capital outlays for this project.

They have also recently delayed the release of their 10-K. It may be related to its derivative accounting issues, or further production issues.

FF is an Illiquid Stock Sensitive to Overselling on News

41% of stock is held by insiders.

44% of FF stock is held by institutions.

That leaves only 15% of the stock as public float .

Source: https://finance.yahoo.com/quote/FF/key-statistics/

This makes the stock illiquid and volatile, providing opportunity for it to be oversold on poor sector or company news.

The Opportunity

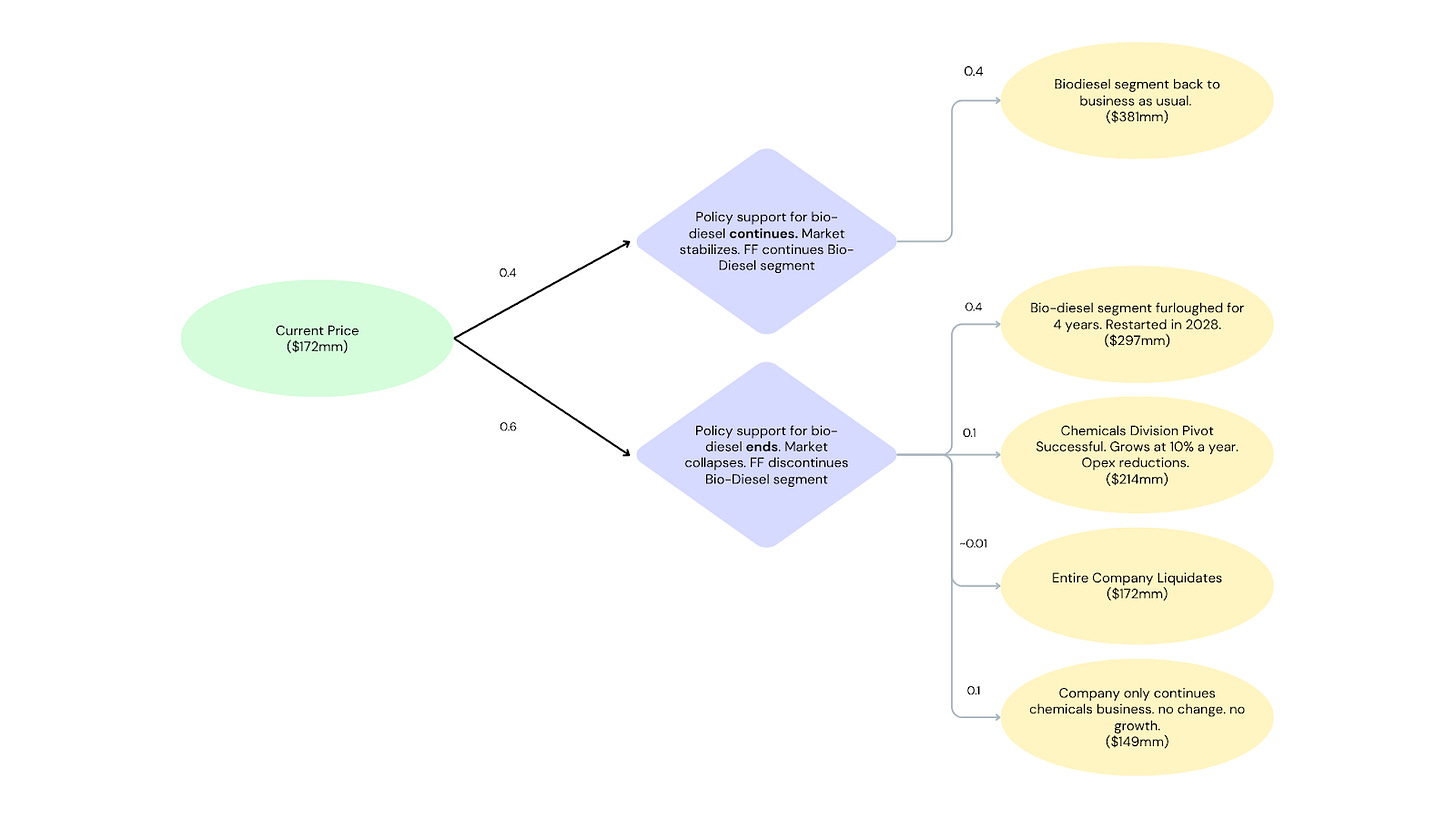

This is an asymmetric trade. Heads you win. Tails you don't lose.

