Buy a Land Bank for 30% of its Fair Value. PE of 6. Historic Growth of 30%. With a long runway for growth at 15%.

Investigating Forestar (FOR) and backtesting John Neff along the way.

I recently read John Neff on Investing, which was published at the peak of the dot-com bubble amid lofty valuations (sound familiar?). In the final chapter he talked about a few industries that he saw potential in.

"Bargains have not vanished entirely from the less-recognized growth sector. Many stocks of home builders feature price-earnings ratios more than 75% below going market multiples… Lust for one's own piece of turf still beats heartily in virtually all Americans who will either buy homes for the first time or move up to more luxurious homes. Thanks to the advent of large regional and some national home builders, housing may turn out to be considerably less cyclical, and multiples will expand in tandem with greater earnings. These publicly owned home builders enjoy at least three basic advantages over fragmented, mom-and-pop home builders (1) better availability of credit even if credit tightens, (2) enough clout to compel price concessions from suppliers, and (3) sufficient resources to exploit expensive technology… And don't forget that big home builders can command the loyalty of plumbers, carpenters, and electricians as markets become more competitive for these tradespeople.

These are some of the several indications that home builders behave less like cyclicals and more like less recognized growth stocks… I'm among the minority who think that these stocks will behave more like less recognized growth stocks than like cyclical stocks. Not everyone agrees. Therein lies the opportunity"

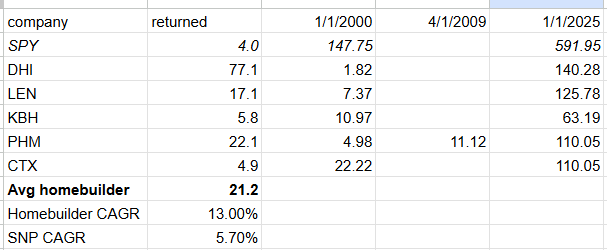

If you had taken his advice and invested in the top 5 homebuilders by market cap at that time: DHI, LEN, Kaufman & Broad (KB Homes), Centex Corp (Bought by Pulte) and Pulte, you would have returned double the CAGR of the S&P 500.

Fig 1. ROI of homebuilder stocks 2000-2025

Note that this return is even after CTX got caught up in the mortgage bubble with large financial liabilities in its financing division. And still, even after losing half of its value from 2000-2009, you still grew your investment 5x. This is because CTX was bought by PHM using company stock in 2009, and PHM appreciated 10x (My value for CTX in the table above is in reference to its converted PHM price, not actual CTX price).

History has validated John Neff here. Homebuilders have been neglected growth stocks.

Notably, this list does not include NVR who pioneered an asset light model where homebuilders don't buy and speculate on plots for homes, but instead have option contracts with land developers for prospective home plots. In this model the land developers have land on their balance sheets and are stuck with the slow work of preparing the plots for home building, while builders focus on building. Since 2000 the industry has heavily moved towards the asset light option contact model.

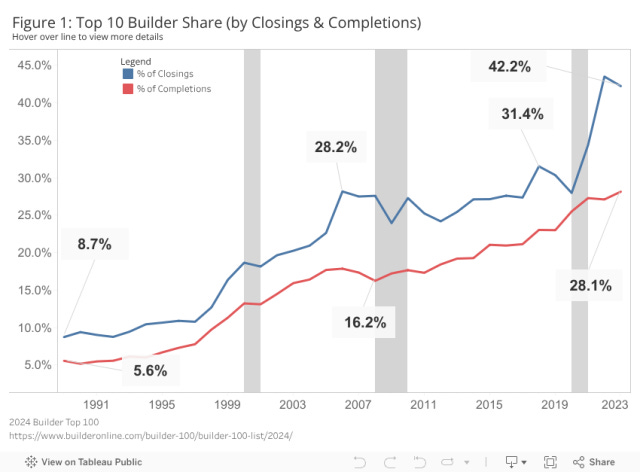

And since 2000 home builders have consolidated. There are less players and overbuilding has been greatly curtailed. That is to say that homebuilders are less speculative than ever.

