A stock selling at 53% of net asset value, liquidating.

Investigating Firm Capital Apartment REIT (FCA.UN)

A big thanks to Hughie at Liquidation Stocks, this was on one of his watchlists.

Similar to a recent write-up by Dirt, I recently looked at a microcap Canadian REIT that is discounted by 47% and that is undergoing a strategic review and likely liquidation. This stock is deeply undervalued, and the value will be realized eventually. The only thing uncertain is the time frame. Still, if you buy something at half off, and it takes 4 years for that value to be realized, that is still a respectable 19% CAGR.

Today I am talking about Firm Capital Apartment REIT which owns multifamily residential housing in the United States. It is a smaller division of a Canadian financial conglomerate: "Firm Capital."

It sells at a 53% Price to Book.

It has a straight-forward balance sheet:

Essentially, FCA has 4 major accounts of assets: parent level debt, owned apartments, equity stakes (both common and preferred) in joint ventures and debt investments in apartments.

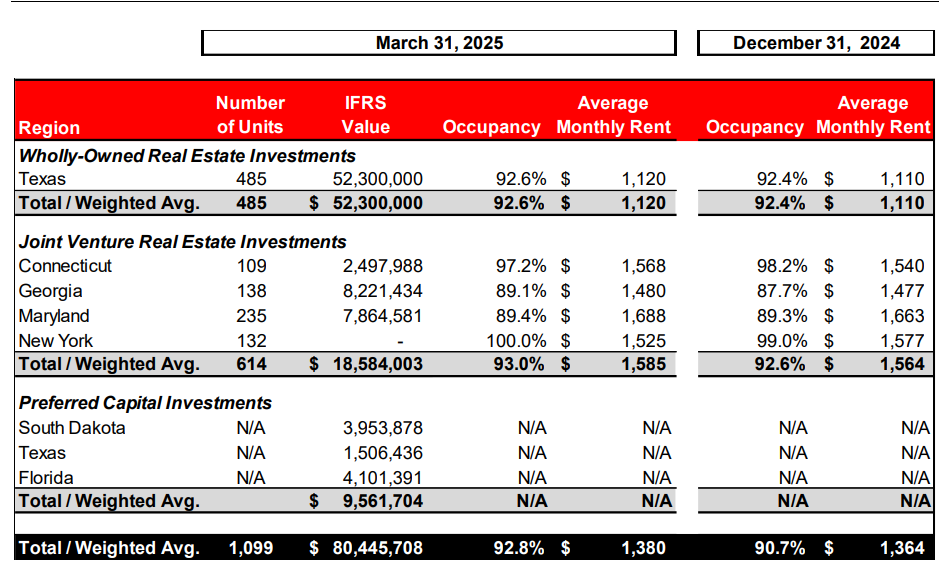

Here is the book value of these assets as stated in Q1 2025:

