Interesting stocks in the chemicals and materials sectors right now.

Here I cover a few gems in a beaten down sector. In this article I review 11 names: KRO, CC, TROX, DOW, LYB, HUN, OLN, WLK, MAGN, SLVM, MERC.

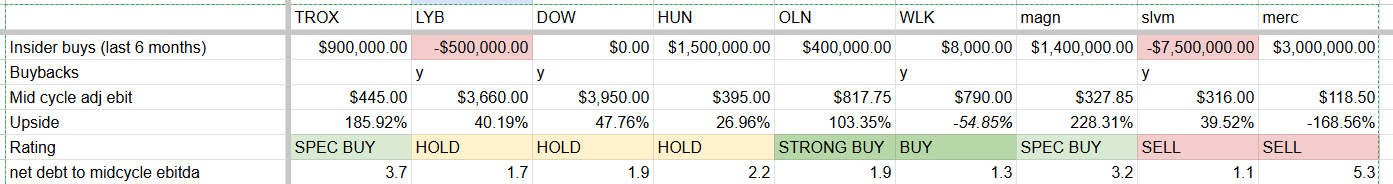

The chemicals and basic materials sectors have been in a tough spot these last few quarters: Earnings misses, dividend cuts, assets sales. Meanwhile insiders are buying. I have found these patterns to be key buy signals for cyclicals. In this article, I look at a few chemical and paper companies that I think are worth considering. For each I make a brief case, and then provide a valuation and a recommendation (not financial advice).

In this article I cover 11 names: KRO, CC, TROX, DOW, LYB, HUN, OLN, WLK, MAGN, SLVM, MERC

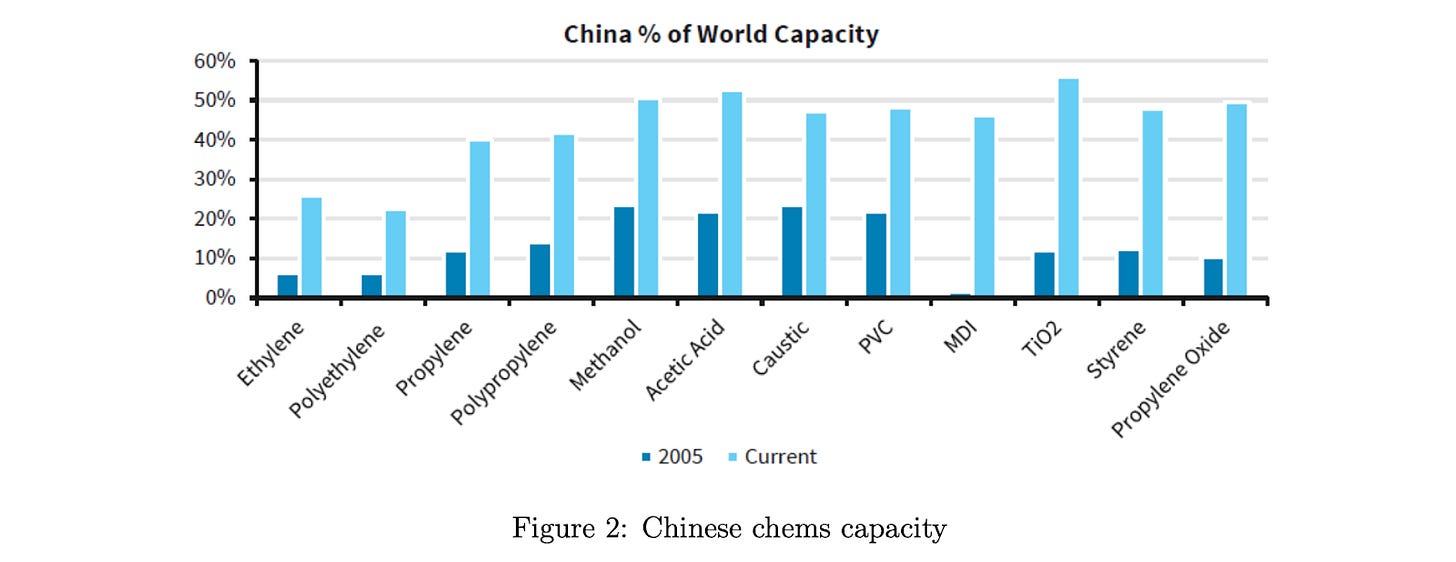

The story for the industry since 2014 has been one of massive growth of Chinese production capacity, which has been brutal for western producers. Chinese companies have been able to make a major impact on western industry due to their strong government support, vertical integration, cheaper labor and cheaper oil (coming from Russia).