The upside is an eventual resumption (or retroactive implementation) of policy incentives as before and a stabilization of the biodiesel market. This is what happened in a similar spot under Trump 1.0

However, let's examine the downside and value FF's earnings by excluding the biodiesel segment. Earnings then are just gross profits from the chemicals segment, less fixed costs previously associated with the biodiesel segment, less operating expenses.

Why subtract fixed costs previously associated with the biodiesel segment? Because reported segment level figures include an allocation of plant level fixed costs in COGS based on segment revenues. According to the 10K: “Cost of goods sold (COGS) is allocated to the chemicals and biofuels business segments based on equipment and resource usage for most conversion costs and based on revenue for most other costs.” A previous write up by fizz808 in 2014 (https://valueinvestorsclub.com/idea/FUTUREFUEL_CORP/7499860215) estimated that $15mm of annual plant level fixed cost is allocated based on revenue. I assume $20mm.

Figure 5. 9 year average of key FF financials by segment. Source

To estimate a rough intrinsic value for market cap (should EBIT stabilize) I use 8x EV/EBIT, then add net cash to arrive at a market cap value.

Keep in mind that this is a very conservative estimate for downside. It doesn't subtract reductions in operating expenses with the discontinuation of the biodiesel segment. Such cost cutting would be probable if the company discontinued the segment.

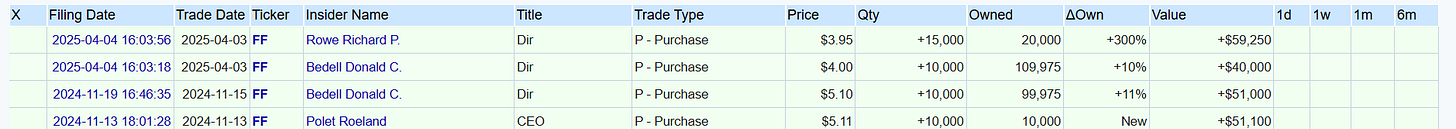

Note that management understands the regulatory situation, but has still gone through with maintenance work on their biodiesel plant in Q1 of 2025 for future production. Insiders have also been buying stock. This suggests that management thinks the downside scenario is unlikely.

Source: OpenInsider

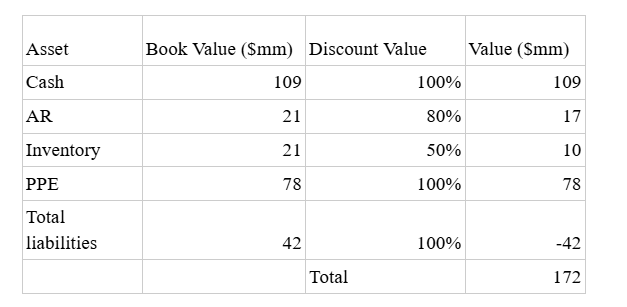

Futurefuel is selling below its liquidation value, providing us with significant downside protection.

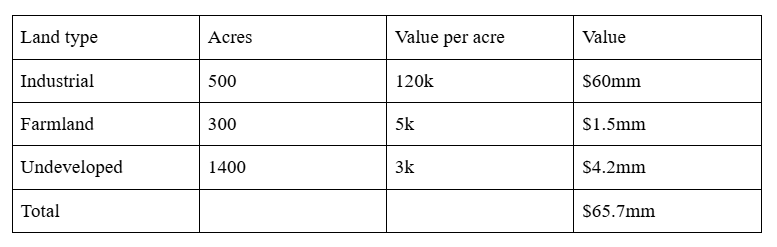

Futurefuel owns ~2,200 acres of land six miles southeast of Batesville in north central Arkansas. Approximately 500 acres of the site are occupied by their chemical plant. The plant is located at 2800 Gap Road, Batesville, AR 72501. It is 48,000 square feet and 5 stories. They acquired this property from Eastman in 2006.

