Legacy Education Appears Cheap, but Regulatory Risks are Too Significant Here, so I’ll Stay Away.

Investigating Legacy Education (LGCY)

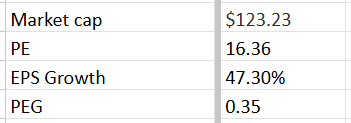

The case for Legacy Education (LGCY) is straightforward. As a for profit college it has no fixed costs, so can scale up quickly. It provides allied health programs which require accreditation and licensure, providing barriers to entry. The industry is countercyclical and does very well in times of recession or poor labor markets (currently true). PEG also trades at a PEG ratio of 0.35, an attractive valuation (based on YoY EPS growth).

After studying a history of the for-profit college industry for the past month, notably my recent coverage of the failure of Corinthian College, it’s clear that regulatory risk is the biggest risk in the industry. And LGCY has enough regulatory risks to keep me away. That is to say, I am not personally invested in this, nor do I recommend it, but some of my more risk-tolerant readers may find this situation interesting.

I don’t invest in things where I have limited or no minority shareholder rights, or where I don’t hold the actual security. For that reason, I don’t invest in Chinese ADRs or corporations not incorporated in Delaware. LGCY went public last year, choosing to list in Nevada, making it a no-go for me. Others may not be as conservative as me on this, and that’s fine. But they should still read on to be advised of all the other risks of investing in this stock.

Favorable Macro

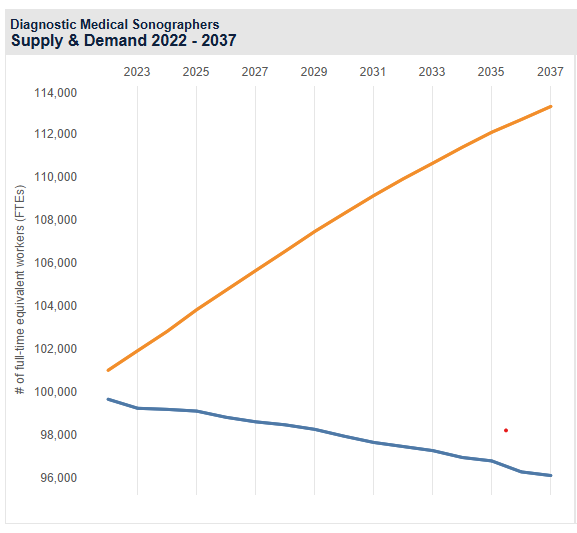

Source: https://data.hrsa.gov/topics/health-workforce/nchwa/workforce-projections

This is a chart of the supply and demand for medical sonographers (a program at all LGCY schools). Labor shortage in allied health professions is the same across the board for most of LGCY’s other programs. As shortages grow and unemployment grows, enrollment increases. This is what makes LGCY an interesting countercyclical play.

Measuring Education Regulatory Risks

When investing in this industry, understanding the downside thoroughly is key.

When we check the regulatory metrics of LGCY and other key leading indicators of business failure, we see that LGCY raises some red flags.

Accreditation And PPA Status.

3 LGCY colleges (HDMC, CCC, CCMCC) are accredited by ACCET (Accrediting Council for Continuing Education and Training). Integrity is accredited by ABHES. And no colleges are currently on “warning,” “show-cause,” or probationary status by the Education Department. (LGCY 10-K)

In order to receive title IV loan funds (over 80% of revenue), colleges must be part of a Program Participation Agreement (PPA). When colleges are acquired they are put on a temporary month-to-month PPA during which time oversight is higher and certain activities are limited (Requires prior ED approval for new programs and locations). During this time the Education Department is supposed to review the program to approve it for the long term. HDMC and CCC have standard PPAs. However Integrity (acquired 2020) and CCMCC (acquired 2024) are participating under temporary provisional program participation agreements (TPPPA). (LGCY 10-K)

Any “change in ownership and control,” puts a college on temporary PPA and triggers an automatic review by the ED.

Ironically, defunding/reduced staffing at the ED will further extend the timeline for approval of these programs and add headwinds to growth.

In early September 2025 the Education Department shared a proposal to engage in negotiated rulemaking to provide institutions flexibility to change accreditors and “remove other burdensome requirements that erect barriers to entry for new accreditation agencies.” (LGCY 10-K) Which undoubtedly will allow for-profit colleges to choose their auditor, create their own accreditation processes, etc.

This change will not benefit LGCY, since it is already accredited, but it will benefit its unaccredited competitors as it lowers the barrier to entry.

Student Success Metrics

The student retention rate is 86%. (LGCY 10-K)

Typical for the industry.

