Amerprise Financial (AMP) is a quality compounder for the long term.

Part 1 of my series: A-Z through every Minnesota company

Warren Buffett was once asked how he achieved 50% returns on investment, and his advice for someone looking to do the same. He answered:

“The answer would be, in my particular case, it would be going through the 20,000 pages [of stock information]. And since we were talking about railroads—you know, I went through the Moody’s Transportation Manual a couple of times. That was 1,500 or 2,000 pages—well, probably 1,500 pages—and I found all kinds of interesting things when I was 20 or 21.”

I’ve known this advice since it was asked a year and a half ago, and haven’t actually followed it yet. I have most often leaned on screeners: Insider buys, EV/EBITDA, EV, High FCF yields, and maybe occasionally look through an entire industry, but never got around to the “read about every company A-Z” method. I still don’t have the time to do it now, but I will anyway.

I actually met the guy who asked the question prompting the quote above, and he also hasn’t followed this advice. Instead his take away was that he needs to re-read Ben Graham’s old books again. Maybe there is some cognitive bias against turning over every stone, and hoping the screener will give you a shortcut. Maybe we just assume that Buffett did it because he didn’t have a screener, but the problem is that everyone else is doing the screener method, so what would be your edge doing so?

I say all of this is to introduce my new series:

Looking through every public company headquartered in Minnesota A-Z. I will look through each company and publish the ones I find interesting or with potential.

Company #13: Ameriprise Financial

Fargo Clip: https://getyarn.io/yarn-clip/e6f589e2-2ea1-4a3b-85bb-071906eb5d17/gif#ebOYbIcf.copy

Amerprise was founded in 1894 as Investors Syndicate, then rebranded as Investors Diversified Services (and built the IDS tower which went on to star in the movie “Fargo”). Then they were bought by Alleghany Corporation, who sold them to American Express.

This company was actually briefly mentioned in Joel Greenblatt’s book “You Can Be a Stock Market Genius.”

“Investors Diversified Services (IDS), had been growing its earnings at a 20-percent rate for almost ten years. This business consisted of a nationwide group of financial planners who provided clients with overall investment and insurance plans based on the client’s individual needs. The planners often recommended and sold many of the company’s own product offering, such as annuities and mutual funds. Since the financial planning business is largely relational business dominated by single or small group practitioners, IDS (now american express advisors) was able to provide the comfort, resources and depth of financial products not easily found in other organizations. The ability to provide services all in one package had allowed IDS to grow its assets under management at a very fast rate. Its revenues were largely derived from the annual fees generated from the investment and insurance products sold to its customers. The bottom line was: IDS also seemed like a valuable and fast-growing niche business.”

Greenblatt focused on the spin off of Lehman Brothers from American Express, but had you also followed the spin off IDS in 2005, you would have done quite well, it grew at a 15% CAGR. It was the top performing stock in the S&P 500 Financials Index in that time.

Today, 60% of AMP’s revenue comes from wealth management (Advice & Wealth Management), with the remaining split between Asset Management, and other products (grouped under Retirement & Protection Services) which includes life insurance.

All revenues are from the US. Historically earnings growth has come exclusively from the wealth management segment.

Earnings growth has been driven by three engines: growth in the value of the underlying securities portfolio (AUM), growth in new product uptake, growth in their client base (notably not from advisor headcount growth).

