My Biggest Position - A company selling at 1.5x cash flows, with an expected 100-200% return on at-risk capital

Immediate catalyst. Lycos Energy (LYC, LCXEF) should re-rate within 3 months. Need to own by November 20th. For small accounts only.

Lycos Energy (LYC, LYCEF)

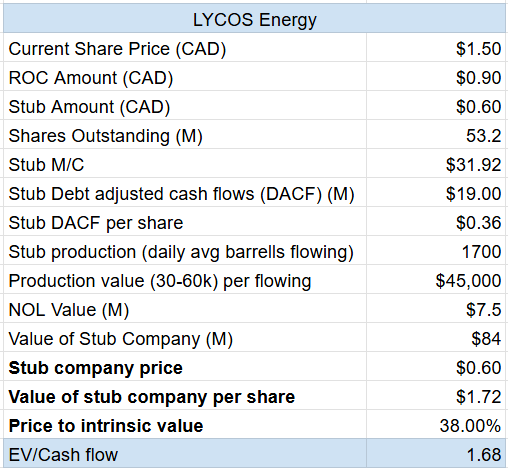

To be clear the price of the stock is 38% of its instrinsic value. 1-2x upside.

Lycos Energy (TSXV: LCX) is a Canadian heavy-oil microcap entering a short-duration special-situation window with an unusually high return on capital at risk. The stock now trades at C$1.50 ( C$78.8M market cap) and on November 28, 2025 the company is set to distribute C$0.90/share as a Return of Capital—representing 60% of today’s share price and creating a highly asymmetric setup. (This applies tor shareholders as of record date November 20, so buy before then.)

This leaves us with a stub with a market cap of C$31.52M.

Management has already sold ~60% of its oil production for C$60M, eliminated nearly all debt, removed most long-term abandonment liabilities, and now returning the rest. Pro-forma, Lycos retains ~1,700 bbl/d of Mannville heavy-oil production, minimal ARO, access to a C$50M credit facility, and C$52M in NOL. Volume is small, and this stock is obscure, contributing to the mispricing.

The remaining business is extremely cheap on both asset and cash-flow metrics. Comparable transactions in Mannville generally occur at C$30k–60k per flowing barrel; at 1,700 bbl/d, valuing Lycos at the mid point of that range implies an value of $76.5 M for the operating business.

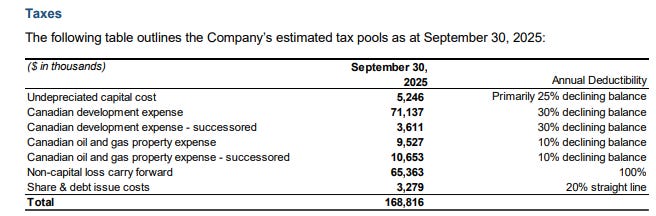

Lycos also carries C$65 million in Canadian non-capital loss carryforwards, which are highly valuable in an asset sale because Canadian tax rules allow these losses to be transferred without limitation so long as the acquirer continues operating in the same line of business. For an Alberta-based E&P company facing a combined federal–provincial tax rate of roughly 23%, these NOLs have an undiscounted tax value of approximately C$15 million. I discount this by 50% to reflect timing and commodity-price uncertainty, implying a transactional realizable value of C$7.5 million. This represents a meaningful incremental value to Lycos’ stub and should be considered in any sum-of-the-parts or takeout valuation.

Even in a downside scenario where management elects to continue operating rather than selling, the remaining assets generate sufficient cash flow to support a strong risk-adjusted return, albeit over a longer time frame. Given management’s prior history of building and monetizing successful E&P companies and the signal of returning 60% of market cap upfront the probability of a full wind-up or asset sale remains high.

It seems you must own this by Nov 20th, but there is a grace period until the final conversion date (ex-date) of Dec 1.

What is left?