Fig 2. Consolidation of the homebuilding industry. Source: https://eyeonhousing.org/2024/07/top-ten-builder-share-declines-in-2023/

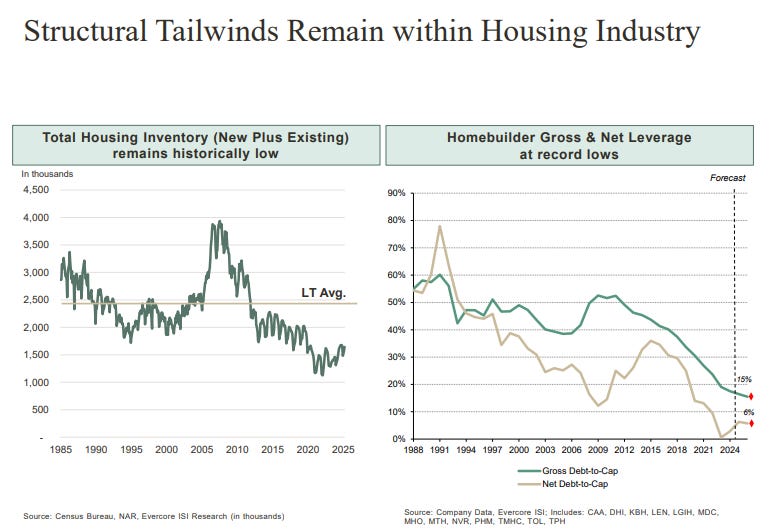

Homebuilders are also building less than ever, and have lower leverage than in recent history.

Fig 3. Home starts are historically low, home builder leverage is also at record lows. Source: Millrose investor presentation