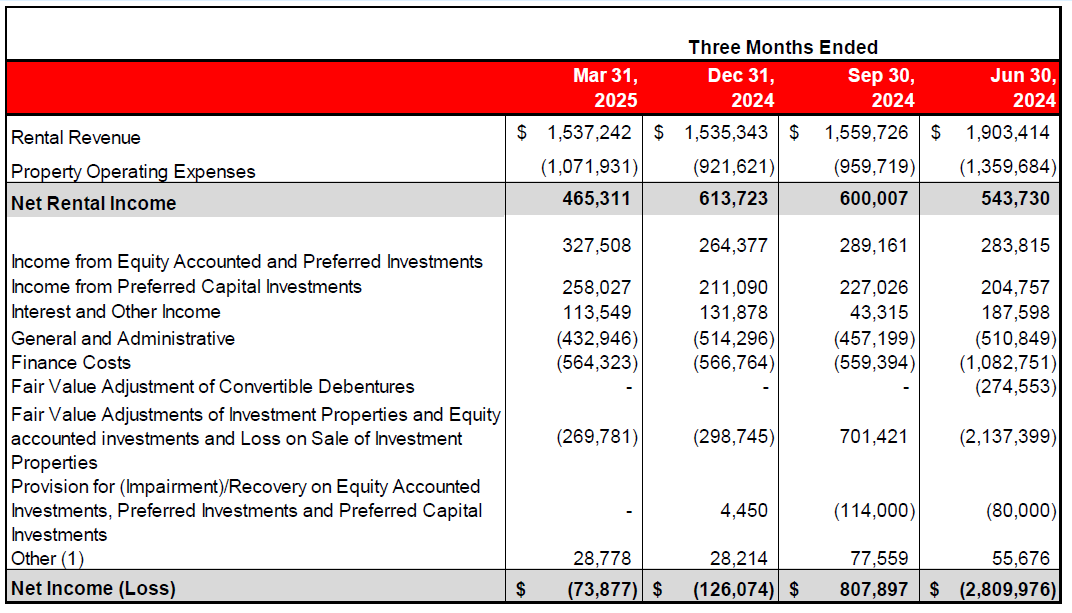

And here is the NOI for each asset segment:

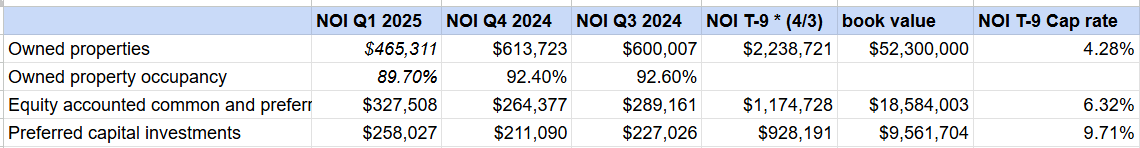

Putting those together we get this cap rate table:

Note that the last property transaction was May 20, 2024, so we have 3 full months of data to use in our NOI calculation. So I use those to get NOI T-9 months, and adjust for a fourth quarter.

Also note that Q1 2025 for the occupied properties had some one off costs that reduced NOI for the quarter, in addition you can see that occupancy rates were unusually low.

CBRE puts multifamily cap rates between 4.90 - 5.90% depending on class and location, so these book valuations seem reasonable.

The biggest source of value and my biggest concern in my valuation is the owned apartments. FCA owns 2 apartments in Houston, Texas. Together these have 485 units. The company states that these are currently listed for sale.

With some sleuthing, I think I know what the properties are. They appear to be previous equity investments that they bought out in 2022:

Woodglen Village - 250 units

"On January 31, 2020, the Trust closed an equity accounted and preferred investment to acquire the Woodglen Village, a 250-unit multi-family residential portfolio located in Houston, TX (the “Woodglen Acquisition”). The purchase price for 100% of the Woodglen Acquisition was $27.9 million (including transaction costs). The Woodglen Acquisition was financed, in part with a $22.1 million, 4.6% first mortgage due on February 9, 2023. The Trust contributed $3.4 million (100% ownership) of preferred equity yielding 9% and $1.2 million of common equity representing a 50% ownership stake in the investment. On February 8, 2022, the Trust acquired the remaining 50% interest in this investment for $4.1 million. The Trust now owns 100% of this investment and accounts for it as an Investment Property in its condensed consolidated interim financial statements. " (Q2 2022 filing)

11111 W Montgomery Rd, Houston, TX 77088

Newmark appears to be selling it: https://www.nmrk.com/properties/11111-w-montgomery-road-houston-sale

The mystery 235 unit apartment

In April 2022, FCA acquired the remaining 50% interest for $5.3 million, making it a wholly owned investment property from that point forward, (Q2 2022 filing). This added 24.7M and 235 to their owned Texas properties line item in Q2 2022 compared to Q1 2022. This implies an estimated market value of ~$24.7M, occupancy of 93.6%, and monthly rent $1034 for that property.

If someone is able to find this or talk to management about it. Please let me know.