Figure 5. Futurefuel Batesville plant property aerial view. Source: https://www.actdatascout.com/

An aerial view of the property demonstrates the following land uses.

500 acres of industrial built land

300 acres of farmland

1400 acres of undeveloped property

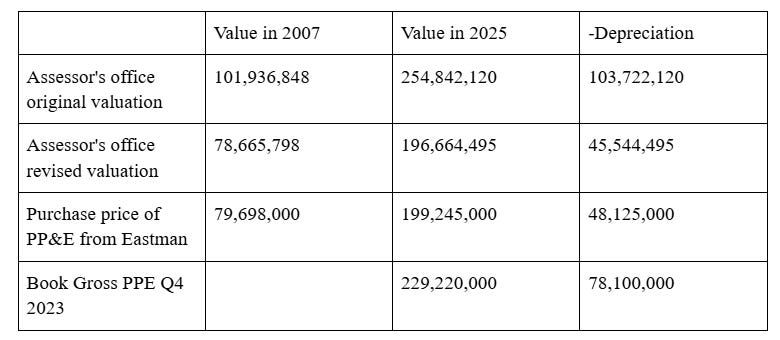

In a 2007 court case CV-07-350-4, it is revealed that the Independence County Assessor's office valued the PPE, less vehicles and Inventory at $101,936,848.00. Upon appeal and settlement Futurefuel negotiated valuation down to $78,665,798.

Considering that Futurefuel valued the PP&E from Eastman at $79,698,000 at the time of purchase, the assessor's revised valuation seems reasonable.

Adjust 2007 prices based on the NPI indsutrial index, subtract accumulated Depreciation of -151,120,000, and we get the following possible valuations:

Or from a bottom up approach, we can use landsearch.com the average 2025 sale price of land sold in Batesville, AR

Again compared with the assessed real property value of $27mm in 2007 at a 250 index, that gets me to a comparable $67.5M.

With all of this in mind, I conservatively estimate that the company's net book value of 78m for its PP&E is likely to be close to its liquidation value, and I use that in the following figures.

Bringing all of this together we can estimate FF's liquidation value:

Source: Latest 8-K https://s3.amazonaws.com/b2icontent.irpass.cc/2518/rl144475.pdf

At a market cap of 172mm, FF is trading at liquidation value.

Risks

1. The risk is that Trump takes an interest in biodiesel and ends all policy support for the biodiesel industry. The courts uphold this. The biodiesel market collapses. Congress doesn't reimplement policy retroactively. Future Presidents (?) don't reimplement these policies. Futurefuel immediately liquidates and sells its PPE at a lowball price. The market is expecting this scenario and pricing the stock accordingly. I place a very low likelihood on all of this. And even so there is likely upside in a resulting liquidation.

2. Futurefuel management pursues value destructive acquisitions or produces biodiesel at negative margins. This is unlikely, management has a long history of focusing on cost control, owners earnings and shareholder yield. I see no sign of this changing. If biodiesel is unprofitable they will not produce.

3. While on average settlements are ~2% of damages in cases like what FutureFuel is facing. A larger than expected settlement payout in the shareholder lawsuit is possible. (https://ippfa.org/wp-content/uploads/2018/01/PUB_2022_Full_Year_Trends.pdf)

4. In the last year it appears that FF has spent 12mm above normal capex spending. I estimate that there may be 6mm left in additional capex spending to come for Q1 2025. However, it could be higher.

Summary

By every metric, FF is undervalued. You are buying the business at its conservatively calculated liquidation value and for 45% of its upside intrinsic value.

You are buying it for 85% of its tangible book value. 2/3rds of which is cash. So your downside is protected. If you win, you win a lot, and if you lose, you don't lose much (if any).

Here is my expected value tree for this investment. It results in 310mm.

Essentially the market is setting the magnitude of a biodiesel market collapse correctly, but it is setting the probability of that event at 100%. I find that very unlikely.