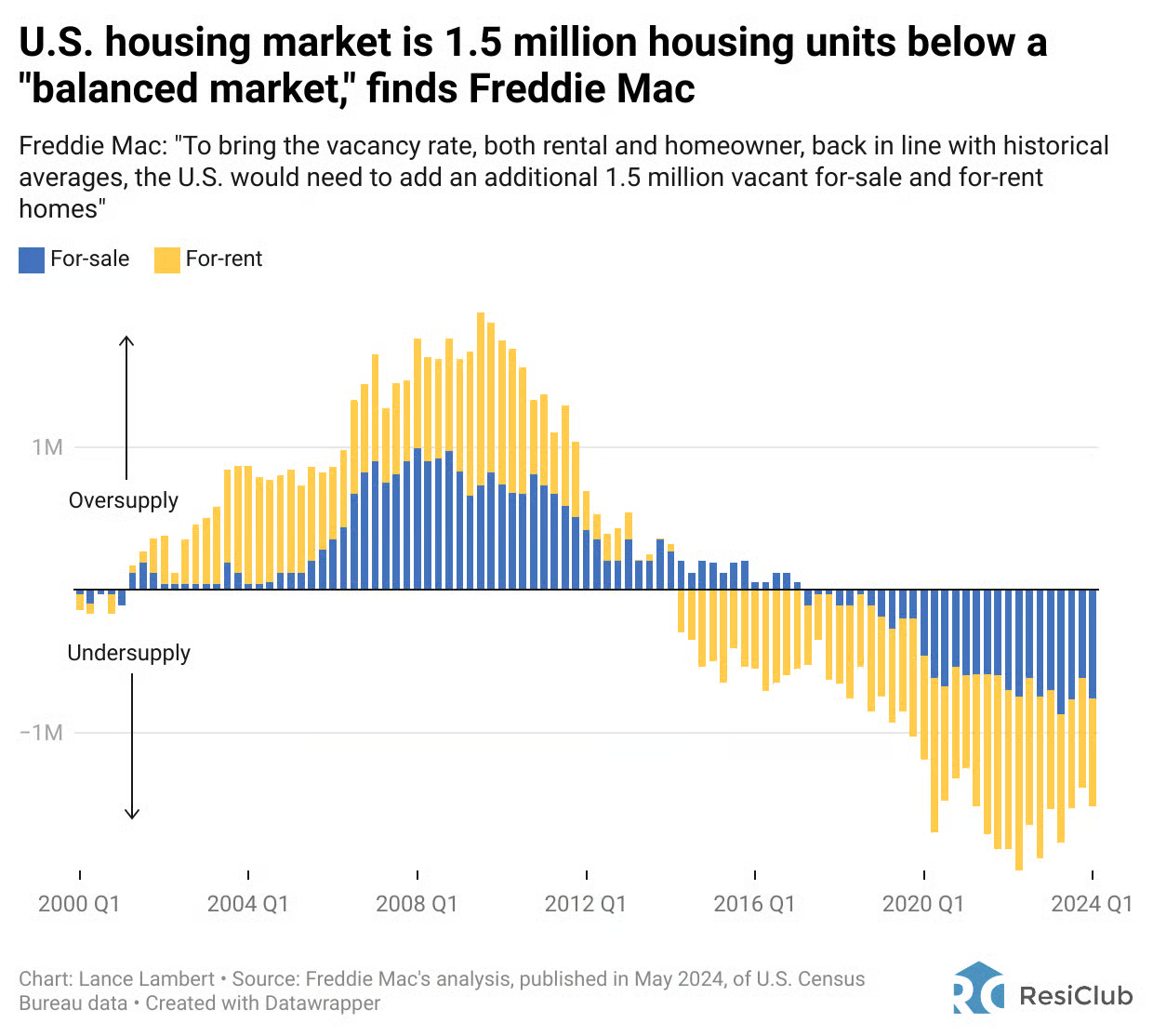

Low starts have contributed to an overall housing shortage, which makes for a tight market.

Fig 4. The US housing market is significantly undersupplied. Source:

https://www.resiclubanalytics.com/p/housing-analysts-think-housing-shortage-last-yearsthis-real-estate-ceo-isnt-sure

New lots to build homes on are similarly undersupplied.

Fig 5. Lots available for home construction are also very low

Source: https://eyeonhousing.org/2024/07/top-ten-builder-share-declines-in-2023/

All of this is to say that home builders have a strong underlying demand and a structural tightness that should continue to support their pricing and margins in the long run. .

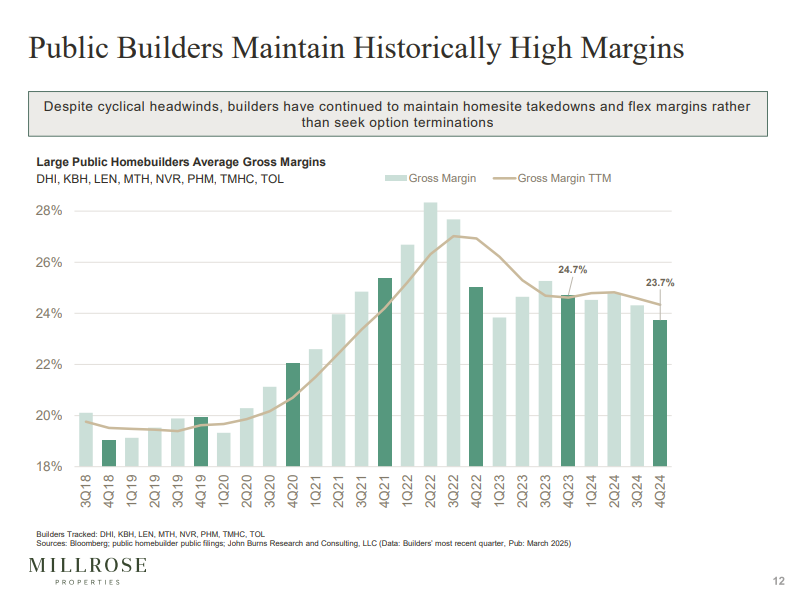

Fig 6. Homebuilder average gross margins. Source: Millrose investor presentation

All of this would also suggest that without major signs of a "boom" cycle, any "bust" cycle would be shorter and of less magnitude.