The value of these properties was established by the company using IFRS accounting standards. Which is the price that would be received to sell an asset in an orderly sale. These values have been audited by MNP at EOY 2024, who in turn verified it with another auditor.

Per MNP: "We involved an independent valuation expert as part of our audit to independently assess significant assumptions used by management in their determination of fair value and provide commentary on the appropriateness of the methodology used by management’s in determining the fair value of the investment properties held for sale."

So from every angle, the book value is reasonable. And the equity sells for 53% of book.

Invert, Always Invert

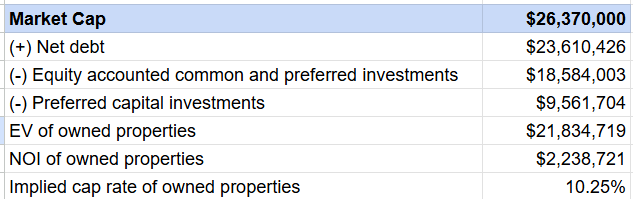

Let's look at this from another angle. What is the market's implied cap rate for the owned apartment?

Which is about twice the market rate.

Undergoing a Liquidation

I don't tend to be interested in REITs unless there is substantial shareholder yield or a special situation where I believe the value can be realized. I think this helps me avoid a "value trap."

In 2022, the company announced that it would pursue a strategic review of its assets:

"The board continues to work to dispose of its remaining Wholly Owned Assets and evaluate uses for the Trust. Senior management has had multiple discussions with a number of third parties as to the best path forward for the entity. Senior management and the board will report back to unitholders in due course. The Board will continue to assess matters on a quarterly basis and determine if the Trust should: (i) distribute excess income; (ii) distribute net proceeds from asset sales, after debt repayment; (iii) reinvest net proceeds into other investments; (iv) distribute proceeds as a return of capital or special distribution; and/or (v) use excess proceeds to repurchase Trust units in the marketplace. It is the Trust’s current intention not to disclose developments with respect to the Strategic Review unless and until it is determined that disclosure is necessary or appropriate, or as required under applicable securities laws."

Since then it has sold off half of its properties and has not reinvested net proceeds into other investments.

Historically they have sold properties very close to or slightly less than their stated book value. For example when they disposed of a wholly owned property in texas, in Q4 of 2023. They sold for $9.9m with an associated “Loss on Sale of Investment Properties” totaling $1m. With this in mind, and to be conservative, you may want to give a 10% haircut to book value.

Summary

This is a company that is being liquidated and that sells at about half of its NAV. The liquidation process has been slow, but it is progressing steadily.

Why the undervaluation? This is a microcap stock. It is a Canadian REIT that invests only in the United States. There is likely some investor mismatch. Canada has very tough rent control laws that make residential REITS in Canada unattractive for many investors. Due to fair value adjustment accounting it has posted consistent negative earnings, so it doesn't screen well. It offers no dividend which many REIT investors want. Many investors will not touch REITS. Finally, it has been liquidating for over 2 years now, so people may be impatient with it.

A little more on that last point. This is a situation that has made me think about the concept of time arbitrage. Many investors simply can't wait for these types of deals to go through. They want to see a catalyst. They want to deploy their money quickly. I think investors that are willing to wait for the market to catch up to intrinsic value have an edge that no institutions have, and that few other retail investors can develop.

I think this explains why there are notable undervaluations in the REIT and land development space, it seems to be a fruitful hunting ground currently.

Happy hunting.

Sources:

https://firmcapital.com/fcareit/

Disclaimer:

The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

I'm not so confident about this one anymore. When I look into the property here: 11111 W Montgomery Rd, Houston, TX 77088

in Harris county property tax records

I see that it is listed as owned by Ashcroft capital: https://ashcroftcapitallawsuit.com/

The company won't answer my questions about it. Nor will major investor ravensource fund

Considering it is in Canada I probably dont have much legal protection here.