Steel Partners (SPLP) is a curious situation - Selling for 15% of its value, PE ratio of 2, P/B of 0.6, growing at 20%, but I won’t buy it.

SPLP is a very curious company. It’s the largest illiquid public stock I have ever seen. It trades at a massive discount by all measures, and yet it will probably never re-price.

Steel Partners was founded as “Steel Partners Holdings” by activist investor Warren Lichtenstein in 1990 as a private investment fund. From 1990 to 2007 the fund earned gross annual returns of 22%.

The only other fund I have found who has ever covered this copmany is Dave Waters at Alluvial Capital (who last wrote about it in 2012). Dave provides an interesting origin story on this odd security:

“SPH ran into trouble in 2008, when the financial crisis caused the value of many of its holdings to drop precipitously. Facing huge requests for redemption, but believing many of its holdings to be too under-valued or illiquid to sell without doing harm to continuing investors, Steel Partners Holdings hit upon a novel solution: going public. Many investors objected to this plan and pressed for a full liquidation, but Lichtenstein prevailed in court. Steel Partners executed a reverse merger into WebFinancial, a tiny pink sheets-traded financial concern operating in Utah, and then distributed the newly-created units to investors in the Steel Partners partnership. The LP now trades under the ticker SPNHU on the pinks. Many objecting shareholders opted to receive cash and in-kind securities instead, so the total assets of the partnership are much smaller than in 2007, when the partnership had $1.2 billion in assets.” Dave Waters

This transaction allowed SPLP to own a bank charter. They found an innovative way to monetize that bank charter. “After originating a loan for a client, WebBank holds it for no more than a few days before selling it back to them, creaming a fee off the top and earning interest for the period it holds the loan.” As the Financial Times put it, “one likened it to the jeweler Tiffany’s, while others called it the “gold standard” of correspondent banking, or charter renting to put it plainly.” (FT)

So, in 2008 SPLP ended up with a number of illiquid industrial investments and holding companies stuffed into a public OTC bank. With some asset management fees paid to the investment managers on top.

WebBank

Notably, WebBank has a capital structure made up of short maturity obligations as its loans are quickly sold to its “marketing partners”. It is also significantly overcapitalized and underleveraged compared to most banks. Tier 1 leverage ratio is the ratio of the bank’s “cushion” (equity and reserves) vs its total assets (loans, etc). WebBank has a very conservative Tier 1 leverage ratio of 18.6% (vs the regulatory minimum of 4%).

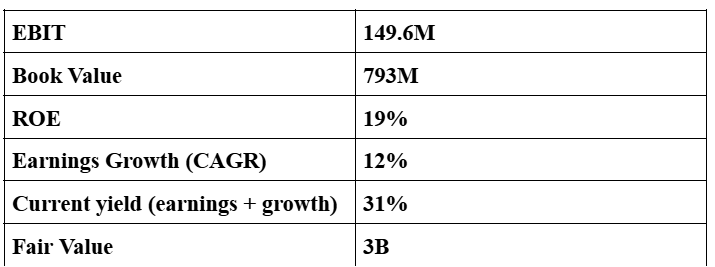

Typically, a Bank with a 30% ROE, compounding book at 8%, conservatively financed would be labelled an exceptional one and command a high premium. This would be a bank with 38%+ yield on equity/book, and if the market yield on equity is 8%, should command a 5x price to equity book premium. Thus a fair intrinsic value of the bank alone would be $1.9B.

The Industrial Conglomerate

This segment includes diversified industrials:

Joining materials (Lucas Milhaupt)

Tubing (HandyTube, Indiana Tube)

Performance materials (JPS)

Electrical products (MTE, MTI)

Specialty films (Dunmore)

Kasco blades & services

Oil & gas service operations

Steel Sports youth businesses

ModusLink logistics / e-commerce fulfillment.

Add the bank and conglomerate together and we get an EV of 4.9B. The company is currently selling for an EV of $0.76B….

Management Fee Layer

Cash management fees are included in the above numbers.

SPLP’s controlling “Manager” (an affiliate corporate group) is entitled to a management fee equal to 1.5% of total partners’ capital, payable quarterly regardless of SPLP’s profitability in the 2024 10-K, the annual management fee was reported as $15,056,000. (steelpartners.com) In addition, the Manager (via an affiliate) holds “incentive units” that, if vesting criteria are met, convert into “Class C” common units granting the Manager a claim on 15% of the increase in stock price per common unit YoY. On top of those structural fees and dilution mechanisms, SPLP also reimburses the Manager (and its affiliates) for corporate-overhead costs, legal, accounting, compliance, travel, and other expenses tied to running the business — in 2024 those reimbursements to the Manager (for e.g. executive travel and overhead) were a few thousand dollars, but the broader indemnification and expense-reimbursement provisions give discretion to the Manager to charge many such costs back to the partnership. The vast bulk of compensation flows through the fee + carry + affiliate-entity structure, which is controlled by the Manager rather than by public unitholders.