Overview of Major Home Builders

NVR and DFH - Entirely option based land development.

DHI - Has a captive land developer (Forestar) that develops plots primarily for DHI as option contracts.

LEN - 60% of their lot pipeline is controlled via options. In Q1 of 2025 LEN spun off Millrose properties (MRP) as a REIT but is structured like a landbank. The business model is that Milrose holds the properties on their balance sheet, while Lennar develops them, and receives "income like rent" from the options fees that Lennar pays on the option contracts. When Millrose sells the properties to Lennar it uses the proceeds to buy and develop land, thus "recycling" the capital.

Millrose earned 64.8M in Q1 of 2025 on its book value of ~6B. This is an annual yield of about 4% that is returned to shareholders. Millrose works exclusively with LEN currently. It can't really compound its book significantly, and it sells at 80% of book. It's an interesting business model that benefits LEN, but I don't think it is worth investing in.

Tolle - Vertically integrated homebuilder. 45–55% of lots are optioned.

Pulte - Vertically integrated homebuilder. Focused on luxury homes in high value markets, 90% of land is owned.

In any case, each of these land developers have to get their developed lots from somewhere, so which is the best land developer in the industry? Can we find one that is advantaged and priced right? I think so…

My Favorite Land Developer (or Land Bank) with a Specialty in Home Builders

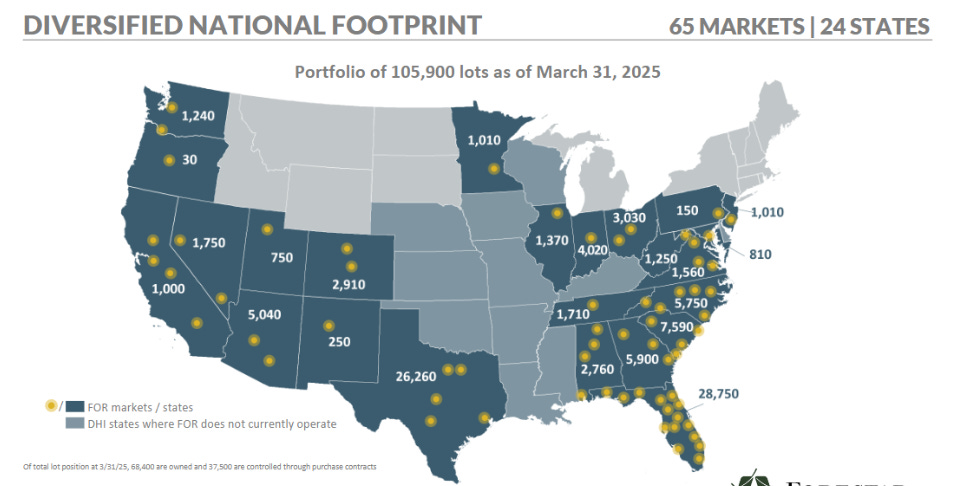

Forestar operates in markets predominantly in the southeastern United States, where development is relatively easier and demand is high.

