Sometimes its not about the money: Overpriced acquisition offer for Unifirst is unlikely to go through.

Cintas has offered to buy UNF at 3x its intrinsic value. Yet I think a sale is very unlikely due to Succession-like family politics.

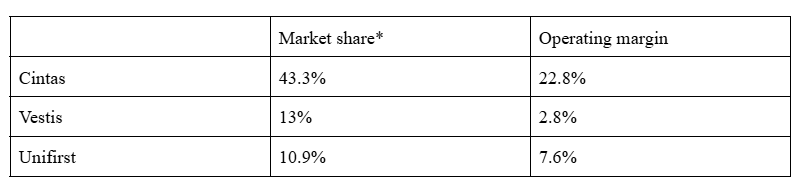

Unifirst is the third largest Uniform sales and rental company in the US with $2.43 billion in revenues. The uniform rental market strongly benefits companies with density of operations as that provides economies of scale. You benefit from dense delivery routes, centralized inventory management, and distributing fixed costs across all sales. You can see the benefit of density in market leader Cintas (43% market share) who has significantly higher operating margins over all competitors.

*($22.2B market size)

If you research the corporate history of Vestis (2nd in market share) you can see that any combination of top-tier management at the company has not been able to overcome the competitive dynamics of the industry. Cintas is the market leader, and will consolidate the market over time.

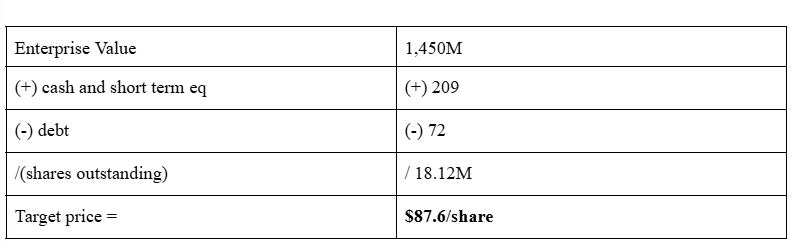

We should not expect this company to grow (and should probably decline), so I used Greenwald’s EPV methods to value this company, based on its earnings in 2025 (and implied future earnings).

EV = (EBIT*(1-tax rate)- capex +excess depreciation)/WACC

(190*(1-0.241) - 154 +140) / 0.09

EV = 1,450M

Politics among the controlling family make a change of control unlikely.

UNF has a dual class structure, where the B shares have 10x the voting power of the A shares (and so 71% of the voting shares of the corporation). The B shares are owned by institutions and the public, but the B shares are owned by the family trust of the founder. The voting trustee is likely the founder’s wife, Marie (over 90 years old), if not it is her daughter Cynthia. Cynthia is very active on the board of UNF and has publicly supported the current “turnaround strategy” and been unresponsive to activists clamoring for a sale of the company. A niece Cecelia Levenstein appears to have B shares, as well as Carol, Micheal and Matthew Croatti, who are more distant relations to the founder, and who have a few shares. Micheal is the only family member to publicly support an acquisition.

Past acquisition offers have consistently failed

In May of 2025, Cintas made an offer to acquire Unifirst for $275 a share. Accepting the sale is very obviously the best outcome for shareholders. However, if the board of directors did so, they would lose their jobs. And so the deal failed.

In November of 2025, activist investors launched a campaign to force a change at the director level and elect 2 new (acquisition friendly) members to the board to pursue an acquisition and represent minority shareholders. This failed. Less than 5% of the B shares voted for change, so the family appears to vote in concert, there is little likelihood that the B shares can be split.

Now, on December 22, 2025, Cintas again offered to buy out the company at $275 a share, this time adding a sweetener of a $350 deal break fee if the deal is not approved by regulators. ($19.44 a share in value). This will also fail.

Currently the market is pricing UNF at $200 a share. Based on an offer price of $275, and minimium LTM price of $150 the implied odds of a sale is 40%. Based on the controlling family’s past actions, I put it closer to 10%.

I do not think the family rejected the deal because they were worried about regulatory issues, or that the price was too low, as they have never once mentioned that. Instead every action they have taken to avoid a merger has been based on their statements that they are planning to unlock more value through operational improvements led by Cynthia Coratti’s heroic efforts.

It appears that when shareholder value is pit against family, family always wins. In fact, I have a feeling that Michael was chewed out here, told something like “Don’t ever take sides with anyone against the family again. Ever.”

Disclaimer: The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

I hold a short position in these securities.