A nanocap with a 30% Return on Capital, 37% FCF/EV yield, and 100% shareholder yield on earnings.

Shriro Holdings (SHM) appears to be very cheap.

Note: All figures unless otherwise denoted are in AUD.

This is a no-brainer stock and my biggest position.

I have always heard of those neglected securities in microcap land that have no analyst coverage, but have a solid balance sheet and earn 30%+ earnings yields. I finally found one.

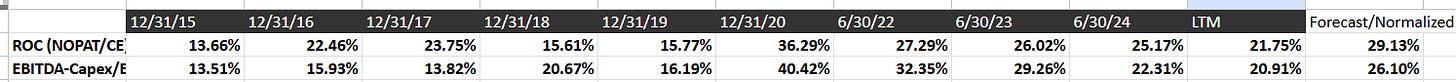

Here is this company's record of return on capital, and its earnings yield as FCF/EV.

Unlike the rest of the cigar butts I have been huffing, this one has no regulatory uncertainty or complex accounting. It is not in a declining industry. It has no shady management. It is just a simple, safe, well run company that earns consistent profit. Even more than that, this is the most shareholder friendly management I have ever seen. With a consistent payout ratio over 100%!

It is undervalued simply because it is a nanocap (~36mn Market Cap in USD). The only way a small-time analyst would find this is by going through every stock in the ASX (no one) or by talking their way into access to a Bloomberg terminal (me).

It has a market cap of 54.5mn

It also has net cash of 8mn, and 14mn in capital lease obligations. They have been liquidating net working capital and PPE, and also still have the potential for further inventory liquidation (moving to 3pl model) and capital asset liquidation (exiting warehouses). I personally give them 5mn for that. But to be conservative for this write up I will not include that in my calculation.

That gives me an EV of 60.5mn.

Over the last 3 years, EBIT has averaged 13mn a year, EBITDA/ has been 19.4mn, FCF has been 19.2 mn, capex has been 1.5mn, and it has returned 20mn a year to shareholders via dividends, stock buybacks and a return of capital. That is a payout ratio far over 100%. They have had some one-off expenses that temporarily depress EBIT (ERP upgrades, restructuring costs) ; these were $1mn for 2024.

Going forward I will conservatively assume that normalized earnings will be $16mn.

The return of capital allocation choice stands out to me. Essentially, management did something incredible, they said, "We had excess cash on the balance sheet to pursue acquisitions. We didn't see any targets priced at a discount. So we returned the capital that shareholders invested initially. We did this because a return of capital avoids capital gains tax." And then they did the same thing, but with a tax advantaged share buyback. If I had a nickel every time I saw a management team do this, I would have two nickels, and they would both be from this company.

Putting it another way this is like buying a bond with a 27% yield. (normalized earnings/EV)

To put this track record in perspective. If you bought this stock in 2018, you would have received back 2x your purchase price in debt paydowns, dividends, buybacks, returns of capital (which was not taxable), and have a market cap worth roughly what you are getting today in the open market.

The market is being completely irrational about this company. In January, management bought back 19% of their shares. What did the market do? Tank the stock 20%...

And here is the best part. This is an Australian company. When I say Australia, what is the first "can't lose" investment you think of? A crisp and clean beach-front property on the Golden Coast? Fosters beer? Or a nice barbie to put your shrimp on?

That's right. This Australian company sells barbeques. Are you in or what?

The company is Shriro Holdings Ltd. (ASX:SHM) They manufacture, market, and distribute consumer products in Australia, New Zealand, and internationally.

Actually, they own more than grills. They own brand names Everdure, Robinhood and Omega (major products include BBQs, and kitchen accessories like range hoods) and have distribution rights for others (Casio calculators, pioneer audio equipment, oral-b).

They were previously very involved in the kitchen appliance white goods space, but it became too competitive, margins became compressed, so they exited to focus on more profitable segments.

For their remaining brands they have been moving to third party logistics for distribution. This has improved their profitability and made them an asset-light company. Because of this transition, D&A overstates capex by 3mn a year, and working capital is being liquidated as it shifts to distributors.

Management is focused on being stewards for the brands they carry, and are working on launching their BBQs into the US (50x the addressable market of Australia).

Keep in mind that in 2015–2016, Shriro completely reinvented Everdure as a premium outdoor cooking brand. Previously it was a heater company. It is likely that they are able to repeat their success in foreign markets.

In summary, this is a company that trades at an expected forward 29% earnings yield. Most of which would be returned to shareholders as real cash. Their highest margin product is Grills which is in a downcycle due to depressed discretionary spending in recent years. They have had some one-off expenses that temporarily depress EBIT. They have $5mn more in buybacks authorized. I expect those to occur.

Management chooses its spots well and focuses on what matters. They have not got suckered into expensive acquisitions or markets where they can not compete successfully. They also have international growth opportunities.

This will not rerate. Since 2019 it has traded at an average FCF yield of 27%. It has been and always will be cheap.

The only major risk I see is in the exchange rate, so I am hedging a bit with rolling call options on FXA.

She'll be right, mate.

Stock Price: 0.71 AUD

Date 5/12/25

Disclaimer:

The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

I recommend closing this position.

Management is not engaging with shareholders citing a 6 month long blackout period.

I reconsidered what it means when management sells into a buyback.

Better investments out there. There is an opportunity cost in this.

Such a weird situation here. I would appreciate anyones advice.

Shriro almost delisted last week, but has now changed their mind and will instead issue dividends/buyback. That’s good news for now, but that potential delisting worries me.

I don’t know how I would feel about owning an delisted Australian stock, I would get the dividends, but I could basically never sell.

I would lose any public insight into the company, which might lead too poor management decisions.

It shows that they can’t find a buyer or better strategic alternative right now.

That’s why I am not in this right now.

On the upside, the company would lose most of its public filing expenses (and after trying to speak with them the investor relations dept is definitely not their strong suit, lol).

Am I thinking about this right, or am I missing something?