Note: I don't invest in China, so those companies are not covered here.

In terms of the Western producers. Macroeconomics have been very poor lately, basically all of these companies have been hit by a triple-whammy:

1. Higher interest rates in the US. This has slowed industrial production and more importantly the construction sector. Titanium oxide is used heavily in exterior home paints. Chemicals like polyols, epoxy and PVC are used heavily in siding and insulation.

2. The Chinese economy has slowed as well (especially the construction sector).

3. The war in Ukraine has increased energy and feedstock prices in Europe. western sanctions on Russia have pushed cheap oil supply to India and China. Oil is a key feedstock for Chinese chemical production (specifically epoxy), while natural gas is preferred in the West.

For all these reasons, pessimism is very high for most of the chemical sector and there seems to be no sign of improvement. In my experience, when things seem hopeless, that's a good time to buy the bottom of the cycle. The cycle eventually turns.

Titanium Oxide (TiO2)

I have previously written up the titanium dioxide market so I won't spend too much time on background here. My write-up on Value Investor’s Club is a good place to start. Briefly, titanium oxide is the opaque pigment that is in all things white. In comes in varying chemical structures and quality. Western producers create a higher quality pigment using a higher quality process and higher quality ore. Notably, these higher quality ores have been in short supply in recent years.

KRO, CC - HOLD

KRO takes titanium ore and processes it into titanium oxide pigment. It is essentially a refiner. I don't see much upside for KRO when the cycle turns, as historically ore prices rose with final titanium oxide pigment prices proportionally, limiting margin improvement for refiners like KRO. This short report on KRO was very clear on this point, and the market has been overly optimistic and has historically ignored this (and in retrospect, under-estimated Chinese competition). I highly recommend you read it.

CC is also a refiner of titanium oxide, but it is more diversified than KRO, also having divisions to do with refrigerants, and performance materials. This report on CC is a good starting place. It points out major regulatory changes in the refrigerant business (switching from Freon to other chemicals) and the data center tailwinds that would benefit CC going forward. However coming with that segment is significant environmental liability. This one is similar KRO, I don't see much upside for the TiO2 segment. And don't know enough to intelligently underwrite the refrigerants business.

TROX - Speculative Buy

TROX is the most interesting of the bunch. I wrote-up an article on VIC about it (DM/ Email me for the full article).

Here is my thesis:

1. TROX is vertically integrated, and has operating and financial leverage, providing a significant benefit when the cycle turns. This is not appreciated enough.

2. Significant anti-dumping measures and tariffs are targeting Chinese dumping. These are taking effect in Europe, India and Brazil.

3. These measures are making a significant impact. Chinese TiO2 exports were down 25% year over year in June. Industry analysts report that supply rationalization is now taking place in China.

4. Western producers have rationalized over the past 10 years, there now is a much smaller production base in the west.

5. TROX is beginning to mine into a higher quality ore deposit, reducing their production costs and ending their recent history of high capex spending to develop that deposit.

6. Management is also executing a turnaround plan, targeting 385Mn in EBITDA-capex for 2026 and by my estimate 215Mn in net income.

7. Meanwhile the market is pricing in a high bankruptcy risk due to low liquidity and high debt. However there are no major covenants in breach (covenant light) and it looks like they should be cash flow positive over the next 2 quarters.

8. Based on returning to the midcycle EBIT (445Mn) alone, I am underwriting a 185% equity appreciation. There are also other upside optionalities to consider:

(a) Reaching full utilization of production lines.

