A misunderstood and unpopular company selling at 1 EV/EBIT, with a history of strong shareholder returns.

Open Lending Corporation (LPRO) was recently oversold due to a unique accounting adjustment.

Note: I looked through 50 low EV/EBIT companies and this is the first good opportunity that I found. No one else is covering it, so I am. I should have submitted this when it sold at an EV of 0 last week. After a 50% run-up. I’m kicking myself for for the delay, but lesson learned: “Don’t take vacation".

This is, in essence, a software company. Since 2020 it has averaged $42mn in earnings, 86% of which has been returned as dividends and buybacks. It is now selling for an enterprise value of ~$50mn. This is an asymmetric bet with limited downside. In a base case the company should be worth $188mn, and with successful cost reductions would be worth $332mn. Now selling for ~$150mn.

This company is an asset light business that carries no major liabilities on its books. It is a "toll booth" type business.

The company has a net cash position of ~$100mn and a market cap of ~$150mn. It has no present default risk.

2021-2024, the company has returned an avg EBIT of $42mn, while it has on average returned $36mn to shareholders in dividends and stock buybacks.

Historically, on average, it has traded at an EV/EBIT ratio of 35.

Background

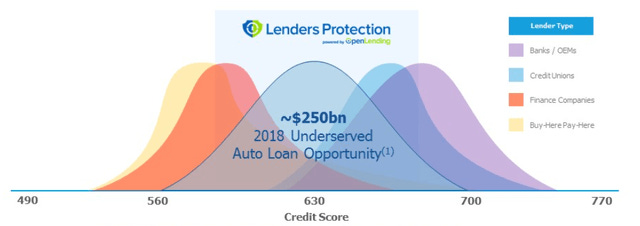

Open Lending Corporation (NASDAQ: LPRO) is a lending and loan risk analytics platform that helps financial institutions offer auto loans to near-prime and non-prime borrowers (credit scores between 560–699). No other institution focuses on this lending segment like LPRO does.

Source: Investor Presentation

Auto dealers connect buyers with LPRO at the point of sale, where buyers enter their information and get evaluated for risk by LPRO. LPRO uses their proprietary models, built on previous analyses and default rates to assess creditworthiness and default risk of the customer. They then share this information with auto loan underwriters and insurers (who insure against default risk). The main product sold through the platform is Certified Loans: Loans that go through the LPP underwriting program and are insured against default. These are Open Lending’s primary revenue-driving transactions.

LPRO recognizes revenue in 3 ways:

Program Fees are charged to lenders for using the LPP platform. Fees are upfront, and from 2020-2024 have averaged $600 per loan. Cash flows are generated over the life of the loan.

Profit Share is a cut of the underwriting profit from insurance premiums. LPRO gets 72% of profits after total premium collected less insurance expenses. This value is estimated at origination for the full life of loan. That means that LPRO books revenue upfront based on expected defaults, recoveries, and insurer costs. However, cash comes in over time. From 2020-2024 revenue has averaged ~$270 per loan. Cash is heavily front-loaded because insurance premiums are paid early (default risk is perceived lower at the start). LPRO collects ~80% of its profit share cash within the first 12 months, but losses (claims) don’t fully materialize until Year 2+.

Claims Administration Fees are paid by insurance partners for managing claims and are ~3% of monthly earned premiums. These are recognized over the lifetime of the loan.

For further background I highly recommend reading this post: https://valueinvestorsclub.com/idea/OPEN_LENDING_CORP/9986257491

Recently, LPRO has written down 96mn in revenue related to that second segment of income: profit share, due to higher than expected default rates in the 2021-2022 vintage, higher expected defaults for the 2023-2024 vintage due to lending to customers with poor tradelines, and a general proactive adjustment for macroeconomic factors.

Why the Revision?

Management explained its rationale for the latest write down:

"First, there was continued deterioration of our 2021 and 2022 vintages. These certified loans were generated when used car values reached an all-time high in late 2021, driven by pandemic-related disruptions in the supply chain. The subsequent decline in used car values has increased the likelihood of default on vehicles that are now worth significantly less than their corresponding outstanding loan balances. Adjustments to the forecasted performance of our 2021 and 2022 vintages accounted for approximately 40% of our total negative change in estimate for the fourth quarter of 2024.

Second, continued elevated claims and delinquencies as a result of broader macroeconomic conditions accounted for approximately 20% of our total negative change in estimate for the fourth quarter of 2024.

Finally, we identified two cohorts of borrowers, borrowers with credit builder tradelines and borrowers with fewer positive tradelines, that caused our 2023 and 2024 vintages to underperform. Adjustments to the forecasted performance of loans to these two cohorts of borrowers accounted for approximately 40% of our total negative change in estimate for the fourth quarter."

Essentially the company marked down its future profit share for the 2021-2022 segments down to zero. It also heavily discounted the profit share of its 2023-2024 vintages (~50%).

