An equity with 98% upside with "hidden" assets and a planned catalyst to close the gap

Investigating Leon's Furniture (LNF, LEFUF)

The business is selling at a 49% discount to intrinsic value.

Upcoming catalyst: A REIT spinoff will be worth ~100% of the current market cap. Expected by the end of 2025.

Adjusting for this real estate value, you are essentially "buying" the business for free.

Consistently profitable company in a stable industry.

Little debt. (5% of market cap).

Insiders own 70% of the stock, with a recent history of further insider buying and share buybacks.

Note: Others have covered this before, but I would particularly like to shout out Daniel Smoak and Smoak Capital for his analysis.

The Industry: About The Furniture Business

The furniture business is competitive with low barriers to entry and few firms have a competitive advantage. The industry has a lower priced segment (IKEA), mid priced segment (Leon's) and a luxury segment (Williams Sonoma). Online players like Wayfair are also a significant presence. Online purchasing in general (from any player) makes up 10-15% of all furniture purchases.

Because furniture is typically a purchase that people want to hold on to for 10+ years, customers like to be able to test the furniture before they buy. This makes the showroom model attractive. Furniture is large and bulky, making ecommerce difficult to pull off without a strong last mile distribution network, which makes a showroom/distribution center model attractive. Finally, cost is a major concern for consumers which means that big box models, and large purchasing volumes are advantaged.

In order to achieve a high return on invested capital (ROIC) a furniture store needs to have high inventory turnover. Being price advantaged with a loyal audience, and maintaining cost efficiency allows firms to achieve a high ROIC. Effectively, once you are the dominant low cost producer in a local market you become incredibly hard to out-compete. Surprisingly only one furniture business that I know of has operated with this in mind.1

About Leon's Furniture

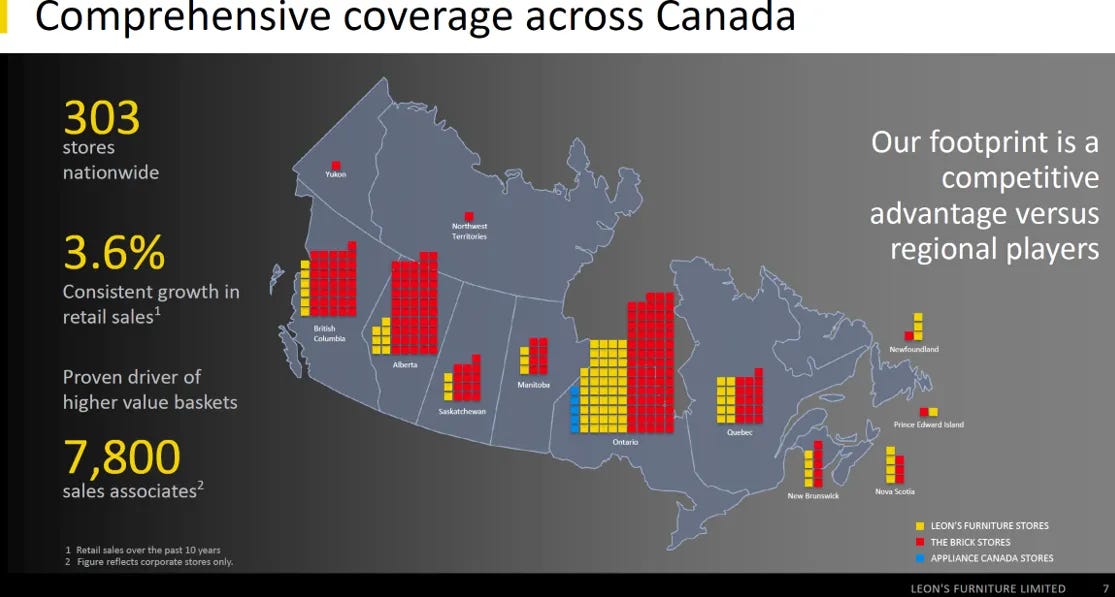

Leon's operates in the low-mid priced furniture segment of the Canadian furniture market. It is the largest furniture store in Canada with 303 stores across the country. Its core store brand is "Leon's" and it purchased "The Brick" in 2012.