Catalysts

A clarification or reinstatement of favorable public policy could cause a sharp rebound in valuation.

Stabilization of the RIN market.

Additional Notes & Footnotes

Notes on the Unit Economics of Biodiesel

Using 2023 financial data, I estimated some unit economics for the biodiesel segment.

Revenue per Gallon of biodiesel

$5.78/gallon ($289M / 50M gallons)

Subsidized by

$2.25 per gallon in RIN credits (based on 1.50 price per D4 RIN in 2023)

$1.00 per gallon in BTC

Gross Profit per Gallon

$11M / 50M = $0.22/gallon

Cost of Goods Sold per Gallon

($289M - $11M) / 50M = $5.56/gallon

Average prices of feedstocks

Soybean Oil: $3.83 per gallon.

Used Cooking Oil (UCO): $2.78 per gallon

Animal Fats (e.g., Tallow): $2.55 per gallon

Subsidies (and the RIN market) are key within the unit economics of the business.

Sources: https://www.statista.com/statistics/675815/average-prices-soybean-oil-worldwide/

https://markets.businessinsider.com/commodities/soybean-oil-price

https://ers.usda.gov/sites/default/files/_laserfiche/outlooks/108091/OCS-23l.pdf?v=24595

Notes on the biodiesel industry

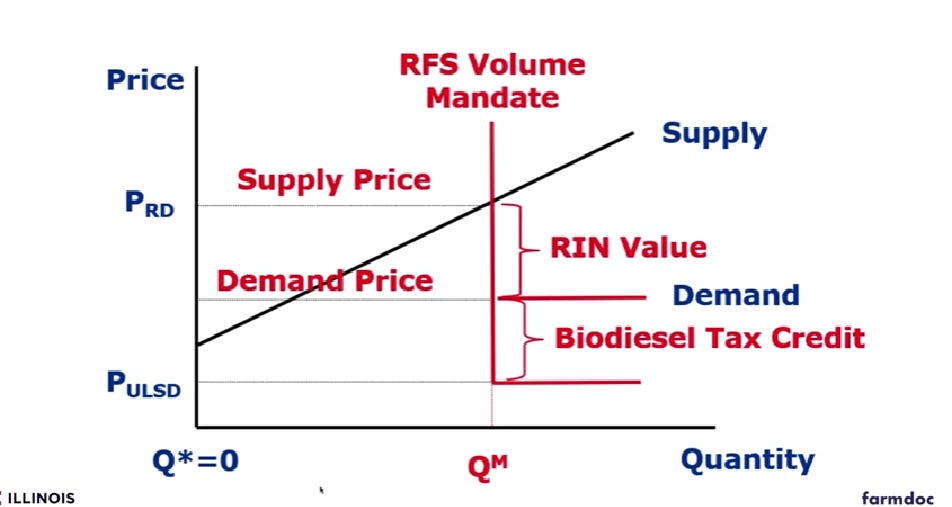

The biofuel market has been created and supported by 3 policies: the Renewable Fuel Standard (RFS) program (which mandates certain ratios of renewable fuels blended into transportation fuels), the production tax credit BTC (now the similar but less generous 45Z), and RINS (a method of accounting to incentivize biodiesel in end products). Because the cost to produce petroleum diesel is much lower than the market price for biodiesel, the market for biodiesel would not exist without these policies.

Scott Irwin, lays out the economics of these subsidies in his talk "The Outlook for U.S. Biofuels." Figures 1-4 come from this source.

Figure 1. How key policies impact the supply and demand curves for renewable diesel. ULSD stands for ultra-low sulfur diesel made from crude oil and RD stands for renewable diesel. RFS sets a production target for biodiesel producers. The BTC (or 45Z) subsidizes/lowers the price of biodiesel, and RINS lower prices further to make up the cost difference between RD and ULSD. In combination, these policies create a market for biodiesel.

However, the sector is now facing regulatory uncertainty as all 3 of these policies have an uncertain (but not necessarily negative) outlook for the next 4 years.