How Lot Development Works

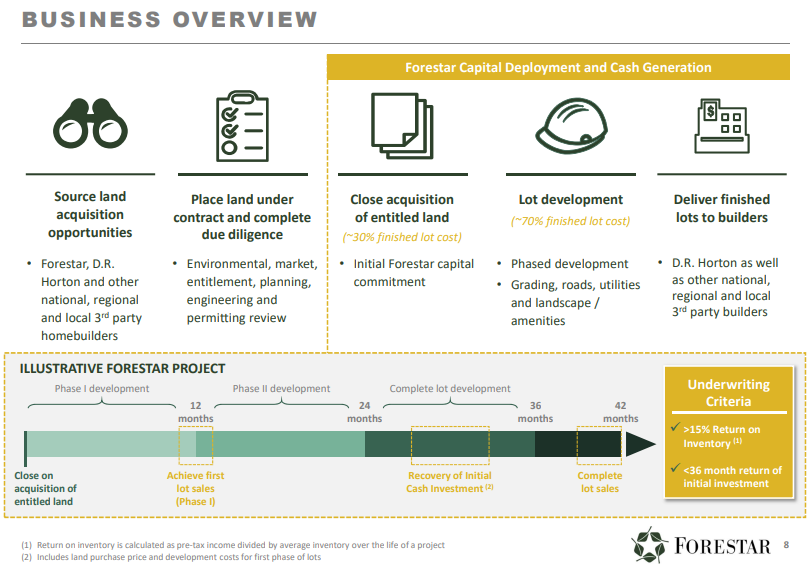

A Forester lot development project looks like this.

Fig 7. Land development timeline. Source: Forestar presentation Q1 2025.

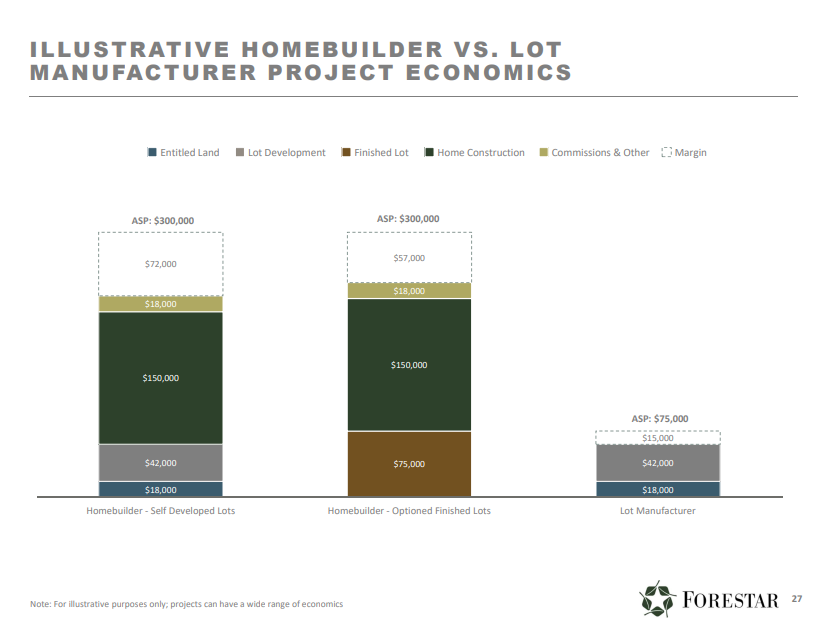

The unit economics (according to Forestar) of lot development look like this:

Fig 8. Forestar project economics. Source: Forestar Presentation Q4 2019

A land developer buys a plot of land, develops it horizontally (adding utilities, roads, etc,) and sells it to a homebuilder. They collect the difference between the sales price and the development costs. Forestar achieves a 20% gross margin on average.

On the lot-level, Forestar buys a lot for on average $30,400, develops it over 10 quarters, and sells it for $101,700. If the lot is optioned by DHI, DHI pays FOR a 5% nonrefundable option fee per annum on the book value of that land. “The Company received $104.1 million in nonrefundable option payments during fiscal 2024.” (on $2.1B in land value). The revenue from this is included in the sales price of the home and recognized then.

Forestar's Competitive Advantages

Management is focused on high asset turnover, now 52%. Similar to NFM or Costco, this is a competitive advantage. High asset/inventory turnover is one of the few ways a land developer can have a competitive advantage, and it improves cash flow generation.