For minority unitholders, this compensation structure means the effective “cost of control” is baked in - a recurring 1.5% annual drag on assets, and potential dilution via incentive units when equity-value triggers are met. That reduces the amount of cash flow and value accruing to public units; it also aligns incentives to grow or acquire “partners’ capital” rather than maximize distributions. In effect, minority units are economically subordinate: they receive residual returns after the controlling Manager and its affiliates take their fixed fee and carried interest for themselves. Furthermore, pay is mostly not paid through a shared reimbursement channel (like dividends) bypassing minority shareholders.

Now why is this company so mispriced at a 85% discount? Will it Re-rate?

1. Very illiquid - Institutions can not touch this. With only 3M in free float shares, and less than 2k shares traded per day on average, very few people are in the market for this security. In May of 2025, the security was delisted from the NYSE and is now only available on the OTC markets. As a publicly traded limited partnership with small float, few institutions can invest in this.

2. The most interesting aspect of this company is that it is majority controlled by Lichtenstein who controls 83% of stock outstanding and is compensated primarily via the holding company layer (not via dividends or share price appreciation).

So now the interesting part. What happens when you have a company with limited liquidity, only 3M/20M shares of free float, where the company that seems to be the only market participant and is buying 1M shares a year? I don’t know. I have never seen this before.

I do think that over 3 years if the remaining free float is bought out in buybacks, supply exhaustion would eventually occur. SPLP would hit a point where it is not able to buy shares at the current price as it finds no willing sellers. Here they either:

A. Increase the bid price to buy out the rest (still at a significant discount).

B. Stop the buyback program, leaving the market with no buyers, and minority stockholders orphaned. Stuck with stock in an illiquid market and no buyers.

C. Buyback the remaining shares at a minimal premium (10%), or execute a reverse stock split to force out small holders.

A few examples I found from history of similar situations.

Pendrell Corp (PCO) was a microcap with a single majority owner (Eagle River Holdings) who had 65% of the shares outstanding. In 2017, they went private with a 1-for-100 reverse stock split, squeezing out the public shareholders. 15% stock premium.

Two micro-cap industrials Handy & Harman (HNH) and SL Industries (SLI) are also interesting to consider. Both were majority owned by SPLP. In 2017 HNH was taken out by an exchange offer of HNH stock to SPLP stock at a modest premium. SLI management offered to buy out minority holders at a 28% premium. Steel partners did this seemingly to reduce their costs of multiple public holdings.

BGI has been majority owned (84%) with low float since 2010. In the 2010s buybacks stopped and minority shareholders were orphaned.

At RWWI minority shareholders resisted a lowball buyout offer, stayed public, and eventually shares appreciated.

Steel Partners is trading at a massive discount, which is unlikely to be realized by minority shareholders

In summary, when considering the majority ownership and incentive structure, supply exhaustion leading to increased buyback prices is unlikely. This market has no forced buyers, and little demand from buyers generally. The only significant buyer is the company itself who can essentially set their buyback price. I think it is mostly likely that minority shareholders are orphaned, SPLP has no real reason to buy them out. It has little to gain from doing so. In fact in many ways they have already orphaned minority shareholders. They delisted from the NYSE in April of 2025, and are now only traded OTC. Buybacks also effectively stopped around this time.

I would encourage any of my more experienced readers to leave their thoughts. Have you ever seen a situation like this before? Is there any value in a security like this? Let me know what you think.

Disclaimer: The information provided in this publication is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy or sell any securities. I am not a licensed financial advisor, and the views expressed are solely my own. Any investment decisions you make are at your own risk. Always do your own due diligence or consult a licensed financial advisor before making any financial decisions. Past performance is not indicative of future results.

I do not hold a position in these securities.

Steel Partners behaviour with Steel Connect over many years was despicable, culminating in legal action. They also engage in other practices with the pref shares and others - based on their track record of looking after themselves and no one else, it’s an easy pass for me too.

I held this shot for 6 to 8 months thinking I've found some buffet level cheap play. Little did I know I had shit on my hands. Other interesting piece is no one ever talks about this stock