Portfolio Positions Heading in to 2026

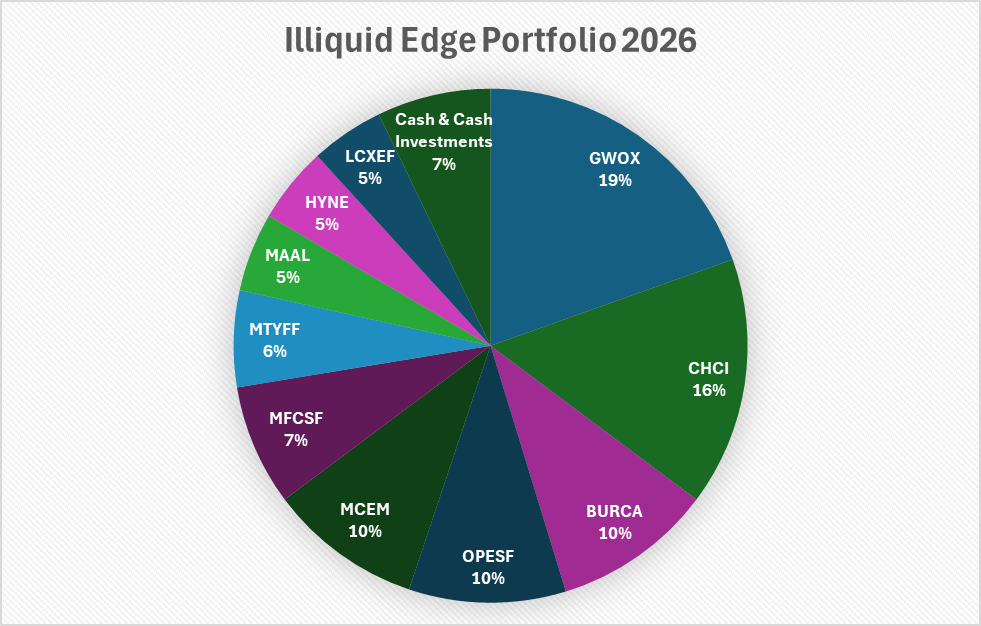

I have 10 positions, all of which I am buying for less than half of their intrinsic value

In 2025, the Illiquid Edge portfolio returned 25% vs. the S&P500’s 18%, while maintaining effectively zero correlation (0.0028) to the S&P. This was done through investments in small, and undercovered stocks.

GWOX - Goodheart-Willcox Company Inc

Goodheart-Willcox is a publisher of career, technical, health and physical education textbooks. Over the past decade it has been growing its capital light e-book division very quickly, so that now the business requires minimal capex and consistently throws off cash. In fiscal 2025, it generated $23M in free cash flow. On a market cap of $193M, that is a 12% cash yield. Historically it has distributed 45% of free cash flow as dividends while the rest of the cash builds up on the balance sheet. Occasionally once cash is too high they announce a special dividend (last in 2021) or tender offer (last tender was April 2019 at a 50% premium to the stock price).

This situation reminds me a lot of Disney in the 1980’s when they found a new format to monetize their content library at essentially no extra cost (VHS), and benefited greatly. Here the new format is ebooks. Because all their pre-publishing and content writing costs have already been spent on creating the print textbook, they have very little cost to digitize these. Now they only have to spend a minimal amount to occasionally update their books when they release a new edition. This is a great business model, and the business transformation has been significant. Over the past 5 years revenue compounded at an annual growth rate (CAGR) of 16%, which with operating leverage has meant that free cash flow has grown at a 46% CAGR.

This is a pretty incredible deal. Why is it cheap? Well for one it is very illiquid, no major fund can buy this. Second, the stock price has not moved much in the past few years, and investors today have very short time horizons. Third, on its books is a 69M non-cash deferred revenue liability related to the future performance obligation they have to deliver textbooks to their customers. This isn’t a financial obligation in the traditional sense (not debt-like), so its net cash position is understated. Fourth, it is majority owned by an employee stock ownership plan (ESOP) - many investors do not touch controlled companies. Fifth, it is very hard to get financials for this company. It is the only company I have run into that does not show up in my stock screener (TIKR), nor in Capital IQ. It is totally obscure and illiquid.

What makes this company so interesting to me is that before the last buyback in 2019, there were around 60,000 shares in the ESOP plan, and today there are around 50,000. A tender offer (buyback) appears due. Even if there is no tender and the company maintains a 10% topline growth and its 46% payout ratio, then we are looking at $100M in dividends received over 4 years, and $200M in cash on the balance sheet at that time, plus the value of the ongoing operating business which you are buying today for ~$200M.

CHCI - Comstock Holding

CHCI is an idea I got from Will Harvey. Will is an accomplished real estate investor that has done well applying his knowledge in the public markets. CHCI is a homebuilder turned asset light property manager in the DC area. Led by Dwight Schar, founder of NVR, its financials are impeccable. It has been growing the topline at 20% and earnings at 50%. Over the next year it is adding 29% in square footage under management. And is set to double its managed square footage in 4-5 years. It has a fortress balance sheet, yet it is very cheap - trading at an earnings yield of 11%

Why is it cheap? Founders own over 60% of CHCI. It is controlled, and relatively illiquid.

But to own a business alongside Dwight Schar at such a low price is a great gift. It’s like we are Norbert Lou buying NVR in 2001.

BURCA - Burnham Holdings

Burca trades at a 10% normalized FCF yield. On a $120M market cap it has 10Mn in net cash and is asset backed by its owned land and buildings which have around ~60M in value. They recently sold off a poorly performing division and invested in a new product line with their High-Efficiency Boiler production line. Headcount and factory size have recently increased by about 33%, and 25% respectively so we can expect significant cash flow growth to come online in the coming years.