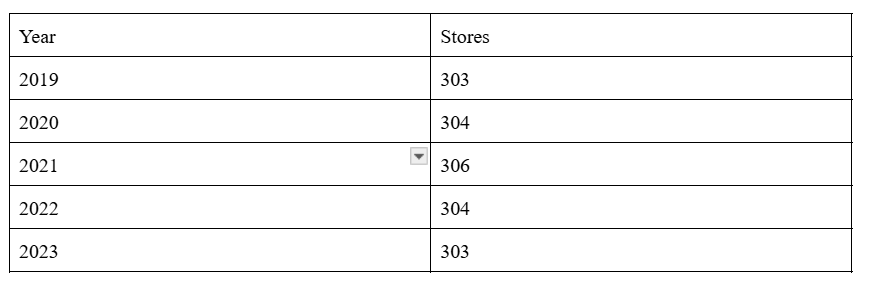

In recent years the store count has been steady

Leon's doesn't have any notable competitive advantages over competitors, but it is a decent business. That is shown in its financial ratios:

18% returns on net tangible capital

44.4% gross profit margin

3.42x inventory turnover

1.73% annualized CAGR in Revenue since 2017

While not a wonderful company, Leon's has been conservatively managed. It has not lost major market share since 2017. It has adapted well to online selling with a growing share of sales coming from its ecommerce sites. Since 2017 it has improved operating margins by 7.7% by controlling its SG&A expenses. It has maintained an average 30% payout ratio to shareholders. Insiders own ~70% of the stock. It has no major debt (5% of market cap).

Essentially this is a decent, boring business (with little risk).

The Opportunity

Leon's is in the process of "spinning out" its real estate portfolio into a REIT (investment vehicle for real estate). The real estate is currently recorded on the balance sheet at its original cost (purchased before 1990). Land + Buildings + Building Improvements are valued on the balance sheet at $278M (All figures used are Canadian Dollars). However, when revalued in 2025, these assets are likely worth $1.86B. . A significant valuation difference for a ~$2B market cap.

Valuing the Real Estate in 2025

Asset 1: Owned retail and distribution center real estate

Leon's outright owns many of their stores, distribution centers and the land on which these sit. In total they own 5.6M sq. ft. of real estate for these uses.

According to management, Leon's owns 3.7M sq. ft. in retail stores (including attached warehouses) and 1.1M sq. ft. in distribution centers.

Currently they lease 6.6M sq. ft. at an effective annual lease cost of $14.12/sq. ft., equating to $93.2M in lease payments. The distribution centers would likely have a slightly higher rent. According to CBRE's Q3 2024 Canada Industrial Figures report, the national average asking net rental rate for industrial properties was $15.67 per square foot. CBRE To be conservative I use the $14.12 per sq. ft. figure.

Investors expect a 6% return on real estate, this is termed a cap rate, we can use this to calculate the value of land based on its expected rents. CBRE sets a cap rate guide of 6%.

Putting all that together we get a 5.2M sq. ft. in owned land that will be leased at $14.12 /sq ft, and priced at a 6% cap rate. That gives us a value of $1.226B for this real estate.

Asset 2: Toronto Real Estate

Leon's owned 40 acres of land in Toronto which they intend to develop into a new headquarters and a 4,000 residential unit development.

This asset is a little harder to value. If we look at similar lots sold for multifamily use recently, we can expect a value of $16M per acre for the lot.

Recent Comparable Transactions:

1325-1361 The Queensway, Etobicoke, ON:

Size: 2.17 acres

Sold Price: $40,000,000

Price per Acre: Approximately $18.43 million

Description: High-density residential development site in a major developing node with easy access to Sherway Gardens and downtown Toronto.

Source GTA MultiFamily

2655 Bayview Ave, Toronto, ON:

Size: 1.05 acres

Listing Price: $16,950,000

Price per Acre: Approximately $16.14 million

Description: Prime residential development opportunity in a sought-after Toronto neighborhood. Source: https://www.zillow.com/homedetails/2655-Bayview-Ave-Toronto-ON-M2L-1B8/2069076778_zpid/

This gives us a value of $640M for this lot.

The Core Operating Business

The core business is earning $192M in earnings before interest and tax (EBIT). And priced at $1923M in enterprise value (EV is the price of the business stock + debt).