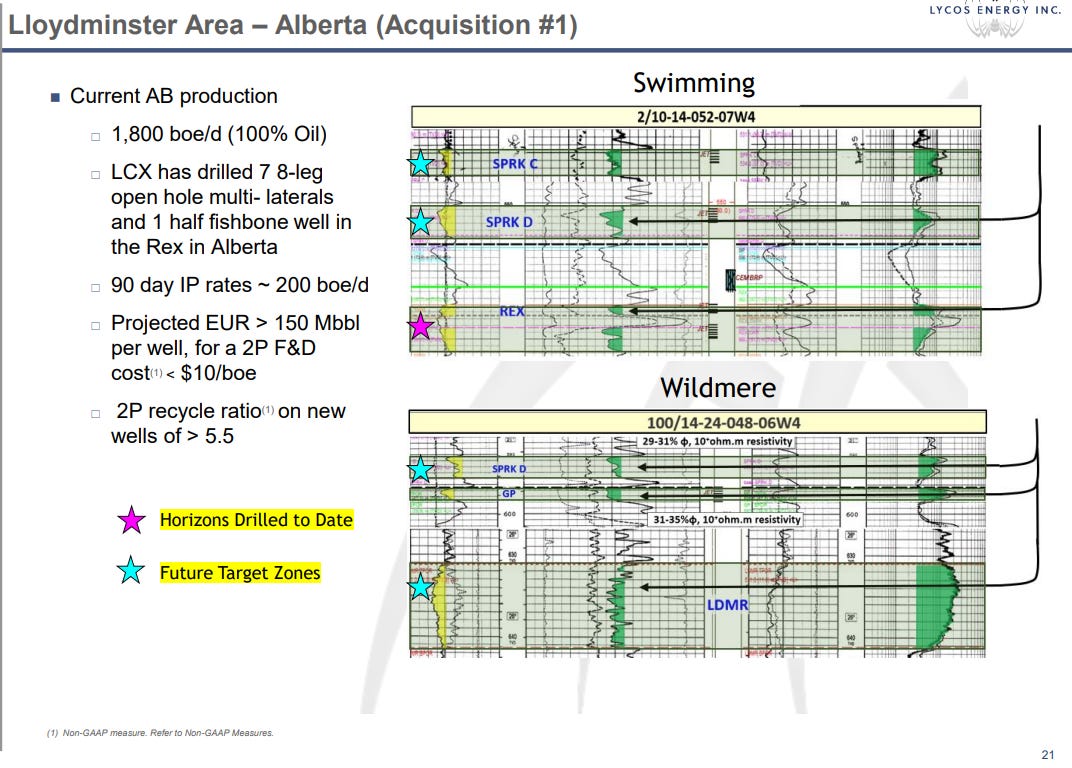

The remaining Lycos production after the 2025 sale are their Alberta assets

Swimming (AB)

Wildmere (AB)

Viking Kinsella (AB)

These all correspond to the Alberta Mannville multilateral heavy-oil program, which includes: Multilateral horizontal wells (6-leg, 8-leg, and hybrid “half-fishbone” multilaterals). These are not CHOPS.

Decline Rates

The Q3 filings (sept 30) states that bbl/d production was 2,958. By the time of the asset sale disclosures, 940 bbl/d were sold and 1,700 bbl/d remained. Implying a 10.75% decline rate for the remaining assets over 2 months.

Well vintages appear to be a mix of 2021-2024 drilling programs and older legacy wells. I use an average well age of 4 years and average well life expectancy of 10 years in my model.

I use decline rates of 30%,25%,20%,15%,10%+ starting in year 1.

ARO

Pre-sale ARO was $14.7M, assuming 64% of production retained equals a similar amound of ARO, leaves us with $9.4M.

Q2 MD&A states that decommissioing liabilties accrued at ~900k a year. Again, assuming accrual is proportional to production rates, future annual accrual should be 576k