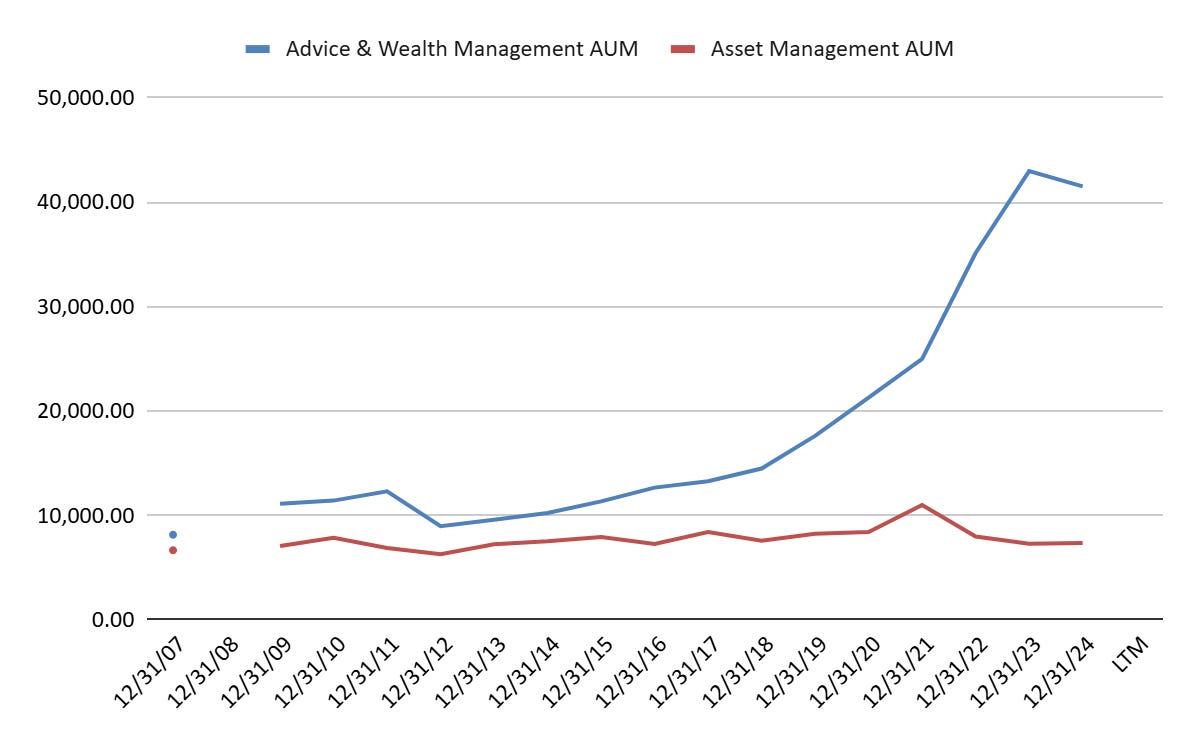

AUM Growth

Margin Growth

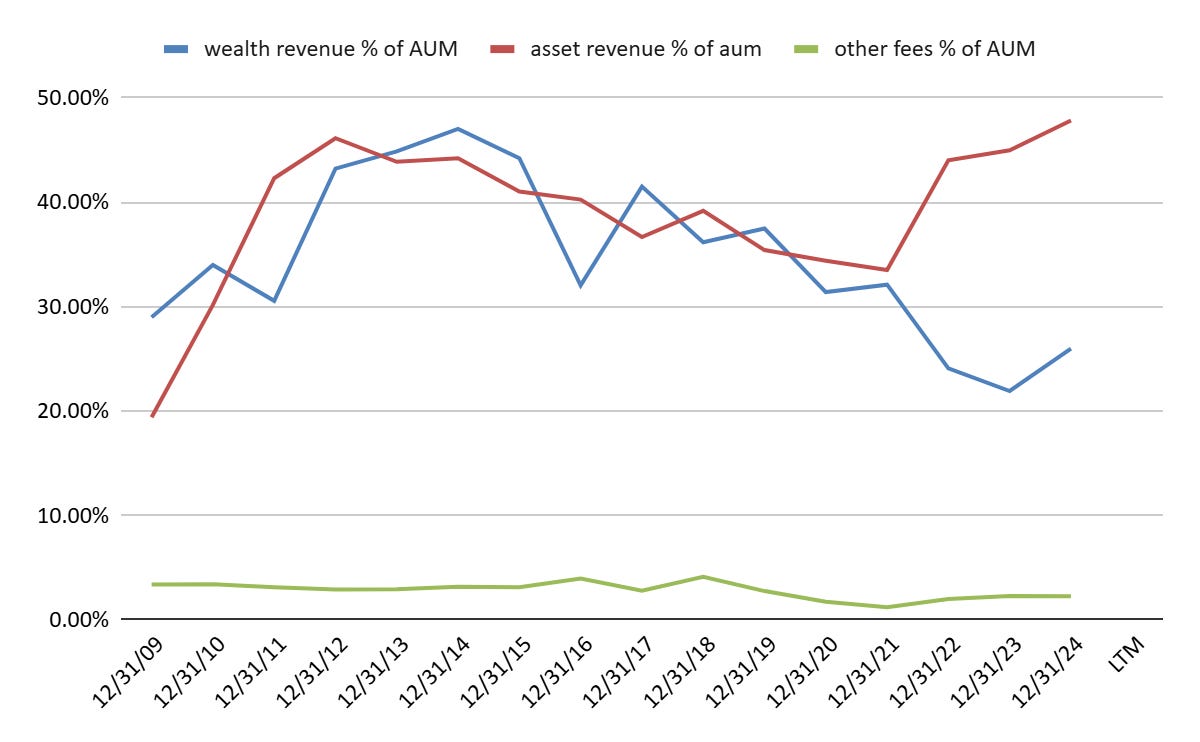

The above data is defined as revenue/underlying asset value, which I use as a proxy for their take rate. As you can see, the wealth management division and asset management divisions are very capital light and productive divisions, (which makes sense, as they are service businesses).

Wealth management AUM is the fastest growing segment, so it seems that AMP is advising on larger client portfolios, both from underlying asset growth and from increasing the amount of the client wealth they are advising (and generating fees) on. From the annual report: “Fees at wealth management includes advisory fees on managed/wrap accounts, financial planning fees, distribution fees, transaction and other fees, and net investment income (earned spread).”

Interestingly, AMP yields an impressive 59.6% ROE, has achieved a 3 year EPS growth of 15% and an LTM PE of 12.4. Making a price-earnings-growth rate of 0.83.

EBITDA has grown at 8%, but significant buybacks pushed earnings growth to 15%.

The wealth management division is based on a flexible cost structure – as employees are generally compensated on some variable payment scheme and management can trim lower-performing advisors during an economic downturn.

There is a lot of concern in the industry around the shift towards passive investments and its implications for the asset management industry, but the advisory business has adapted as it has moved from a commission-driven business model to a “wrap-fee” business today where the advisor and client’s interests are better aligned.

In the latest annual report management highlighted a couple of interesting things as well:

“Wealth management is now the primary driver of earnings and caters to lower AUM clients, a segment that is underserved, sticky, and benefitting from advisors leaving wirehouses… Wealth management’s earnings are driven by management or wrap fees and are less reliant on product sales.”