Again, based on the expected leasing cost of $14.12 per sq. ft. The cost of the new leases paid to the REIT will be $72.8M. Leons will own ~51% of the REIT, and so receive 51% of that back in income. It will also receive property tax benefits to the core operating business. It will sell the remaining 49% of the REIT to the public (this is my estimate for execution, but the concept remains the same, no matter the split.)

Deducting 51% of the lease payments, we would get to an expected EBIT of $156M. We multiply this by an expected EV/EBIT multiple to arrive at a value for the core business.

An EV/EBIT ratio for Leon’s of 9 is typical for the last 5 years of Leon's, and conservative so I will use that. That gets us to an EV value of $1404M for the core business.

Final Valuation

The core business is worth $1404M, add in the real estate values of $1860M, subtract current net debt of 100M and we get a fair market cap price of $3164M or a fair share price value of $46.40 CAD. LNF is now trading at $23.38 CAD providing us with a 98% upside.

An Planned Catalyst to Unlock Value

As previously mentioned, the value of this real estate is currently hidden, and so for LNF’s market value to be realized, it needs to be unlocked. Management recognizes this, stating:

"The market value of our real estate assets is well above the historical cost of $256 million we report for accounting purposes. Our two-part strategy to unlock that value includes (1) creating a Real Estate Investment Trust, and (2) developing the properties that remain within LFL Group"

–2023 Annual Report

In order to unlock this real estate value, Leon's appointed a new CEO. Michael J. Walsh, who oversaw a similar REIT spinoff at Canadian Tire in 2013. He became CEO of Leon's in 2021 and has taken steps to effectuate this REIT spinoff plan. He is aligned with shareholders and sees value in this transaction. In November 2021 he repurchased 10% of the shares outstanding at a price of $25 per share (recall that the current price is ~$21).

The REIT was announced in May of 2023. I expect that it will be launched by the end of 2025. Management states that the delay is due to regulatory approval, the generally poor conditions in the REIT market and (I suspect) the lack of zoning approval for the Toronto site. Zoning approval is expected by mid 2025.

Risks

The risk here is that this gets delayed for 2+ years, reducing our internal rate of return.

Land bank type transactions are not favored by the market. It isn’t until cash flows hit that a revaluation occurs.

Over 60% of stock is owned by the Leon’s family.

Why Does this Discount Exist?

Leon's does not communicate the valuation of their real estate. They have not provided an estimated value of it, they have only stated that they think it is undervalued. They also have not set a specific date for the REIT to occur. I think that the market is either unaware of the pricing discrepancy, or anticipating a spinoff date long into the future.

[1] Footnote: On the Virtues of Nebraska Furniture Mart (NFM)

"I'd rather wrestle grizzlies than compete with Mrs. B [founder of NFM] and her progeny. They buy brilliantly, they operate at expense ratios competitors don't even dream about."

- Warren Buffett

Researching the furniture business I spent a fair amount of time reading about and considering NFM, and its competitive advantages. I think it's a fascinating business.

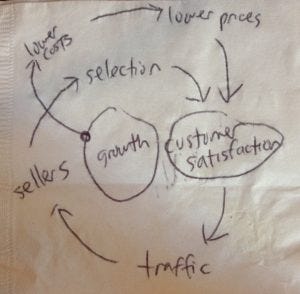

NFM maintains gross margins of 20-22%, while the average industry competitor (like Leon's) maintains a 44% gross margin. This business model allowed NFM to price furniture at a significant discount to competitors, passing the savings on to the consumer, which provided the firm with a higher sales volume, inventory turn over and an even lower price, a virtuous cycle.

In essence the NFM model is a precursor to Bezos' flywheel concept for Amazon.

The benefits of its low cost pricing advantage explain NFM's industry leading inventory turnover, measured with its industry leading $500 sales per sqft (in 1983). With the limited information we have about the transaction, I can only estimate that NFM sold at a tangible book value of 31M. Considering the high inventory turnover and competitive advantages, I think a 2x book multiple based on the 61.5M purchase price is reasonable. Compare that with its 15M in EBIT, and we arrive at a ballparked 50% ROIC. Despite the obvious advantages of this model, few furniture businesses (or retailers) operate at this level. It takes someone like Mrs.B to make it happen.

Disclaimer:

The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.