Firestar only takes on projects with an expected 15% return, not including land appreciation in their models (an added bonus), which means that management stays focused on operational excellence and not speculation.

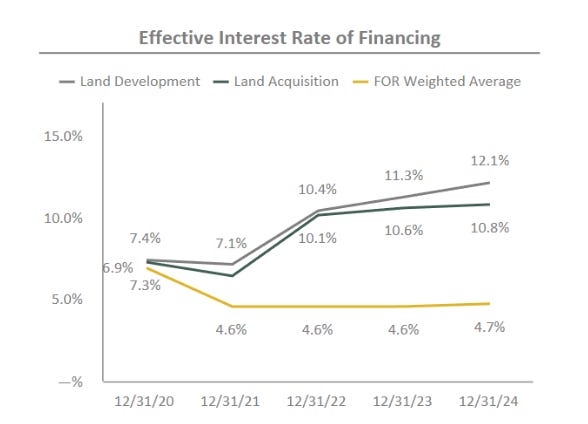

Land development loans are difficult for small developers to obtain at attractive rates. Banks and lenders do not like the slow and uncertain nature of land development. However, because Forestar has access to public debt markets, the backing of DHI, and a strong reputation in land development they have a cost of debt that is 50% less than their competitors. This would be like a bank with half the cost of funds of competitors.

Management is managed towards pre-tax income and ROE (which basically means they are laser focused on return on assets, as that is their main lever to improve those KPIs). There is a lot to like about this business model.

As Forestar management states:

"We believe we are well-positioned to consolidate market share in the highly fragmented lot development industry because of our low net leverage and strong liquidity position, low overhead model, geographically diverse lot portfolio that is focused on affordable price points and strategic relationship with D.R. Horton"

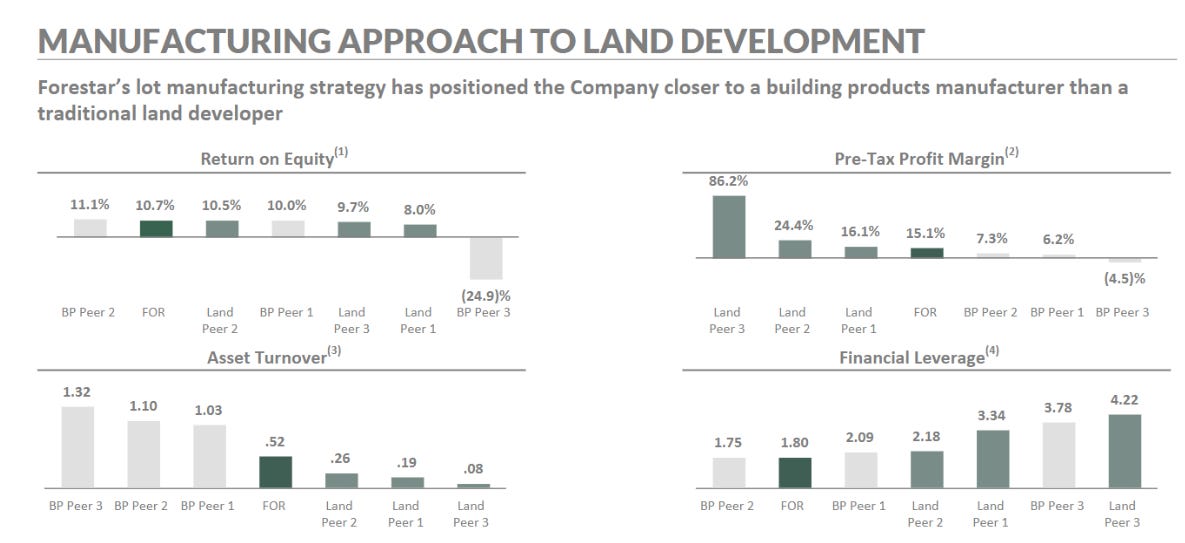

Fig 9. Forestar has industry leading turnover, ROE and low leverage. "BP" stands for building products, which I don't consider a peer to FOR. Source: Forestar presentation Q1 2025.