In his first term, Trump's EPA expanded waivers (SREs) for small oil refiners, allowing them to avoid meeting RFS standards. Thereby neutering the impact of RFS regulation, which is the single most important policy for the industry. Further weakening or elimination would be disastrous.

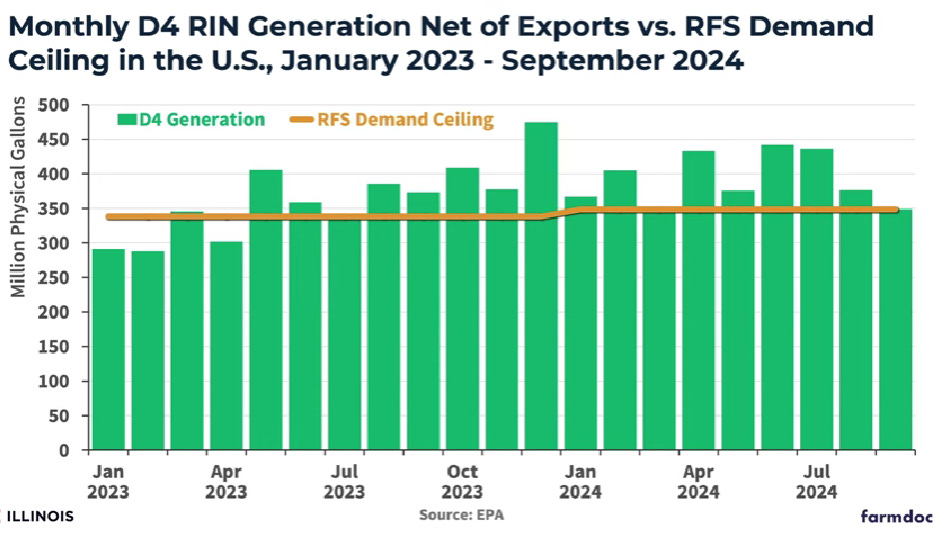

The RIN market has crashed again recently, mostly due to overcapacity, as production has exceeded RFS targets.

Figure 2. Monthly D4 RIN Generation Net of Exports vs. RFS Demand Ceiling in the U.S.

In 2018, under Trump, the BTC expired, but was later reinstated by Congress in 2020 and applied retroactively through 2018: https://www.opisnet.com/blog/biodiesel-tax-credit/

Guidance for the 45Z credit (the next generation of BTC) was never fully provided by the Biden administration and remains on shaky ground. [1]

Source: https://www.dtnpf.com/agriculture/web/ag/news/business-inputs/article/2024/12/04/ag-economist-irwin-trump-away-45z

Trump hasn't made any clear statements on any of these policies going forward. His recent appointments to the EPA and USDA are both oil executives and have opposed pro-biofuel policy in the past, but to be confirmed to their positions they relaxed those previous positions and now express support for these policies.

Historically, we have seen RINS crash to this level or below in 2014 and 2018. FF successfully passed through the downturn in both instances. This is because FF has a high production capacity (8th largest producer in the US) allowing it to better distribute its fixed costs and maintain profitability. It is also able to make biodiesel from multiple feedstocks (not just soybean oil) which offers some competitive cost advantages.