Risks

There are a few notable risks to be aware of and track with this company. Advisor departures are a real risk in this business, per the Q3 2025 Earnings Call “Two practices went RIA... But overall, it’s fine for them. We’ve recruited very strongly.” The company seems to walk a good line between supporting their advisors and allowing them enough independence where advisors feel it is in their best interest to stay with the company. Also, fee compression pressure will likely continue, but Ameriprise has been navigating this well so far. Furthermore, while mass-affluent clients are underserved, they are also more sensitive to cyclical drawdowns. If there is a major market drawdown, Ameriprise would be more impacted than ultra-high net worth focused providers.

Summary

Ameriprise Financial is a well run financial services provider. By owning all the major functions of wealth management: Advisory, asset management and in-house insurance products, they are able to provide a one-stop-shop for their clients. Further, because they focus on lower AUM (mass affluent) clients, they are competing in a space where they have less competition from the likes of JP Morgan, Goldman Sachs and Morgan Stanley. Furthermore, with their independent advisor model, they attract advisors leaving the major wirehouses who are seeking to “own” their book of business. They have found success and appear to be positioned well in a world moving towards passive indexing products. With growing earnings, boosted by a significant share buyback program, and a current slight undervaluation, Amerprise is a quality compounder that you can hold for the long term.

Disclaimer: The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

I do not hold a position in these securities.

I plan to do this will all UK stocks