Deceptively cheap earnings don't compensate for mediocre holding company assets and significant hidden liabilities at the Contran Group.

PE's of 4-5 at Contran Group (VHI, NL) are misleading and dangerous.

While NL and VHI consistently appear cheap on many value screens (low P/E ratios), once we consider NL's considerable environmental liabilities and high corporate level expenses, any apparent discount disappears.

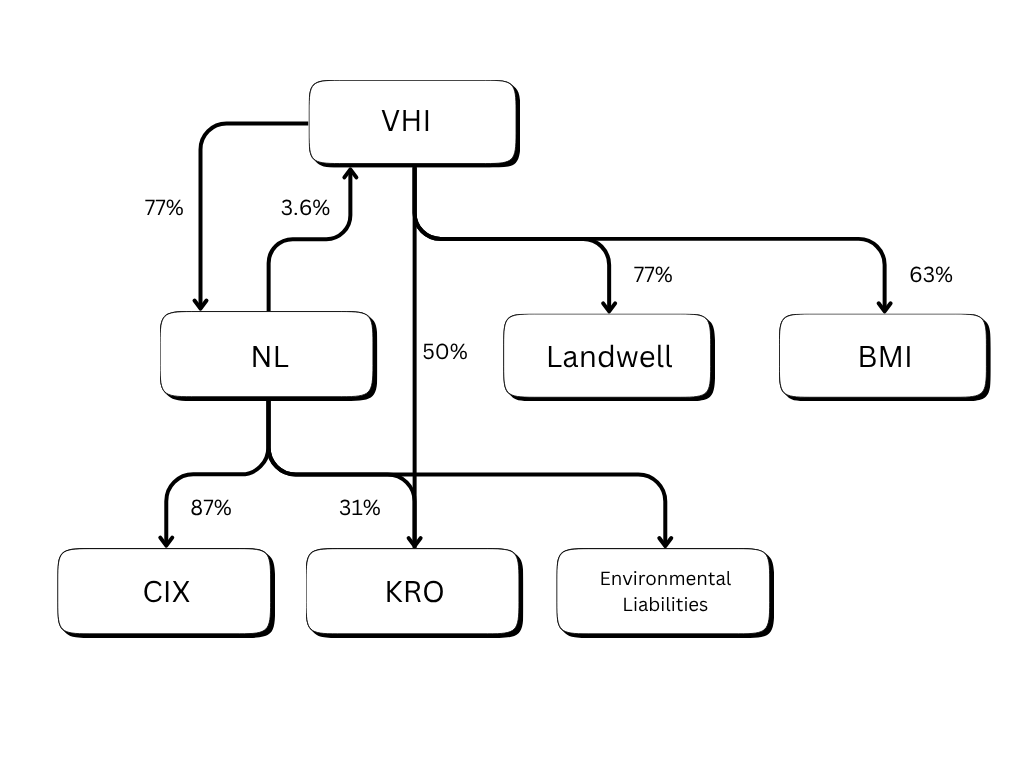

The Contran Group is made up of parent company VHI, which has inter-related subsidiaries NL, COMPX, and KRO. Valhi is majority-controlled by the Contran Corporation, a privately held investment vehicle which owns 91% of the stock (25.9M shares). Harold Simmons created this strange corporate structure over the course of the 90s-early 2000s. He died in 2013, leaving his shares to a trust. Control of the trust ultimately resides with heirs of the founder Harold: namely, Lisa K. Simmons and related family trusts. Successor trustees are bound to vote with Lisa (age 63) through April 22, 2030 at which point they are unbound.

The ownership structure of VHI is complicated. So I recommend starting at the bottom and working your way up.

On Seeking Alpha I have previously covered and set price targets for CIX (PT: $23.78, now $23.65) and KRO (PT: $5.55, now 6.23).

VHI's land development subsidiaries: Basic Management, Inc (BMI) and Landwell

BMI and LandWell are involved in the land development of the Cadence master-planned community in Henderson, Nevada, which is approximately 2,100 acres. They have very little land left for sale. As of June 30, 2025, 20 saleable acres in the community remain. A contract for the remaining 20 acres is currently in escrow with a home builder, and the sale is scheduled to close by the end of 2025. Adjacent to Cadence, Landwell owns 15 salable acres (in 2 parcels) for commercial and light industrial use. These 2 parcels are also under escrow and expected to close in the third quarter and fourth quarter of 2025.