(b) Monetizing their rare earth byproducts by EOY 2025.

(c) A repeat of the 2022 boom, pent up supply + limited supply base.

Risks:

- Highly levered, but covenant light.

- Maturities are due in a wall in 2029. About half are variable rate, so there is interest rate risk on those.

- Chinese subsidies for industry, loosening anti-dumping measures

- Recession (though it feels like chemicals have already been in one for some time).

Because it is a highly levered cyclical at trough earnings, this is my most speculative investment. I have a stop-loss in place here.

Chemicals

DOW - HOLD

DOW is involved in plastics, Industrial Intermediates and performance materials.

Midcycle EBITDA should be 7Bn. With an average capex spend of 2Bn, D&A of 2.8Bn, working capital costs of 0.5Bn taxes of 21%, and the structural benefits of their headcount reductions, portfolio optimizations of 0.5Bn, I think midcycle adj. EBIT is around 4Bn. EV is 31Bn. M/C is 17.8Bn. So that's about a 50% upside. Based on management's guidance, it will take 2 years to get there as this trough is dragging on much longer than any in recent history with no end in sight. After cutting their dividend, they have sufficient liquidity to get through to the other side.

Management is doing a few things to improve the company, which is where I get my 0.5Bn in portfolio optimizations.

Closure of 3 underperforming European plants.

Reducing headcount.

Closing unprofitable production lines.

Selling non-core JV - DowAksa.

Also consider that they have:

Deferred 1Bn in 2025 capex.

Raised 2.4Bn from asset sales (USGC infra deal with Macquarie).

All in all it is a reasonable cyclical bet, but doesn't meet my hurdle rate.

LYB - HOLD

LYB is similar to DOW. It is involved with petrochemicals like Olefins and Polyolefins, styrene. propylene oxide, polymers.

Average big corporate management, they are doing a very similar playbook: Taking portfolio actions, including asset sales and deferred capex investments. Management guides to an incremental $1.1 billion in cash flow from here through 2026. About half of that seems to be permanent cost reduction.

Midcycle EBITDA has been 6Bn. Capex 2Bn, D&A, 1.2Bn, taxes 0.8Bn, portfolio optimizations of 0.5Bn. This all gives us a midcycle adjusted EBIT of 3.7Bn. EV of 29Bn, MC of 19Bn. I see 40% upside.

Huntsman - HOLD

Huntsman has great management with high insider ownership.

They have been moving downstream to higher margin and value businesses. I like this strategy, it makes them more profitable, and "stickier" with their customers. They sold their Titanium Dioxide business via IPO in 2017, sold their commodity chemical intermediates and surfactants business in 2019, and sold its textiles business in 2023. With the proceeds it paid down debt and bought back stock.

The company is now involved in polyurethane (foam) which is used in products (i.e. A/C) or insulation (like in homes). As well as in Performance Products, Advanced Materials, and Textile Chemicals (dyes, etc.).

Valuation:

With a midcycle EBITDA of 700Mn, Capex of 200Mn, a 21% tax rate, I arrive at a mid cycle adj. EBIT of 395Mn, on a 3.4Bn EV and 1.9Bn M/C, that would be a 27% appreciation.

OLN - BUY

Is a sort of marginal/merchant producer (and the largest North American producer of) Chlor-Alkali Products (“CAP”) namely Chlorine and sodium hydroxide

"Simplistically, Cl2 demand is tied to housing and NaOH demand is exposed to general industrial production. Since Cl2 and NaOH are produced in fixed ratios, strong housing markets historically lead to PVC production increases which in turn lead to an oversupply of NaOH. However, in a weak housing market, as PVC volumes go down CAP production is curtailed to reduce the surplus of Cl2 (a toxic gas that is difficult to store and transport), which constricts NaOH supply."

" In 2021-2022 OLN began articulating a “value over volume” strategy. OLN reduced its output to keep Cl2 and NaOH prices higher in the cyclical trough. So it has significant operating leverage available when the cycle turns.