Fig 10. Forestar has a lower effective rate of financing. Source: Forestar presentation Q1 2025.

"Forestar's capital structure is one of our biggest competitive advantages and it sets us apart from other land developers. Project-level land acquisition and development loans are less available and have become more expensive in recent years, impacting most of our competitors.

Other developers generally use project-level development loans, which are typically more restrictive, have floating rates and create administrative complexity, especially in a volatile rate environment. Our capital structure provides us with operational flexibility while our strong liquidity positions us to take advantage of attractive opportunities as they arise."

Source: https://www.stockinsights.ai/us/FOR/earnings-transcript/

Evaluating Forestar's Book.

What originally got me interested in Forestar is their price to book of 0.63.

Market cap $1,032 Mn

Book Value: $1,646 Mn (all of which is tangible)

The balance sheet is straightforward, and the biggest item is the real estate with a book value of $2,759 Mn as of March 31, 2025.

What is the nature of that real estate? Well they have 9,500 lots fully developed, in Q1 they recently sold 3,411 lots for $101,700 per lot. So those fully developed lots have a market value of $966 Mn.

When subtracted from our book value, we get a book value of $1,793 for the remaining 58,900 owned lots that are undeveloped. That means each lot is held on the books for $30,400 (roughly at cost of the raw land).

Considering the lot development takes 10 quarters, and they spent an estimated 2.3B on lot improvements over those 10 quarters, that means they have invested $39,000 per lot on improvements.

I think of these lot improvement costs as sunk, but not on the books. Including the value of those improvements would double the book value.

Or think of it another way, assume that these lots are at various phases of development but on average, half finished. (The weighted average age of these lots is 397 days, vs. 912 days in 10 quarters). Then it will cost a further $2.3 Bn to develop these properties to be sold for $101,700 per lot. Take that final sales price of $5.9 Bn and subtract the remaining development cost to get a fair market price of $3.6B. Add back the $1B in already developed lots, and we get a fair value of the real estate of $4.6B. Adding back the other balance sheet items, we get a fair book value of $3.5B (on a stated book of $1.65B). And the market price is $1B. Making the price to adjusted book value about 30%.

Historically, the market has valued the company's book appropriately. It is trading at a historically low price to book today.

FOR trades at a 14% discount to fair Earnings Power Value

I expect a sustainable revenue for them to be 1.4Bn, and an operating margin of 14%. That is an operating income of 196 mn, at their average 24% tax rate that equals earnings of 149mn. At an 8% WACC. I get a fair EV value of 1.86B. And a fair market cap of 1.16Bn, the current market cap is 1B. Or a 14% discount to fair value. I personally think about this as a 15% earnings yield, considering that MRP (the only peer) trades at a 6.6% yield, that seems high.

A note on capitalized interest:

"We capitalize interest costs throughout the development period (active real estate). Capitalized interest is charged to cost of sales as the related real estate is sold to the buyer. Interest incurred was $32.6 million and $32.8 million in fiscal 2024 and 2023. Interest charged to cost of sales in fiscal 2024 was 2.5% of total cost of sales (excluding impairments and land option charges) compared to 2.4% of total cost of sales in fiscal 2023." FOR 2024 10-K.

Consider that we have $32.7mn in capitalized interest expense that is within cogs and reduces operating income. I don't want to double count the debt, so I would rather add those costs back to EPV to find fair value, or take the debt out of the EV calculation. Including 32.7 mn in the EPV calculation adds 310 mn in EPV value, and a total 32% discount to fair value.

