Jefferson Capital, Illiquid, Controlled, Overly Discounted to Peers, but Facing Tough Underlying Economics.

Part 2: A-Z through every Minnesotan company

Jefferson Capital (NASDAQ: JCAP) is a newly public, private-equity-controlled purchaser of charged off consumer debts, headquartered in Sartell, MN. It IPO’ed on June 28, 2025. JCAP has strong balance sheet discipline and a business model that historically benefits from recessions. At a 20% levered cash flow yield, and a 39% YoY operating income growth rate, on the surface it appears to be very fairly valued, but when considering the economics of the underlying business I am not entirely convinced.

About the Business

Jefferson Capital is a consumer finance company specializing in buying and collecting distressed, non-performing and defaulted consumer debts. Once a bank charges off loans they deem as uncollectible, Jefferson capital can buy that loan book and start collecting. Historically they buy loans from financial institutions at 5-6% of face value, and profit by recovering more than they paid for the loans - through settlements, payment plans and legal collections. On average they have yielded a 2x return on their purchased loan book.

Vintage Data

Mature vintages 2017-2020 have returned a 2x multiple on purchase price. And IRRs of over 27%. Notably this doesnt include operating costs, just gross cash recoveries. Cash operating expenses historically average about 40% of collections.

So for example, take the 2018 vintage and assume a flat 60% profit margin on that years recovery (in line with mature peers). When we do this, the stated 2x gross recovery multiple, is actually a 9% IRR or a marginally positive net present value, when we discount future cash flows back to present value at a 4% discount rate.

In short the underlying economics of this business are not stellar.

Average incremental gross recoveries by year as a percent of purchase price

On the surface this company is attractively priced vs. peers

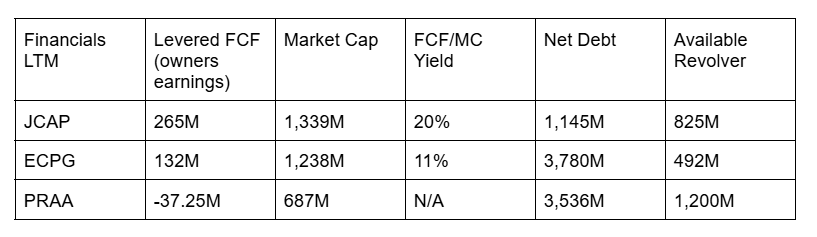

Peer U.S. publicly traded debt buyers are Encore Capital (ECPG) and PRA group (PRAA). JCAP trades at a high levered free cash flow to market cap yield with lower leverage and higher liquidity to peers.

Quick valuation

Model 1: When I take the purchase price of each loan book vintage, and apply JCAP’s expected 2x multiple, subtract previous recoveries and assume 60% of the remainder is recovered after tax, I get a loan book value of 1.7B, subtract the liabilities of 1.4B and I get an equity value of 300M.

Model 2: If I use the above yield curves for recoveries and a 70M annual increase in loan book purchases each year and project that out to 2030, I get a residual loan book value of 4.1B, assuming 60% is recovered to owners and that discounting back to present value, I get an asset value of 1.7B. After sutracting 1.3B in liabilities, I get an equity value of 400M.

Governance and Ownership

JCAP is incorporated in Delaware and is a Nasdaq “controlled company.” Approximately 67% of the equity is owned by J.C. Flowers affiliates, a private-equity sponsor focused on financial services. J.C. Flowers controls the board and vote, and we can expect capital allocation decisions to optimize sponsor economics and liquidity first. For example, dividends will be prioritized over buybacks.

Mitigant: Management is long tenured with the company and well experienced in the industry. I found no major instances of fraud, blowups or accounting issues. This team has survived multiple market cycles through 20 years.

Public buyers are the company’s exit liquidity. That doesn’t mean that this is uninvestible, but it is something to be aware of.

Notably, the insider lock up period for stock sales ended December 23, but no sales have occurred.

Stock Illiquidity

JCAP trades at roughly a $3M/day average in dollar volume, which is too small for large institutions, funds and benchmarked managers. So, institutional demand is constrained, sell-side coverage is limited (2 analysts are covering this now).

Summary

Based on commonly used multiples, JCAP appears to be undervalued. Additionally, during a downturn, it would appear to be best positioned among peers to buy loans at attractive multiples. If the price is only constrained by majority PE control, that overhang should dissipate in 2-3 years as JCP sells out of its position. As this happens, share liquidity should improve as more buyers are eligible to own JCAP.

However, on an absolute basis, the stock appears overvalued, and the underlying economics are weak. I don’t see greater scale as adding much value to the enterprise in the future. For these reasons, I am not an owner. The upside appears to be a re-rate, or the possibilty that they are able to take advantage of a recession with their industry leading liquidity.

I also would like to point out that the economics of the industry (like many oil fields) demand all excess capital to get plowed back into the business. This fact is not reflected well in those financial metrics.

It reminds me a bit of the Charlie Munger anecdote, “We tend to prefer the business which drowns in cash. It just makes so much money that the main — one of the main — principles of owning it is you have all this cash coming in. There are other businesses, like the construction equipment business of my old friend John Anderson. And he used to say about his business “You work hard all year, and at the end of the year there’s your profit sitting in the yard.”

This business is much the same.

Optically cash flows and earnings appear good, but that is because in 2025, reported incoming cash flows were far higher than the typical reinvestment rate we should expect for the industry, in fact the difference was made up in Q4 of 2025, when JCAP announced they bought a $300M loan book, evaporating the remainder of cash flows for the year.

To bring this all together, it appears to me that Jefferson Capital is better thought of as a capital-recycling business than a compounding/growth one. Historical vintages suggest that purchased debt portfolios earn high-single-digit unlevered returns after collection costs and long recovery timelines. The company enhances these returns through leverage, pushing equity returns into the low-teens, but much of that benefit is offset by financing costs, overhead, regulatory friction, and reinvestment inefficiencies. The result is a sustainable, through-cycle return on equity of roughly 12–13%. Because nearly all excess cash flow is reinvested into new debt purchases simply to maintain and grow the loan book, growth itself is largely value neutral unless portfolio-level economics improve (in a recession perhaps). Assuming a cost of equity of approximately 12%, a business earning low-teens ROEs should trade near book value over a full cycle. In that framework, a price-to-book multiple around 1.0x appears reasonable (vs. today’s 3), with upside requiring either structurally higher portfolio returns or a lower cost of equity driven by improved liquidity, changed governance, or capital returns. Absent those changes, high headline cash flow yields alone are unlikely to justify a materially higher valuation.

Disclaimer: The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

I do not hold a position in these securities.