A warrant-arbitrage that yields a 168.6% annualized return.

Investigating National Energy Services Reunited Corp. (NASDAQ:NESR)

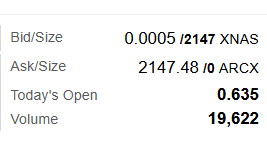

This is a small trade for "beer money". You are buying warrants and exchanging them in a tender offer for common stock. The exchange is scheduled for June 30th. The warrants sell for $0.50, and the daily trading volume is around 20k a day with 5 days left to trade, so this is for people with very small portfolios and time on their hands.

National Energy Services Reunited Corp. (NASDAQ:NESR) is an integrated energy services provider in the Middle East and North Africa. It recently announced an exchange offer. If warrant holders voluntarily exchange their shares, then on June 30th they will receive 0.1 shares of common stock per warrant. After June 30th, they will be automatically converted and shareholders will receive 0.9 shares of common stock.

The offering period will continue until 11:59 P.M., Eastern Time, on June 30, 2025.

Today 6/23 NESR common stock is selling for $5.72 a share, and warrants are $0.50. That means you are buying shares for $0.50 and receiving a value of $0.572.

Considering you have to wait one week to receive your value, that is a raw return of 14.4%. Annualized to an IRR that is 168.6% return.

This is the bid ask spread right now.

So it is hard to get a piece of this trade, but if you have a small account and time to call around at your brokerage, it is possible.

If you do get a piece of these warrants, you will need to call in to your brokerage again and ask them to participate in the exchange offer.

Disclaimer:

The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.