Valhi's balance sheet lists Landwell's land held for development at a value of $5.9 million. These are marginal values in the overall valuation, so the value of Landwell is essentially already reflected on the balance sheet, which includes the future recovery of a TIF with the city of Henderson. Per the 10-Q, "The maximum reimbursement (labelled as OPA) is $209 million. We have collected $39.3 million to date and expect to reach the maximum over the next 7 to 10 years." In the latest 10-Q, Valhi levels this under "Note receivables - OPA" under the "Other noncurrent assets" section of the company's financial statements. As of June 30, 2025, the value of these receivables was $102.8 million. So it appears that the land development subsidiaries' value is accurately reflected on VHI's balance sheet.

NL Industries Valuation

NL is essentially a holding company that holds shares of CIX, VHI, KRO.

NL is the corporate remnants of Dutch Boy Paint, which was an American paint producer that manufactured lead paint from 1907–1978. NL continues to be burdened by Dutch Boy's environmental pollution.

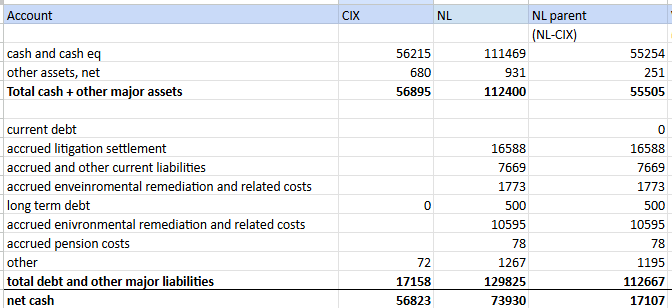

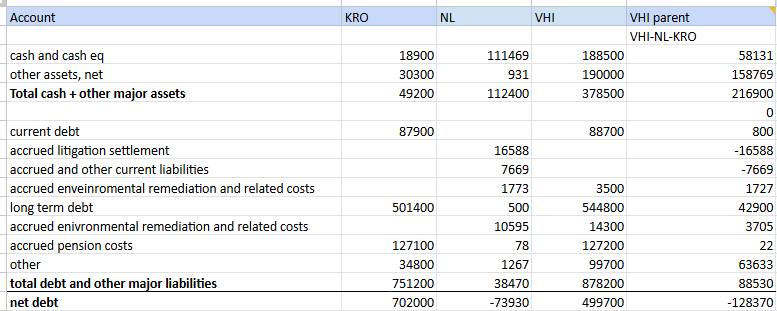

In order to value NL and VHI, I think the best approach is a deconsolidated net cash position. That means consolidating the balance sheets and seeing what the NL and VHI holding companies actually own. Consider the off-balance sheet liabilities and capitalize the corporate costs (quite high at both for being just holding companies).

Deconsolidated valuation of NL.

In order to find a figure of net cash (or debt) at the parent level, we deconsolidated by subtracting out what was listed on CIX's balance sheet from NL's stated balance sheet, leaving us with the relevant cash and debts to state a net cash figure. Accrued liabilities are effectively debts, so I include those, including pensions and environmental liabilities.

Thus, deconsolidated net cash for NL is $17.1 million.

Consider the Off-Balance Sheet Liabilities at NL.

The balance sheet includes $108 million in environmental liabilities for ~30 sites. This includes a ~$30 million allowance that the company is holding for future claims or settlements for the existing sites that may or not be owed.

However, it also has 5 additional sites that we can expect future cash liabilities for, but it is not "able to quantify the expected value" of these claims. These claims could be massive. Management does not disclose what these sites are, so you could stop there. However, after some research I have found what these 5 sites may be. These sites have active litigation but not confirmed settlement payments yet.

Based on publicly available legal and regulatory records, here are five sites that are likely among NL Industries' unquantified liabilities.

One site is a Colorado mine where a plant leaked sulfuric acid into a nearby river. The mine operated before 2000 and the contamination involves sulfuric acid and heavy metals such as arsenic, manganese, lead, and zinc. Cleanup costs for similar mine sites can range from millions to hundreds of millions of dollars. I will ballpark this to $25 million.