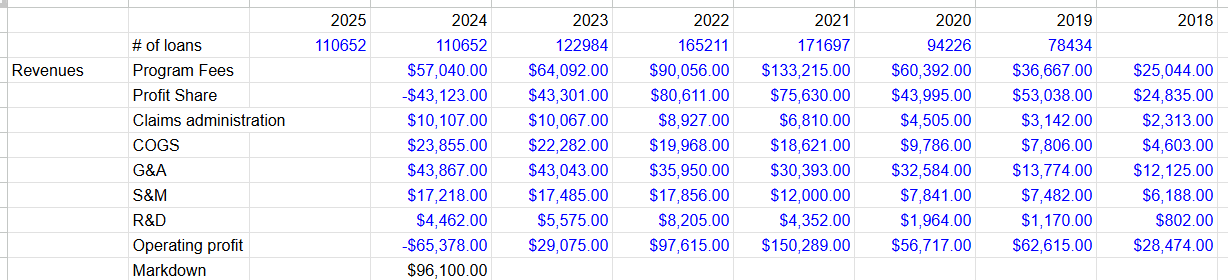

To summarize, stated financials were

Source: https://docs.google.com/spreadsheets/d/14M7kKFqfy5wLmDEBa2e87l0QAHe3yt7INaEde1aW_Ss/edit?usp=sharing

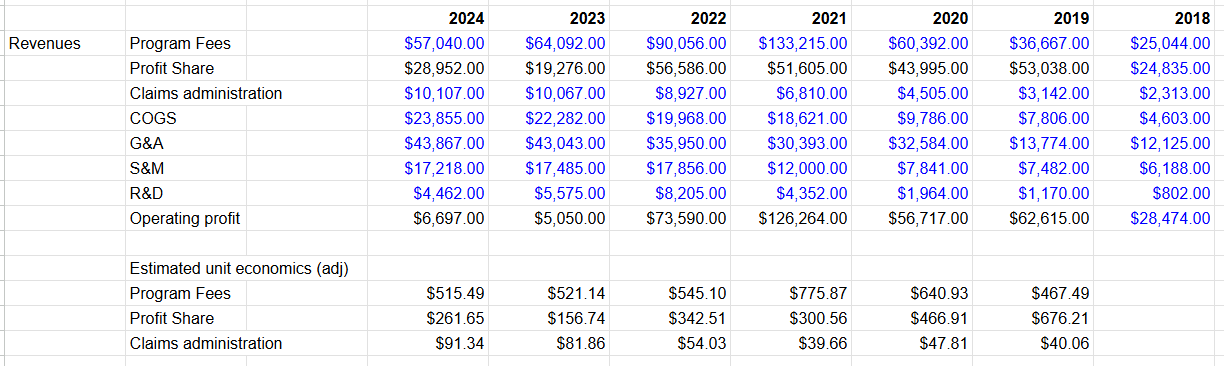

If we take the $96mn mark down and distribute it evenly across 2021-2024 (following management attribution above), we arrive at adjusted financials of:

Source: https://docs.google.com/spreadsheets/d/14M7kKFqfy5wLmDEBa2e87l0QAHe3yt7INaEde1aW_Ss/edit?usp=sharing

Management guidance is for $300/loan in profit share going forward, so if we assume similar loan origination numbers (reasonable considering a slight decline of 0.8% YoY for Q4 2024 vs Q4 2023), and that guidance for profit share unit revenue is hit for 2025, then base operating profit should be $10,945.00 in 2025.

Add an 8x multiple on that and add $100mn in net cash, and we get to a base market cap of $188mn.

Free Option: Operating Cost Reduction

The core business is LPP, which is essentially a software product. Once the software is developed, you need essentially no additional spend to operate the software (just hosting, maintenance, occasional updates). However from 2020 to 2024, the business has seen loan volume increase by 14%, but cost of service increased 144% and sales, marketing, general and administrative costs increased 50%. The company has a lot of opportunity for cost control.

Management recognizes this. They brought in a new CEO Jessica Buss who has made this a priority.

“In the near term, we expect general and administrative expenses to decrease as we focus on cost saving initiatives.” 10-K, 2024

“Identifying potential cost efficiencies and process improvements throughout the loan life cycle that may further streamline our business, as well as planning to focus our future investments on our core Lenders Protection Program.”

— Jessica Buss, Q4 2024 Earnings Supplement

If we assume, they bring opex down 20% (and not the potential 50%), then this adds $18mn in operating profit and (at an 8x multiple) $144mn in value.

New management is highly aligned

Jessica Buss, CEO of Open Lending, earns a base salary of $800,000 annually, with the potential for an annual cash bonus equal to 100% of her salary (up to 150% based on performance). She also received 4,776,000 time-based stock options that vest evenly over five years, with accelerated vesting if she is terminated without cause or resigns for good reason within 12 months of a change in control. Additionally, she received a $400,000 sign-on bonus, subject to repayment if she departs within the first year for cause. These stock options significantly tie her compensation to the company's stock price, offering substantial upside if LPRO’s share price appreciates—potentially yielding $19 million if the stock rises from $2 to $6—aligning her long-term incentives with shareholder value.

Jessica has a history of insurance experience and is planning to treat the core LLP product as an insurance product. She has hired a new chief underwriting officer and for the first time actuaries on staff. (how they spent all that operating expense without investing in actuaries is surprising).

"Yes. I would say that the infrastructure and the piping and the tools are built. The team has done a great job with scorecard with LP2.0. [Matt Roe] (ph) has joined us as Chief Underwriting Officer. That was a big addition to the company last year, really bringing in sort of the underwriting view. We now have actuaries on staff that are helping on the pricing side. And then Josh has joined us on the product side. And really, what we need to do, again is sort of bring that all together." (Q4 earnings call transcript).

In Summary:

This is an beaten down stock and now an asymmetric bet. At a market cap of ~$150mn with net cash and no major book liabilities there is no downside risk. Meanwhile, it is undervalued from the $188mn base case and the $332mn “turnaround” case. The path to EBIT improvement is clear, and new management is pursuing this path going forward.

Disclaimer:

The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

Great work, man! Thoughts on management owning practically 0 stock?

Bought at a cost basis of 1.50, sold at cost basis of 2.04. 36% return.