Typically a company’s cash flows during a growth investment phase are understated due to capital investments, and such times make a great entry point before the growth shows up on the income statement.

Furthermore, the management team is top-notch, recently removing significant off-balance sheet liabilities, specifically their asbestos and pension exposure.

With this company we are getting a reasonably priced company with a top notch management team, likely growth, and good exposure to the housing market upcycle. It is also a likely PE target.

I heard about this and MAAL from Dirt Cheap Stocks, I suggest you check him out.

OTEC - Otello Corp

Otello is the Norwegian company behind the Opera browser, which they divested in 2018. Today their only asset is a significant stake in Bemobi Mobile Tech S.A., a Brazilian technology company which “develops and manages digital payment solutions for multiple B2B and B2C service providers.” Bemobi was listed on the BOVESPA B3 stock exchange in 2021. Otello’s owned subsidiary Otello Technology Investment AS, owns 32,719,588 shares of Bemobi. In the last reporting quarter, the company had 150M NOK in cash on hand, cash burn was 15M NOK, 75M NOK in dividends were received and 50M NOK was spent on stock buybacks.

Bemobi trades at BRL 23.06, which at 32 719 588 shares at (1.87 NOK/BRL) is worth 1.41B NOK. Otello’s market cap is 1.22B NOK. This means you could buy the all of Otello’s stock for 1.22B, liquidate the company and receive 1.66B NIK in value (+36%)

The underlying is also slightly underpriced. It has been growing earnings (net income) at a 17% CAGR since 2021. It trades at a 7.5% earnings yield.

Putting this all together, you have a company with a holding that grows at 17% a year, and that buys back 10% of its stock each year. If it also re-rates to the value of its cash and investments, we will achieve a 145% return over 3 years.

MCEM - Monarch Cement

Monarch Cement is a cement producer in Kansas. The nature of the cement industry is that cement can not be transported over long distances so needs to be produced at scale locally. Making most cement plants effective monopolies, and makes MCEM an excellent, well protected business. Earnings per share have grown at a 18% CAGR for 10 years. And the book value of their investment portfolio has grown at 16% over that time. Here you have a defensible operating business with a strong local moat that throws off cash and is able to reinvest capital at 16%. Over the long run you will do well owning this company. Today, it trades at a 8% yield on normalized earnings.

TSE:DR - Medical facilities Corp

Medical Facilities Corp is a Canadian listed company that owns American surgery centers. Surgery centers are cash cows in the American medical system, and revenues are very stable, recurring and recession-proof. Today, DR trades at a 15% FCF yield with a 6% growth rate. They recently sold off facilities, and may sell the rest piecemeal or be bought out entirely.

I think I first heard about this from Dan Smoak, again, someone I highly recommend you follow.

MTYFF - MTY Group

MTY Group is a special situation. It currently trades at 25% levered FCF yield. It is undergoing a strategic review, and it has been reported that there are 3 companies currently bidding for the company (at a 20% premium to today’s price). Bids should be submitted within the week making this a timely situation. Final terms should be established within 3 months.

Interestingly to me, this company screens poorly. It has significant lease obligations on its balance sheet, but these leases are paid by the franchisees, and are essentially a tool to extract lower rents from lessors, and not a debt-like financial obligation at the corporate level. As a result, many screeners state that this company has more debt than what is economically true.

MAAL - Marketing Alliance

MAAL is an online insurance platform, connecting buyers with brokers. It trades at a 9% earnings yield with 30% of its market cap in cash. It recently announced a buyback program to deploy that cash, which should be about 10% of share a year. Shares are illiquid and the business is majority owned. The shift from dividends to buybacks proves there is a good management team conscious of shareholders and focused on unlocking shareholder value.

HYNE - Hoyne Corporation

I wrote up HYNE on ValueInvestorsClub in November. It is a recent bank demutualization. You are buying the equity of the bank for 66% of its value, and as their commercial lending program ramps up we should expect it to re-rate to 100%. Over 90% of their market cap is covered by their strong net cash position and they also own significant real estate. Buybacks would likely be accretive here. We also have recent insider purchases near the current price.

Considering you are buying a bank for almost nothing here, it’s a good deal. There are many ways the business can create value here, we just don’t yet know how or when.

LYC:CA Lycos Energy

I covered this previously on SumZero. Lycos sold 66% of its producing assets and returned the proceeds to shareholders. What remains are high quality multi-lateral Alberta oil wells with low breakeven prices. Based on management commentary and because Lycos is subscale, we should expect the rest of the company to sell this year. There is commodity risk inherent here so I have significantly scaled down this position based on the poor oil outlook for the year. Chances of a sale are reduced with lower WCS prices, but are not entirely eliminated. Once clean post-divesture earnings print in April, I expect a re-rate.

Each of these owned businesses is illiquid, and trade at what I estimate to be under half of their intrinsic value. As I discuss in my investing philosophy statement, each of these businesses is creating shareholder value independent of market pricing. All are backed by significant assets and cash, and should do well in a downturn. I feel very comfortable owning this group of businesses heading into 2026.

Disclaimer: The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

I own a position in these securities.

Impressive concentration strategy on illiquid micro-caps. That zero correlation to the S&P while beating it by 700bps is the real edge here—most small-cap managers end up inadvertently replicating market beta because they chase similarsectors. The GWOX ESOP tender dynamic is especially interesting since ESOPs typically don't maximize shareholder value but here the historical pattern suggests otherwise. I've been burned before buying 'cheap' illiquid stuff that stayed cheap forever til I learned the catalyst matters more than the valuation.

Thanks for your posts and insights. Very helpful! Was curious what your background is and full time job?

Also, if there were a major markey pull back due to either AI bubble, economic wars, etc... Do you think these microcap positions will be affected (or mostly immune)? Have any backtests been done?