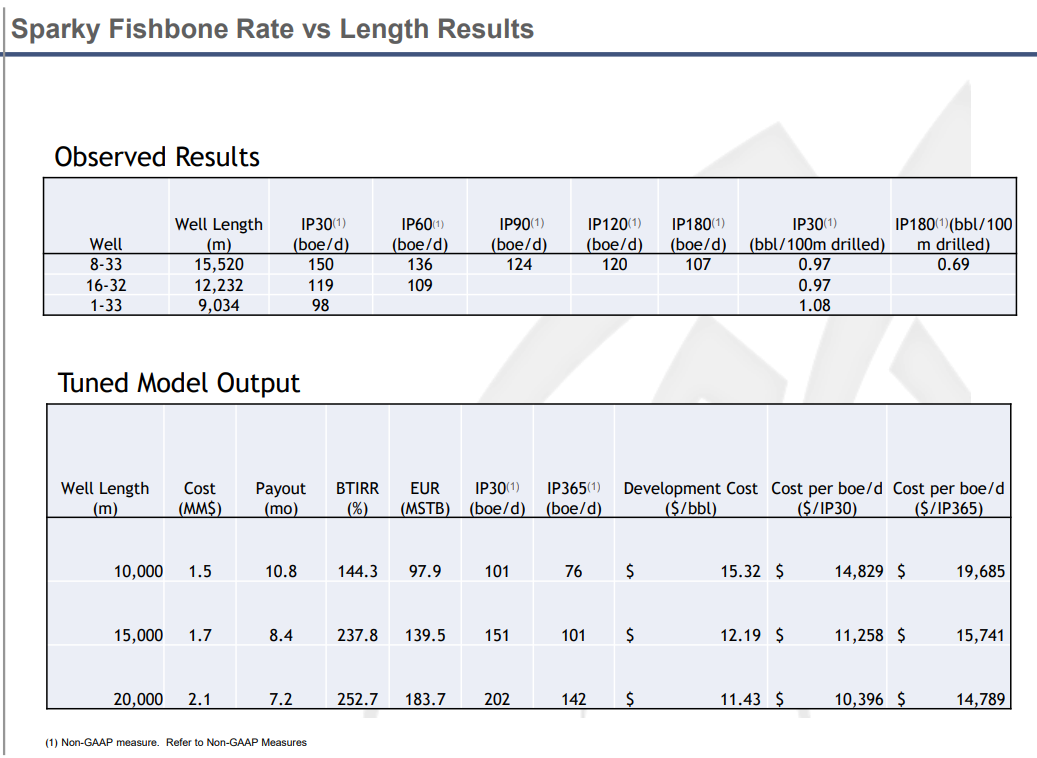

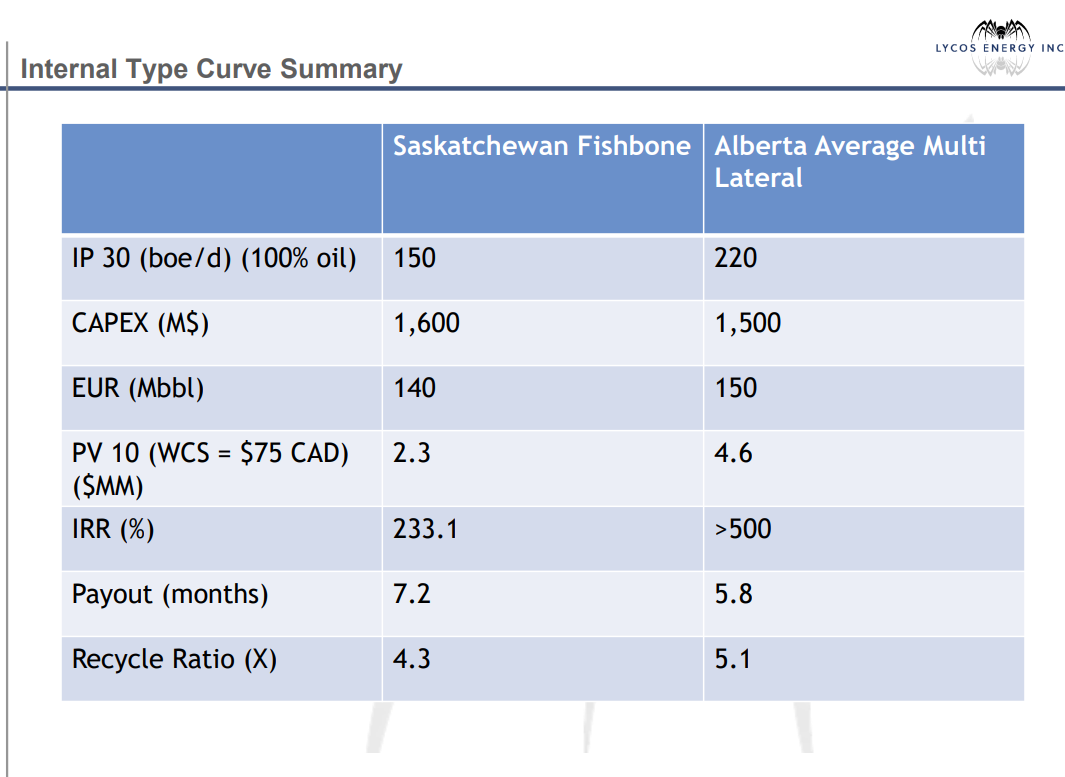

Capital Efficiency

Relevant slides from the investor presentation: https://lycosenergy.com/wp-content/uploads/2023/06/LCX-JUNE-2023-FINAL-PPT-002.pdf

Based on the above the Alberta assets seem to have a best case capital efficiency of $6.8k/flowing, but a typical efficiency of $15-20k/flowing. Based on an avg decline curve of 26% or 442 bbl/d, I would estimate maintenance capex to maintain production to be $8.8M CAD a year.

When I do so and stress test a few oil prices, and maintenance capex costs, I get the following valuations for lycos’ enterprise value (for the operating business).

Catalysts

C$0.90/share ROC distribution in 3 weeks

Potential sale of remaining assets within 6–12 months

Appendix A: Tax Pool Benefits

Lycos has the following tax benefits.

In Canada the Non-capital loss carry forwards can be acquired without limit, so I focus on those. But my writeup above does not include a valuation for the other 100M in tax benefits. By my estimate, if fully used at relevant Canadian tax rates, these tax benefits should drive C$39M in value, but in an M&A context the realistic value is discounted to C$15–20M.

Appendix B: The Northern Asset disposition

This closed on October 16th.

Sale assets were older, lower-quality Lloydminster heavy oil with higher operating expense, lower netbacks, and a lower reserve life index.

Pro-forma earnings should be:

~27M in operating netback/net operating income

~23M in Adjusted Funds Flow / OCF.

My back of the napkin pro-forma model is here: https://docs.google.com/spreadsheets/d/1d1sowZoKnZTQFWKJSriI3EJfz6mQN9gqNuJx8ElnJXM/edit?usp=sharing

Disclaimer: The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

I do hold a position in these securities.

Closing the position. I have reconsidered the commodity risks implicit in owning E&G, the recent drop in WCS pricing, and poor outlook for WCS this year, make a private sale of the remaining assets less likely. Without a sale the thesis falls apart.

However it may re-rate when earnings are reported in April, so if you are comfortable waiting until then.

Why necessary to own before the dividend? Why not buy now for the rerate?