OLN also has an epoxy business. This makes sense, because key ingredients for epoxy are derived from Cl2 and NaOH. However Epoxy too is in a downcycle.

OLN also owns Winchester, which makes up ~35% of all US ammo sales. Guns and ammo are also in a down cycle, with a Republican president in the White House.

I highly recommend this write-up for more information.

Valuation:

With a midcycle EBITA of 1500Mn, capex of 275Mn, working capital expenses of 150Mn, a 21% tax rate, I find a midcycle EBIT of 817Mn, with an EV of 5.4Bn, and market cap of 2.6Bn, I see over 100% upside to the equity. However, keep in mind there are 3 cycles we are dealing with here, so it may take longer for these to align beneficially.

WLK - BUY

Westlake has some of the lowest debt in the industry, and some of the highest quality management. It is ~72.3% owned by the Chao family. It is significantly vertically integrated from ethylene and chlor-alkali through to PVC and building products, and so is cost advantaged in its production.

It trades at a PE of 9, and historically compounds at a 15% CAGR through the cycle. In my mind, I don't value it like a cyclical, instead I think it is a fairly priced compounder. If you think the bottom of the cycle will go on longer, or you expect a recession soon, then WLK would be in a good spot to take advantage of its highly levered competition.

For more information, I recommend this short write up.

Honorable mention for a Materials Play - Magnera - Speculative Buy

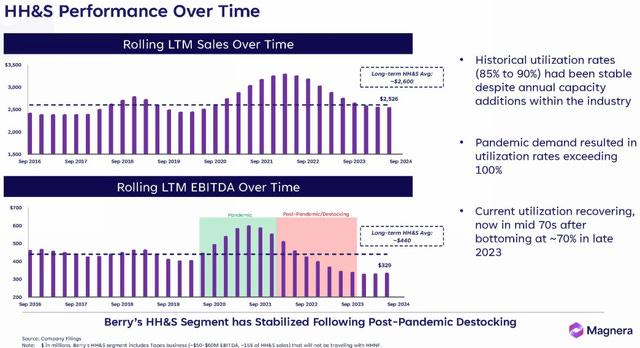

Magnera was formed on November 4, 2024, through a merger between Glatfelter Corporation and the nonwovens & films business of Berry Global (HHNF), structured as a Reverse Morris Trust transaction. It began trading on the NYSE on November 5, 2024

The company is the world’s largest specialty materials and nonwovens firm, with over 46 manufacturing facilities and serving over 1,000 customers.

Kingdom capital has covered this one best, you can read their work on seekingalpha, it is very good.

The short story is that this is a cyclical company with a short track record (and recent historical results have been poor).

This gets us 440Mn in EBITDA from the HH&S segment, plus 100Mn in contribution for the Glatfelter segment. They are also aiming for 55Mn in synergies by 2027. D&A averages about 120Mn. Capex as well. Tax rate of 21%.

Based on that I think midcycle operating income should be 330Mn, at an EV of 2.3Bn and a market cap of 473Mn. All together it is now selling at 7x midcycle EBIT. and 3x net debt to midcycle EBIT. I find the upside for the equity to be about 2-3x once the cycle turns. '

Even through the cyclical trough the company is cash flow positive, and has 500Mn in liquidity. Also its maturities are spread out longer than TROX, but there are tougher covenants and less optionality on the upside.

Just Like TROX this is a highly levered cyclical so tread with caution.

Dishonorable mentions - SELLs

A couple more in the paper industry. SLVM had insider selling and an active buyback, which is a red flag for me. Mercer also didn't have enough upside, it's midcycle EBITDA was too low, and I didn't see signs of that changing. Also Mercer has a lot of debt.

Conclusion

I hope one of these piques your interest, whether you like growth, cyclicals, turnarounds or levered equities, there are many interesting options in the chemicals space right now. If you feel I missed a great deal or a particular materials subsector, let me know!

The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

As of 9/19/2025, I hold positions in Magnera and Olin.

My main recommendation here was TROX. I bought at 3.40. Sold on 9-17 for 4.97.

46% return.