Forestar has a long runway with aggressive growth targets

Forestar grew EPS from $0.79 in 2019 to $4 in 2024. A CAGR of 38%. And revenue compounded at 28%. They compounded book value at 13% over that time. They have more room for growth, with management targeting a 5% market share by the end of 2030. They currently have a 2.5% market share, so that growth would be a 15% CAGR.

Forestar has 3 engines of growth:

1. Increased total SFH sales. ( In 2024, 19% of D.R. Horton’s finished lot purchases were from Forestar.)

2. Increased proportion of SFH sales by DHI. (In 2024, DHI had 13% market share)

3. Increased lot purchases of FOR lots either by DHI or other home builders. (In 2024, DNI had 2% of the US lot development market)

Fig 11. Even as total industry wide SFH closings have fallen, DHI has taken a greater share of those sales. Forestar has taken a greater share of DHI's lot sourcing.

Management Quality

Donald J. Tomnitz has been the Executive Chairman since DHI merged with Forestar in October 2017. He was previously Vice Chairman and CEO of D.R. Horton (1998–2014) with a long career in land development.

Anthony (Andy) W. Oxley is the President, CEO & Director, he joined Forestar in 2024. He was the former Senior VP at D.R. Horton for 25 years, overseeing business development, M&A, and land acquisition.

Both men are very impressive and oversaw DHI's impressive run that I started this article with; they left top roles at DHI to take on the task of building up Forestar.

A Land-Light Land Development Model (?)

Similarly to how home builders wait to buy a lot until it is ready for construction and hold options contracts in the meantime, Forestar holds unentitled lots as options.

~35% of their total lot position is held via options/contracts, and that land is not yet owned.

While under option entitlements and approvals are secured. If entitlement is successful and market conditions are favorable, they exercise the option and convert it into an owned lot. If not, they can let the option expire or negotiate differently. This offers flexibility and capital efficiency. I think this is an underappreciated element of their business model.

DHI Control

DHI bought 75% of a nascent Forestar in 2017. Today they own 62%. The reduction has come from share issuance to the public over that time and has averaged 2% a year. They have a master service agreement with DHI that continues until the earlier of (i) the date at which D.R. Horton owns less than 15% of our voting shares or (ii) June 29, 2037; however, we may terminate the agreement at any time when D.R. Horton owns less than 25% of our voting shares. And "D.R. Horton has the right to nominate a number of our Board members commensurate with its equity ownership. As long as D.R. Horton owns at least 20% of our voting securities, it retains the right to nominate individuals to our Board based on its equity ownership as well as designate the Executive Chairman."

Risks

In 2023, Forestar traded for a PE of 3. So the price could go down 50% with a similar multiple contraction. A major recession could lead to major write downs and zero or negative earnings. A resulting stock crash would be a better time to buy.

It is a captive company, so DHI could take advantage of it. It has shown no signs of doing so, and it would be like "stealing your child's piggybank money" but it could if the situation is dire enough.

Conclusion

Today you can buy Forestar for 30% of its fair market value of book, providing downside protection. Its balance sheet is conservatively stated. It has little leverage.

It has an LTM earnings yield of 17% and 15% expected future growth. It has a long runway for growth with 2% market share. It has competitive advantages that paint a clear path for how they get there.

I believe the stock is selling at a great discount due to its controlled position under DHI. I also think it is a victim of short-termism and poor macro outlook in that time frame. In the short term many things could depress the stock, but in 5-10 years it will do fundamentally well. Maybe I am overly optimistic and delusional, please let me know if that is the case.

Disclaimer:

The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

Bought July 7 at 20.25, sold Sept 7 at 27.80

Further reading

https://www.builderonline.com/builder-100/leadership/what-makes-don-tomnitz-tick_o

https://valueinvestorsclub.com/idea/FORESTAR_GROUP_INC/2030113623

I recommend exiting this position. Up ~40% on it. Im switching into DHI. Management tends to sell when close to book and we are there now.

Great this one!