Another potential liability is a former titanium dioxide facility on the Raritan River in Sayreville, New Jersey, which ceased operations in 1982. A federal court has found the company responsible for contributing to the pollution. The expected contamination includes arsenic, copper, lead, nickel, and zinc in the riverbed sediments. A similar NL New Jersey site involving lead had a global settlement had a total cost of nearly $152 million (of which $52 million was NL's share). TiO2 isnt nearly as dangerous as lead, so I would discount this to $12 million.

A third site is a former secondary lead smelting facility on Penns Grove-Pedricktown Road in New Jersey. The facility operated from 1972 to 1982, recycling lead from spent automotive batteries. The site contains an on-site landfill with slag and contaminated soils. Cleanup costs for similar secondary lead smelter sites have ranged from approximately $6.4 million to $21 million.

There is also a former plant in Colonie, New York, that made products for military use with uranium, lead, and other chemicals between 1958 and 1982. A project is currently underway to address health concerns for former employees and nearby residents. Cleanup costs for similar sites with uranium and lead contamination have ranged from approximately $63 million to $125 million.

Finally, the company's legacy as National Lead Company includes a former secondary lead smelting facility in St. Louis Park, Minnesota, which operated from approximately 1934 to 1981. The site was first investigated by the EPA for contamination of the soil and groundwater with lead in 1980. Cleanup costs for similar secondary lead smelter sites have ranged from approximately $6.4 million to $21 million.

Obviously costs vary based on the extent and nature of the contamination, which makes it hard to ballpark without knowing more, but let's just take the midpoint of historic costs for similar sites ($25M + $12M + $13.5M + $94M + $13.7M). When we do this, we should find a ballpark figure of $158.2 million, which I use in my model or you could use a range of $50-250 million.

Backing out the income statement. NL parent averages excess corporate costs of 11.8 million typically. Capitalized at 8%, That adds 147.50M in negative enterprise value.

Then they have their equity holdings

10.8 million shares of CIX

35.65 million shares of KRO

1 million shares of parent company VHI. (This is a circular relationship, but here I used the share price that I derived later).

At the prices I have established earlier, we get the following:

Assuming my fair values above are correct, we arrive at a fair value of $3.66 for NL. At a current share price of $6.28 it is trading at a 71% premium to fair value.

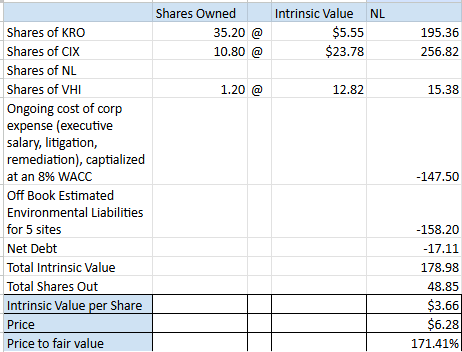

Valhi Deconsolidated

The low valuation of NL further compounds on VHI. Once we account for the fair value of NL, we can work out the fair value of VHI.

Based on deconsolidated balance sheets of VHI - NL - KRO, we find that parent VHI has net cash of 128M.

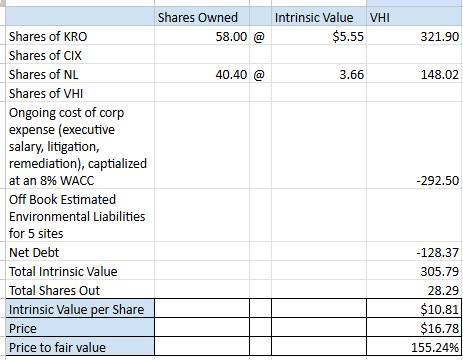

Add in the 58 million shares of KRO, 40.4M shares of NL, and ongoing annual corp expenses of 23.4 million capitalized at 8%, and we can find the intrinsic value of VHI shares.

VHI shares are 55% overpriced.

In conclusion, while NL and VHI appear cheap on many value screens (like PE), once we consider NL's off balance sheet environmental liabilities, ongoing corporate expense at the parent level, and the intrinsic value of their shares held, any apparent discount disappears. There isn't even an opportunity for major shareholder action to unlock value until 2030. Buyer beware.

Disclaimer: The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

As of 9/19/2025, I do not hold a position in these securities.

seeking alpha rejected this. Saying “too much of a valuation exercise”

This is a holding company. Isnt valuation the point?