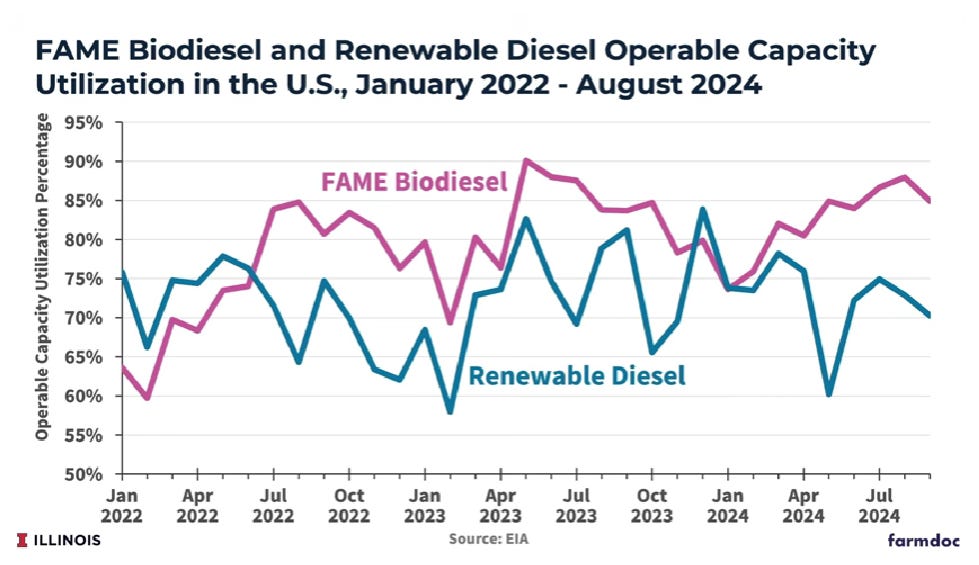

Most recently, when RIN prices collapsed in 2023, FAME biodiesel (Fatty Acid Methyl Ester Biodiesel, FF's product) production remained relatively steady, while the market for their competitive substitute, renewable diesel, collapsed. [2]

Figure 3. Weekly D4 Biomass-Based Diesel RIN Price.

Figure 4. FAME Biodiesel and Renewable Diesel Operable Capacity Utilization in the U.S.

I believe that this suggests that in a prolonged RIN D4 down cycle, RD plants would go offline before FAME producers, followed by single feedstock biodiesel producers and then the biodiesel producers with poor cost control or high debt. FF is positioned well to navigate this downturn.

Notes on Management

I want to stress that management has been heavily aligned with investors here with 41% of stock held by insiders. 40% of which is owned by Paul Novelly (and his associated entities St Albans Global Management LLC, and Apex Holding Co.). Insiders were buying heavily when the stock was priced in the $4.15-4.60 range in 2024.

Source: https://www.nasdaq.com/market-activity/stocks/ff/insider-activity

Novelly receives a sizable compensation of over $50k a year, but donates this to charity. The rest of the board receives a sizable compensation (~$50k a year), but owns little stock. I would be concerned if Novelly was not involved.

Also the board is confidential, and could not be reached for comment.

Glycerin Business

According to their latest 10-K

"A byproduct of the biodiesel process is crude glycerin, which is produced at the rate of approximately 10% by mass of the quantity of biodiesel produced" The plant typically produces 59 million gallons of biodiesel B100 a year.

The typical density of B100 biodiesel is approximately 7.3 pounds per gallon. That means 430,700,000 pounds of B100 is produced each year, and 43,070,000 pounds of crude glycerin is made each year.

As of January 2025, 80% crude glycerin prices were quoted between $0.17 and $0.20 per pound.

https://thejacobsen.com/2025/01/13/glycerin-prices-unchanged-buyers-sellers-cautious-about-market-trend/

So an estimated $8mm of crude glycerin is sold each year from the biodiesel operations.This is accounted for under the chemicals business.

Footnotes

[1] 45Z. I am not very concerned about the 45Z credit, as RINs should compensate. RINs (Renewable Identification Numbers) are generated when renewable fuel is produced and are required by refiners/blenders to meet Renewable Volume Obligations (RVOs) under the Renewable Fuel Standard (RFS). If production becomes less profitable due to lower tax credits (45Z, BTC), and mandates stay the same, then RIN prices must increase to keep production viable and meet compliance demand, compensating for the lost tax credits.

[2] FAME biodiesel is cheaper to produce than RD. It takes 8.5 gallons of feedstock to produce RD while it takes 7.5 to produce FAME biodiesel. FAME biodiesel is often added to RD (80% RD, 20% FAME) to add lubricity to the final product.

Disclaimer:

The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

With their announcement yesterday, shuttering a major production line - biodiesel production, the probability of my upside case is greatly reduced. I no longer feel that the investment is attractive.

This is why knowing your downside well matters. In this case, trading below TBV provides this company with a lot of downside protection. I didn’t lose money on this trade.

On the other hand refiner exemptions were smaller than expected and the RINs will compensate for the higher feedstock/lower oil price spread.

I am keeping an eye on it.