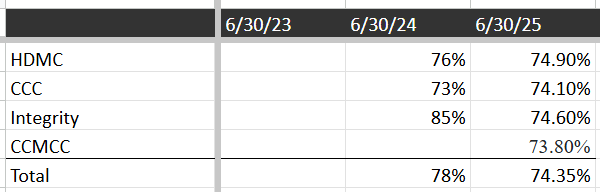

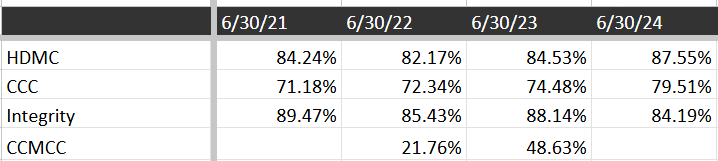

Average placement rates post graduation are dropping slightly:

Source: LGCY Sec filings 2024-2025

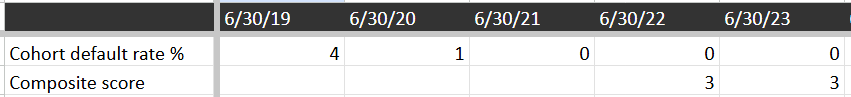

Cohort default rates and Composite Scores

CDRs are low, which has been a benefit of the recently ended tuition payment freezes. We should expect rates to normalize closer to the 2019 rate of 4%, which is well below the 30% limit set by regulators. With composite scores of 3/3, LGCY is rated as financially sound, and above the cutoff of ⅓. (LGCY 10-K)

Title IV Compliance

90/10 rule compliance: A majority of LGCY’s tuition revenue comes from federal loan programs, receiving over 90% means that funding would be limited. In 2024 the rule on federal Title IV funding was expanded to include GI Bill funding.

The 2024 fiscal year was the first one calculated under the stricter rule 90/10 that includes GI BIll funds in the federal funding portion. So the company has stood up well to that update.

Notably, on January 30, 2024, due to a failure to timely return unearned Title IV funds to ED, Integrity was required to submit an acceptable form of financial protection for 25% of the refunds that were made for the fiscal year ended June 30, 2023 in the amount of $18,828. This is a major concern for me. Regulatory compliance is key, failure to stay on top of regulations (intentionally or unintentionally) is a major red flag. (LGCY 10-K)

Borrower Defense to Repayment

LGCY is party to the Sweet v. Cardona settlement, which entailed seven active BDR applications. (LGCY 10-K)

Notably, the OBBBA delays the effective date of the 2022 version of the revised borrower defense to repayment regulations and closed school loan discharge regulations for ten years, until July 1, 2035. This should protect them from future BDR claims. (LGCY 10-K)

Exposure to Private Student Loans and Credit Risk

LGCY extends credit for tuition with the “TuitionFlex” program which provides a flexible tuition credit plan for students. In association with this program, the company reported long-term accounts receivable of $1,966,137. The company does not break down whether this is gross, or net of allowance for credit losses. However YoY from 2024 to 2025 the proportion of the credit losses account to net accounts receivable increased from 5% to 10%. The proportion of accounts receivable that was classified as “long term” also grew from 9.6% to 11.6%. (LGCY 10-K)

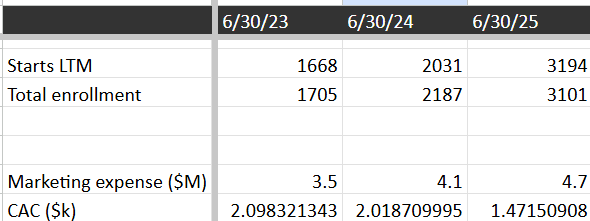

Customer acquisition costs (CAC)

At a for-profit college facing strain, CAC’s rise. However here CAC’s are declining, which is a good sign.

Security Regulatory Risks

This point is the final nail in the coffin.

When LGCY went public, the company decided to incorporate in Nevada. This means the management has weaker fiduciary duties, litigation and appraisal rights are limited, and fewer shareholder rights generally.

The last point bears repeating, in Nevada, shareholders have fewer rights to inspect corporate documents, and have a higher bar to request them. As compared to Delaware, shareholder rights are less developed and proven. (Snell & Wilmar)

This is already a morally gray business, and history shows these businesses have many incentives to inflate financial records. Now add in a management that is less accountable and more able to inflate financial figures and you get a very dangerous situation.

The latest 10-K, includes management’s conclusion that internal control over financial reporting was not effective.

Conclusion

On the surface, LGCY should be an attractive investment, sporting an attractive valuation, but the red flags here are too many.

The first red flag is that two of LGCY’s colleges are on a temporary program participation agreement (PPA) which stifles enrollment growth. Recent regulatory changes will make it harder for these programs to get fully accredited, and any future acquisitions will face a similar problem.

The second red flag is that LGCY is sloppy with its regulatory compliance, with its recent failure to timely return unearned Title IV funds to ED. This also includes the fact that the company has insufficient internal controls over their financials.

The third red flag is the existence and growth of its in-house student loan program “TuitionFlex”. With a growing proportion of accounts receivable being part of this program, and growing allowance for credit losses on these loans, I am worried about the quality of their underwriting on these loans, and the perverse incentives this creates.

The final (and most important to me) red flag is that LGCY went public last year as a Nevada corporation. Limited shareholder rights, and transparency in the state raise questions to me about management’s intentions. Consider also that management is not buying stock. With only a year of track record here, I am not confident that management won’t abuse public investors or alter financial statements going forward.

Disclaimer:

The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

I’ll give some of my thoughts as someone who 1. Likes Legacy but 2. Hates for profit Ed stocks and 3. Hates companies incorporated in Nevada: they seem to be lower risk than the rest of their sector, you notice that post acquisition the graduation metrics increase each year at the unit level. On a comparable basis the quality is much higher. Education, like pharma, is a litigious environment but comparing Legacy to PRDO or Adtalem it’s much cleaner. I view them more like LINC or UTI. As to the Nevada thing, the company went public very young and lacked a lot of internal controls that it seems like they are trying to clean up. I wouldn’t be shocked if they move to Delaware later.